Overview

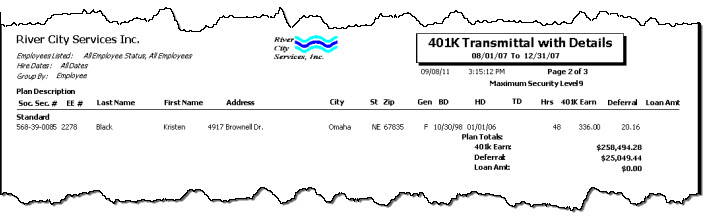

The 401K Report is used to prepare a 401K TFransmittal Report (with or without details) or to list employees for a Census Status, to list 401K deferred amounts, or to calculate the employers' 401K match amount.

The 401K Transmittal Report accommodates for any 401K Other Deduction Code activity. Since it is possible to have multiple 401K Plans, the system calculated 401K is always referred to as the "Standard" Plan (ID #1). You can set up other plans in the Other Deduction area under 401K Options, Plan add/edit list using a different ID and description.

Subcontractor Checks are excluded from this report.

You may sort the report by Employee Number, Social Security Number or Employee Name.

You may also select to include records from employees based on their status (Active, Leave of Absence, Inactive, or All).

You may filter the report by Check Dates, Employees, Hire Dates, Companies, Locations, and Paycheck Companies based on the Report Type. If you are preparing the report for employees with an Inactive status, you may also filter by Inactive Reasons.

For information on computation of 401K Earnings, Gross Earnings, and Deferral Amounts, see 401K Report.

The PAY Report 401k screen has its own Security Group, SECURITY GROUP.

The PAY Report 401k screen is part of the PAY Reports All Employees Security Group.

Tip: For more information see Security Groups Overview and Security Groups By Module.

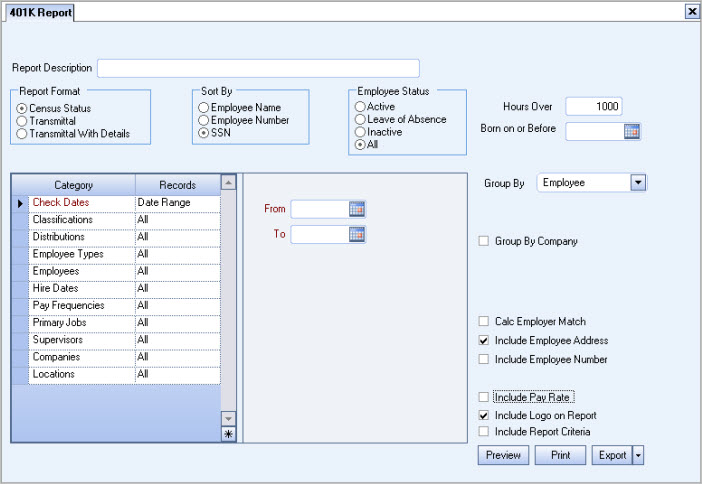

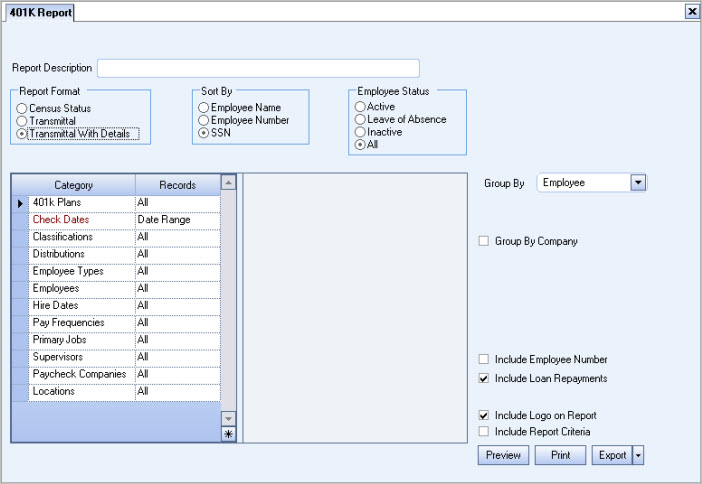

401K (Transmittal) report options screen

Key Functionality

Type a description to name the report. This description prints above the Report Title.

