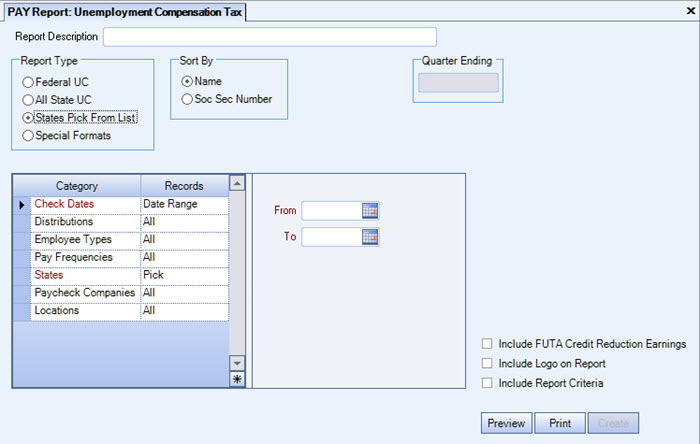

Overview

Unemployment Compensation Tax Report options are accessed from Payroll Reports. Use the Unemployment Compensation (UC) Tax report to gather unemployment compensation detail for each state and the federal government. This report displays Gross and Taxable Earnings for each employee (although there are a few state UC formats that do not want the 'Taxable' earnings shown on the report).

Formats that include timekeeping hours information will only look at paid Timekeeping records. Subcontractor Checks are excluded from this report. This report should be run at the end of each quarter. You may print this report or prepare an electronic file.

Important: For security reasons, TEAM cannot upload files to states on your behalf. You must upload the file to the state’s website using your user name and password. Contact the state directly if you need assistance, or if you encounter an error during the upload process (after you inform TEAM about the error). To help avoid upload errors, be sure to review your account numbers and make sure they don’t contain any hyphens or negative amounts before filing.

To prevent possible errors from coming back when filing the electronic files, the program will remove all ASCII characters from the employee’s name when creating each electronic file. These include the following characters:

~ ! @ # $ % ^ & * ( ) _ = ` { } [ ] \ , . ; ' : " < > ? - + / |

Illinois

Beginning with the 2020 tax year, a Schedule P (Illinois Withholding Schedule) must be filed with every Form IL-UC (Illinois Withholding Income Tax Return). This file is created when you create the current IL UC electronic file. A prompt to save the file displays following completion of the existing file and summary. The default location for the file is the location selected for the original file and the default name is ILUIMonthlyWage-SchedulePxxxxxx (xxxxxx is the quarter ending date-for example 063020). You can edit both the location and file name.

Maryland

The electronic file for MD UC (Maryland Unemployment Compensation) is created created as a .csv file, but to retain the correct formatting it should be opened using Notepad (or similar app) instead of Excel. If opened using Excel, we cannot guarantee the data will remain in the correct format.

Texas

If you are filing Texas unemployment compensation, download the QuickFile program from the state and use this to upload your ICESA file to the state of Texas. Before filing, review the records to ensure there are no negative amounts or invalid UC Account Numbers.

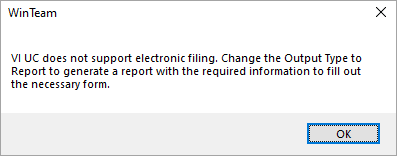

Virgin Islands

The Virgin Islands does not accept an electronic file, instead they require the information in an Excel spreadsheet. To create this required spreadsheet, use the Report output type.

Key Functionality

Type a description to name the report. This description prints above the Report Title.

Use the Report Type option to choose the level of detail for the report. You can select a Federal, State or Special Format. Click Federal UC to print a report for Federal Unemployment Tax. Click All State UC or States Pick From List to print a report in standard format acceptable to most states. The standard format is available for all states regardless of the state's special format.

When you select States Pick From List, the Include FUTA Credit Reduction Earnings check box is available. When this is checked, a column displays on the report called CR (Credit Reduction) Reduction Earnings. This report is helpful for companies required to pay extra for their State's Credit Reduction. You can get the Earnings that qualify for this credit reduction and then figure the extra liability.

See this link and this link for more information about the FUTA Credit Reduction.

Note: A reduction in the usual credit against the full FUTA tax rate increases an employer's tax liability on the Form 940. For example, an employer in a state with a credit reduction of 0.3% computes its FUTA tax by reducing the 6.0% FUTA tax rate by a FUTA credit of only 5.1% (the standard 5.4% credit minus the 0.3% reduction) for an effective FUTA tax rate of 0.9% for the year. Any increased FUTA tax liability due to a credit reduction is considered incurred in the fourth quarter of the year and is due by January 31 of the following year.

Click Special Formats to generate a report either to hard copy or to create an electronic file. This option is designed for submission for states that require some special formatting (i.e. California's DE6 report). Contact Team for assistance if you must use a special format and your state is not among those listed.

Use the Sort By option to sort the report data by Employee Name or Social Security Number. The default selection is to sort by Employee Name.

The Output Type option group is available if the Type of Report is Special Formats. Use the Output Type option group to select an export method for the report.

