PAY: Holiday Pay

Overview

Use the Holiday Pay window to create an employee compensation record for Canadian holidays. Overtime and double time hours do not count towards timekeeping hours when calculating holiday pay. When wages include vacation pay (an Other Compensation record is added, which is set up for vacation pay reimbursement), this is included in calculating the holiday pay.

Note: WinTeam can calculate holiday pay when the employee works in only one province or territory. If the employee worked in multiple provinces or territories in the past four weeks, contact TEAM Client Services by phone at 800-500-4499 or by email at supportstaff@teamsoftware.com for assistance.

Eligibility

To be eligible for statutory holiday pay an employee must:

- Have been employed for 30 calendar days before the statutory holiday

- Have worked or earned wages on 15 of the 30 days immediately before the statutory holiday.

Employees who work under an averaging agreement or variance at any time in the 30 days before the holiday do not have to meet the 15-day requirement.

No pay for ineligible employees

An employee who is not eligible for statutory holiday pay is not entitled to be paid an average day’s pay. If an ineligible employee works on a statutory holiday they may be paid as if it were a regular work day.

Statutory holiday on a day off

When an employee is given a day off on a statutory holiday, or it falls on a regular day off, an eligible employee is entitled to be paid an average day’s pay.

An average day’s pay is calculated by dividing the total wages earned in the 30 calendar days before the statutory holiday by the number of days worked. Vacation days taken during this period count as days worked.

Total wages include wages, commissions, statutory holiday pay, and vacation pay but does not include overtime pay.

Tip: See Employment and Social Development Canada for detailed eligibility requirements for each jurisdiction.

Recommended Process

- Create a Compensation Code with a description of Holiday Pay and a Basis of One-Time.

- Create a payroll batch.

- Get vacation pay from the Review Checks window (if applicable).

- In this Holiday Pay window, click the Preview button to verify the accuracy of the report and then click the Update button to update the compensation records.

- Next, run the Other Compensation report using Details From the Employee Master and filter for the holiday pay compensation code to verify the holiday pay.

- Delete the batch you created.

- Create a new payroll batch using the same criteria and WinTeam will include the holiday pay.

Calculation Methods

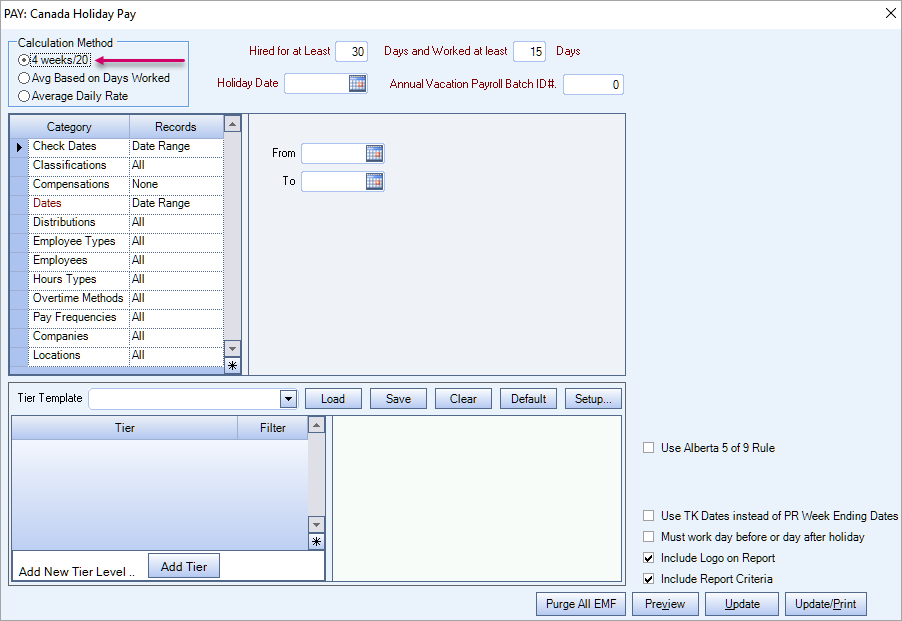

- 4 weeks / 20 - (Default) – The employee must have worked four weeks to be eligible–used for Ontario primarily