Report Format

Census Status

Select this option to prepare report for Census. If this Report Type is selected, two additional fields display for filtering the criteria by Hours Over and Born On or Before date.

Transmittal

Select this option to display selected 401K compensation wages, deferrals, and employer match amounts (if selected), Hire Dates, Term Dates, Hours, 401K Earnings, and Loan Repayment amounts (if selected). This is the default selection.

Transmittal With Details

Select this option to display 401K Transmittal information with details.

Sort By

Sort the report data by Employee Name, Employee Number, or Social Security Number.

Employee Status

Filter the report data by employee status.

- Select Active to include only active employees on the report.

- Select Leave of Absence to include only employees who are on leave of absence on the report. If this options is selected, you may also group the report by Inactive Reason.

- Select Inactive to include only inactive employees on the report.

- Select All to include all employees on the report, regardless of their status.

Category/Records

401K Plans

This category is available when the Report Format is Transmittal or Transmittal With Details.

Select the 401K Plans to include on the report.

Select All to include all 401K Plans

Select Pick to define specific 401K Plans for the report. When you select Pick, the 401K Plans list displays. Select the check box next to each 401K Plan to include on the report.

Check Dates

Select the Check Dates to include checks based on the Check Dates.

Select All to include all Check Dates.

Select Range to define a range of Check Dates to include. When you select Range, the range fields display. Type the beginning Check Date in the From field and the ending Check Date in the To field.

Classifications

Use the Classifications category to select the Classifications to include on the report.

Select All to include all Classifications.

Select Pick to define specific Classifications for the report. When you select Pick, the Classifications list displays. Select the check box next to each Classification to include on the report.

Distributions

Use the Distributions category to select the Distribution to include.

Select All to include all Distribution types.

Select Pick to define specific Distribution to include. When you select Pick, the Check Distributions add edit list displays. Select the check box next to each Check Distribution to include.

Employee Types

Use the Employee Types category to select the Employee Types to include.

Select All to include all Employee Types.

Select Pick to define specific Employee Types. When you select Pick, the Employee Types list displays. Select the check box next to each Employee Type to include.

Employees

Use the Employees category to select the Employees to include on the report.

Select All to include all Employees on the report.

Select Range to define a range of Employees for the report. Type the beginning Employee Number in the From field and the ending Employee Number in the To field.

Select Create to define your own list of Employees. When you select Create, a small grid displays to the right. Enter the Employee Numbers you want to include in the list, or use the Lookup to locate the Employee Numbers.

Select Exclude to identify records that should not be included. When you select Exclude, a small grid displays to the right. Enter the Employee Numbers you want to exclude in the list, or use the Lookup to locate the Employee Numbers.

The Hire Dates Category is used to filter the employees to include on the report based on Hire Dates.

Select All to include all employees, regardless of the Hire Date.

Select Range to define a range of Hire Dates for the report. When you select Range, the range fields display. Type the beginning date in the From field and the ending date in the To field.

Pay Frequencies

Select the Pay Frequencies to include on the report.

If using the Pick from List option, the system determines the check records to include by the Employee's current Pay Frequency set up in the Employee Master File. The only exception is when running the report for Format: Report and Report Type: Detail by Check.

Note: When running the report for Format: Report and Report Type: Detail by Check and limiting the pay frequency using the Pay Frequencies category, the system will look at the pay frequency of the batch instead of the Employee's current pay frequency. All Batch Types have a Pay Frequency defined except for Void and Tax Adjustment Batches. For Void and Tax Adjustment batches, the current pay frequency of the Employee (as indicated in the Employee Master File) will determine whether the void or tax adjustment record is included.

Primary Jobs

Use Primary Jobs to filter the report by Primary Jobs.

Select All to include all Primary Jobs.

Select Range to define a range of Primary Jobs for the report. When you select Range, the range fields display. Type the beginning Primary Job Number in the From field and the ending Primary Job Number in the To field.

Select Pick to select the Primary Job(s) to include.

Select Create to define your own list of records. When you select Create, a small grid displays to the right. Enter the records you want to include in the list, or use the Lookup to locate the records.