Click Report to print a standard report. Click Electronic to create a file for submission to the federal, state, or local taxing authority.

If you do not enter a Taxpayer ID Number for City, County/School Districts, Disability, State, or State UC (on the Payroll, Taxes screen) your electronic files will not contain any records.

The Quarter Ending field defaults to the To date entered in the Check Dates category. The system does not validate that the To date is the last day of a quarter.

The Report Format to Use field is available when the selected Type of Report is Special Formats.

Select the State format to use for the report. Contact Team for assistance if your state is not listed and requires a special format. If your state requires that you submit the report electronically, an Electronic File Output Type becomes available.

Important: For security reasons, TEAM cannot upload files to states on your behalf. You must upload the file to the state’s website using your user name and password. Contact the state directly if you need assistance, or if you encounter an error during the upload process (after you inform TEAM about the error). To help avoid upload errors, be sure to review your account numbers and make sure they don’t contain any hyphens or negative amounts before filing.

The system defaults the State Code based on the Report Format to Use field.

Check Dates

Select the Check Dates to include checks based on the Check Dates.

Select All to include all Check Dates.

Select Range to define a range of Check Dates to include. When you select Range, the range fields display. Type the beginning Check Date in the From field and the ending Check Date in the To field.

Distribution Types

Use the Distribution Types category to select the Distribution Types to include.

Select All to include all Distribution types.

Select Pick to define specific Distribution Types to include. When you select Pick, the Distribution Type list displays. Select the check box next to each Distribution Type to include.

Employee Types

Use the Employee Types category to select the Employee Types to include.

Select All to include all Employee Types.

Select Pick to define specific Employee Types. When you select Pick, the Employee Types list displays. Select the check box next to each Employee Type to include.

Pay Frequencies

Select the Pay Frequencies to include on the report.

If using the Pick from List option, the system determines the check records to include by the Employee's current Pay Frequency set up in the Employee Master File. The only exception is when running the report for Format: Report and Report Type: Detail by Check.

Note: When running the report for Format: Report and Report Type: Detail by Check and limiting the pay frequency using the Pay Frequencies category, the system will look at the pay frequency of the batch instead of the Employee's current pay frequency. All Batch Types have a Pay Frequency defined except for Void and Tax Adjustment Batches. For Void and Tax Adjustment batches, the current pay frequency of the Employee (as indicated in the Employee Master File) will determine whether the void or tax adjustment record is included.

Paycheck Companies

This category is available to users who have more than one company.

Use the Paycheck Companies category to select the Paycheck Companies to include.

Select All to include all Paycheck Companies.

Select Pick to define specific Paycheck Companies. When you select Pick, the Paycheck Companies list displays. Select the check box next to each Paycheck company to include.

Locations

The Locations category is available for Clients using the Multi-Location feature.

Use the Locations category to select the Locations to include on the report.

Select All to include all Locations on the report.

Select Pick to define specific Locations for the report. When you select Pick, the Locations list displays. Select the check box next to each Location to include on the report.

This option is available to users who have more than one company, but is not selected by default. If selected, the default company prints on the Grand Total Page and the Report Criteria page. All other pages print the applicable company name. If not selected, the default company prints on every page of the report.

This option is available when you select the Report Type of States Pick From List.

When this is checked, a column displays on the report called CR (Credit Reduction) Reduction Earnings. This report is helpful for companies required to pay extra for their State's Credit Reduction. You can get the Earnings that qualify for this credit reduction and then figure the extra liability.

For more information on the FUTA Credit Reduction, see: http://www.irs.gov/taxtopics/tc759.html and http://hr.cch.com/news/uiss/101013a.asp

Note: A reduction in the usual credit against the full FUTA tax rate increases an employer's tax liability on the Form 940. For example, an employer in a state with a credit reduction of 0.3% computes its FUTA tax by reducing the 6.0% FUTA tax rate by a FUTA credit of only 5.1% (the standard 5.4% credit minus the 0.3% reduction) for an effective FUTA tax rate of 0.9% for the year. Any increased FUTA tax liability due to a credit reduction is considered incurred in the fourth quarter of the year and is due by January 31 of the following year.

Select this check box to print the company logo on the report. It is selected or cleared by default based on the option selected in SYS:Defaults. However, you can modify the setting on each report.

Select this check box to include a list of the report options selected for the report. The Report Criteria page includes any ranges specified and each Category/Record selection made for the report. This check box is cleared selected by default.

Preview button

Click the Preview button (or use the shortcut key, ALT + V) to view the report before printing.

Create button

The Create button is available when you have selected the Report Type of Special Formats. Use this option when you need to generate an electronic file for submission.

Note: When you select Report Type Special Formats and Output Type Electronic, the Transmitter Information screen is displayed. If your state requires a county code, enter it in the Miscellaneous Information County Code field, and the number will appear following the last number in the T record. If no county code is entered, the electronic file will include 000 in this field.

Security

The PAY: Report Unemployment Compensation Tax screen has its own Security Group, PAY Report Unemployment Compensation Tax, which is part of the PAY Reports All Employees. For more information see Learning about Security Groups.