Overview

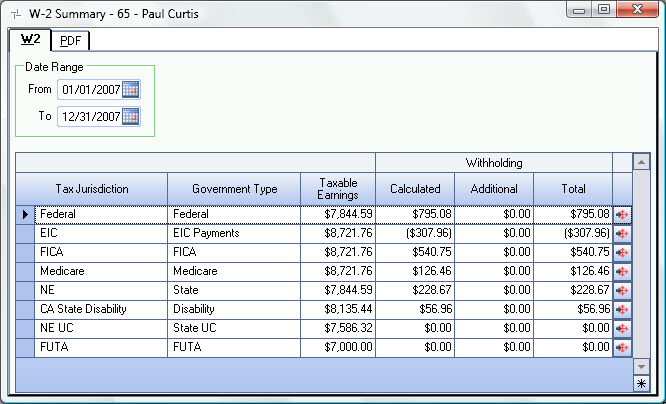

The W-2 Summary screen displays the total earnings and withholdings within a specified range of dates for the selected employee. Each Tax Jurisdiction lists with the associated Government Type, Taxable Earnings and total withholdings.

When payroll is run, we check to see if the employee has the tax code in the Employee Master File, and if it matches what is coming through from Payroll Check Processing, then the record is marked as a resident code. If the tax code does not match, then the tax code came from the Job Master Files, and it is marked as a non-resident.

To view detailed records for each tax jurisdiction, click the Detail button. The Tax Jurisdiction screen will list each pay date in descending pay date order.

Standard grid functionality applies to this screen. For information on grid functionality see Understanding Grids and Using the Filter Row Feature.

The W-2 Summary screen can be accessed directly from an Employee Master File record (from the Paycheck Info submenu).

Key Functionality

The Date Range filters the records that are included in the tax information on this screen. Enter the From and To Date, or use the Date Control to select a date.

This field is visible only for Clients using the Multi-Company feature.

The Paycheck Company field filters the records by the employee's Company at the time the paycheck was created.

Leave the Paycheck Company field blank to display all records regardless of the company the check belonged to.

Displays the tax authorities that apply to this employee.

Displays the government entity associated with the Tax. Tax Jurisdictions and Government Type information are maintained on the Tax Tables screen.

Displays the total taxable earnings for this employee, Tax Jurisdiction, and Date Range.

Displays the total amount of withholding calculated for this employee, Tax Jurisdiction, and Date Range.

Displays the total amount of additional withholding for this employee, Tax Jurisdiction, and Date Range.

Displays the total amount of Calculated Withholding and Additional Withholding for this employee, Tax Jurisdiction, and Date Range.

Click the Detail button to display the Tax Jurisdiction Detail screen for this employee. The Tax Jurisdiction screen details the earnings and withholdings for each pay date for the selected Tax Jurisdiction.

The PDF tab displays the sources of the W2 and W2C information.

If there are Federal Taxable Earnings being reported, then the Federal Taxable check box would be selected. Same with FICA and Medicare, but if there are no taxable wages, then these are not selected.

Click the PDF icon to display the PDF copy of the Employee W2.

Note: In order to view pdfs the user must have security for the PAY Show Full SSN Security Group. The PAY ALL and SYS ALL Security Groups have this group included. You could also set up a custom security group to include the PAY Show Full SSN in the Groups tab.

Click the book icon to display the W2 Instructions.

Security

In order to view pdfs the user must have security for the PAY Show Full SSN Security Group. The PAY ALL and SYS ALL Security Groups have this group included. You could also set up a custom security group to include the PAY Show Full SSN in the Groups tab.