This information applies to Clients using the Multi-Company feature of WinTeam. WinTeam can accommodate for employee transfers between Companies. You can change the Employees Company Number in the Employee Master File to show an employee being permanently transferred to a new Company. When transferring an Employee to a new Company, all future payroll activity will be tied to the new Company.

Note: If using this feature, it is very important to understand that all earnings and withholdings will start over in the new Company. This means earnings for Unemployment, FICA and all tax jurisdictions will start at $0.00 again. If you want the balances brought over to the new company, tax adjustments will need to be made in order to transfer the balances for the employees.

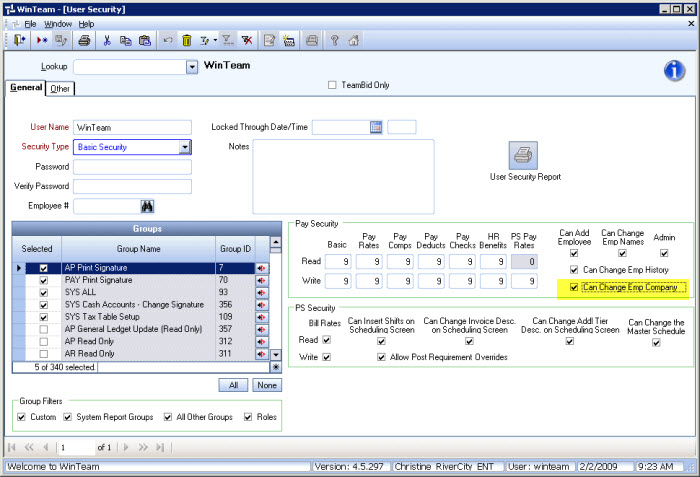

Security

On the User Security screen, you must select the Can Change Emp Company check box. This option allows a User who has Write Rights to Basic Info to change the Company Number in the Employee Master File for an existing employee. If this check box is not selected, the Company Number field on the Employee Master File cannot be changed by the selected User Name.

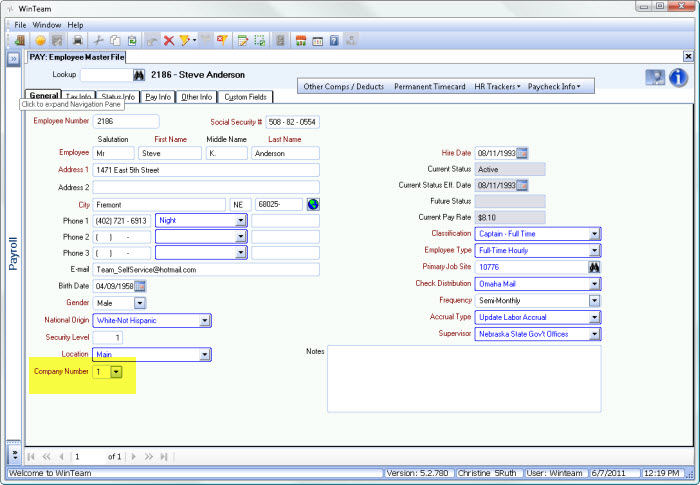

Employee Master File

The Company Number field is used to indicate the Company the employee is assigned to. Only the Companies that the logged on User has security rights to will display in this list.

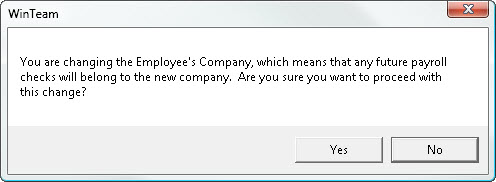

Be advised that changing an Employee's Company results in all future payroll checks to belong to the new Company. If you change the Company Number, this message displays:

Click Yes to confirm the change.

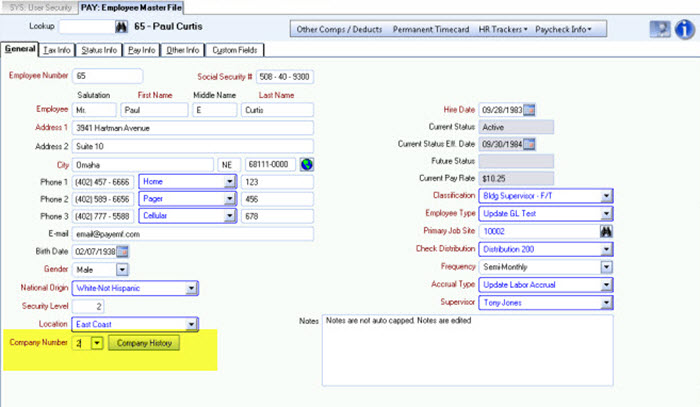

Once the record is saved the Company History button becomes visible next to the Company Number.

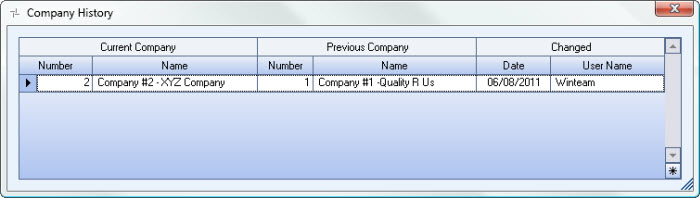

Click the Company History button to display the Company History screen. The Company History screen tracks Company changes that have been made to an employee record.

The Company Number field is used on the Paycheck Review and Edit, Tax Adjustments, Other Compensation Adjustments, and Other Deduction Adjustments. The Company field has been added to grids in these Payroll screens in order to see what Company the check record belongs to: Hours Summary, Hours Type, Check History, Other Compensations, Other Deductions, Tax Jurisdictions.

In addition, the Paycheck Company field can be used to filter records based on the employee's Company at the time the check was created when viewing Hours Summary, Check History, Other Compensations and Deductions (History tab), Employee Other Compensation Details,Employee Other Deduction Details, W-2 Summary,

The following reports can use the Paycheck Companies Category/Records:

- 401K Report

- 941 Report

- Check Register Report

- Employee W-2 Report- When running the Employee W2 Report and the Magnetic Media Report, the report will always be Grouped by Company. When running W-2 Laser Forms, if you choose to Group by Company all of the Company #1 W2's will print out first in the sort order you choose, followed by the next Company, and then the next Company. If you do not Group by Company when running the W-2 Laser Forms, then the W2's will sort in your normal Sort Order that you have chosen (Companies intermixed).

- NACHA Bank Transmission Report