Select Exclude to identify records that should not be included. When you select Exclude, a small grid displays to the right. Enter the records you want to exclude in the list, or use the Lookup to locate the records.

Supervisors

Use the Supervisors category to filter the report by Supervisors.

Select All to include all Supervisors.

Select Pick to select the Supervisor(s) to include.

Paycheck Companies

This category is available to users who have more than one company.

Use the Paycheck Companies category to select the Paycheck Companies to include.

Select All to include all Paycheck Companies.

Select Pick to define specific Paycheck Companies. When you select Pick, the Paycheck Companies list displays. Select the check box next to each Paycheck company to include.

This category is available when the Report Format is Transmittal or Transmittal With Details.

Companies

The Company Pick option filters for AR Invoice and Payment records. The Companies category is available for Clients using the Multi-Company feature.

Select the Companies to include on the report.

Select All to include all companies on the report.

Select Pick to define specific Companies for the report. When you select Pick, the Companies list displays. Select the check box next to each Company to include on the report.

Note: When running reports using the Company Category/Record Pick and the company name exceeds the maximum number of characters, WinTeam will truncate the name.

This category is available for the Census Status report.

Locations

The Locations category is available for Clients using the Multi-Location feature.

Use the Locations category to select the Locations to include on the report.

Select All to include all Locations on the report.

Select Pick to define specific Locations for the report. When you select Pick, the Locations list displays. Select the check box next to each Location to include on the report.

Hours Over

This field defaults to 1000.

Group By

Select to Group By Employee, Classification, Distribution, Employee Type, Pay Frequency, Supervisor, or Primary Job. The default selection is Employee.

This option is available to users who have more than one company, but is not selected by default. If selected, the default company prints on the Grand Total Page and the Report Criteria page. All other pages print the applicable company name. If not selected, the default company prints on every page of the report.

Calc Employer Match

Select this check box to include the employers match portion of the 401K amount. This information is set up on the Company Setup screen, under the Payroll area.

If the Employer Match calculation is not calculating the way you want, you can export the report to Excel and manipulate the necessary information.

Include Employee Address

This option is NOT available for the Report Format of Transmittal With Details.

Select this check box to include the employee's address information on the report.

Include Employee Number

Select this check box to include the Employee Number on the report.

Include Loan Repayments

This option is available for the Report Formats of Transmittal and Transmittal With Details.

Select this check box to include 401K Loan Repayment information on the report.

Include Pay Rate

This option is available for the Report Format of Census Status.

Select this check box to include Pay Rate information on the report.

Select this check box to print the company logo on the report. It is selected or cleared by default based on the option selected in SYS:Defaults. However, you can modify the setting on each report.

Select this check box to include a list of the report options selected for the report. The Report Criteria page includes any ranges specified and each Category/Record selection made for the report. This check box is cleared selected by default.

Preview

Click the Preview button (or use the shortcut key, ALT + V) to view the report before printing.

Click the Print button (or press ALT + P) to send the report to your default printer.

Export

Click the Export button (or press ALT + X) to export the report to a specified format. Reports may be exported to Adobe Acrobat (PDF), Excel, Comma-Separated Values (CSV), Grid View and E-mail (available for premise-based clients only).

Computation of Hours

Hours are computed based on whether an employee is Hourly or Salary, then by Pay Type (Monthly, Semi-Monthly, Bi-Weekly, or Weekly).

Computation of 401K Earnings

If a Payroll check that has deferred 401K activity does not already have 401K earnings computed (because the deferred activity came strictly from Other Deduction area), the system automatically calculates what the 401K earnings should be just as Payroll Processing does with the normal system calculated 401K.

Wages + Other Compensation (selected with Include in 401K Computations) – Other Deductions (selected with Include in 401K Computations) = 401K Earnings

Computation of the Deferral Amount:

The deferral amount includes all normal 401K deferral activity (through the system calculated standard plan), plus any other deduction activity for the plan that is marked as a “Deferral Deduction”.

401K Census Report

Computation of Gross Earnings

The Gross Earnings that prints on the 401K Census report is the Federal Gross Earnings figure and all Tax Deductible deductions that are marked to "Include in Gross Earnings".