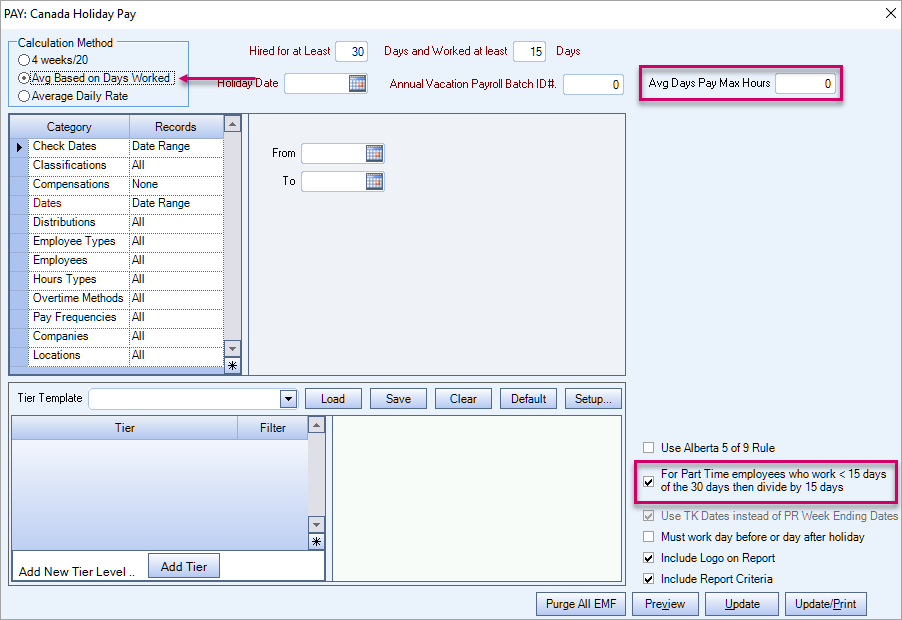

- Avg Based on Days Worked – Used for all other provinces and territories except Ontario and Alberta

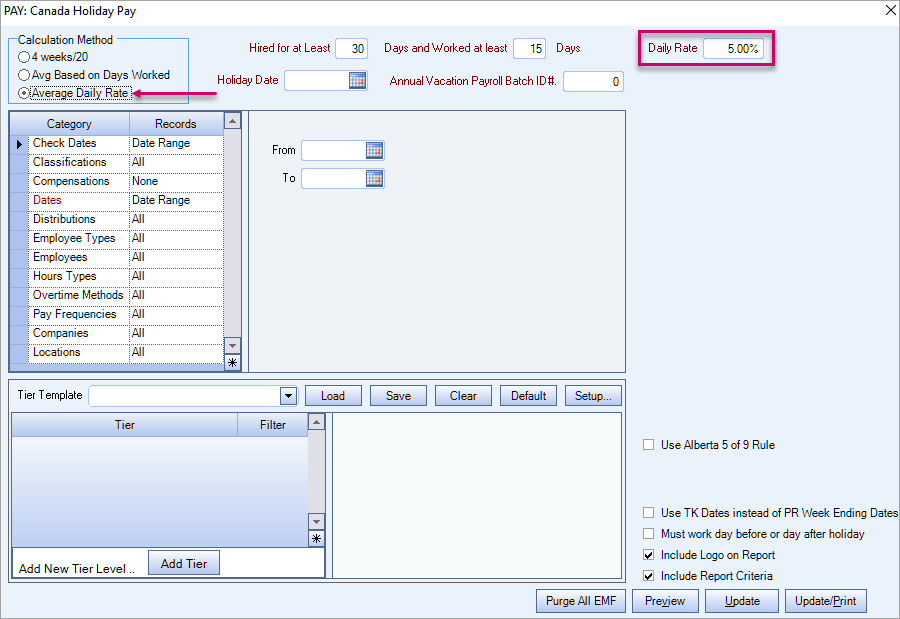

- Average Daily Rate - Used for Alberta only

Four Weeks / Twenty

To use this calculation method, the employee must have worked four weeks to be eligible–used for Ontario primarily.

Average Based on Days Worked

This calculation method is used for all other provinces and territories except Ontario and Alberta. When this calculation method is selected, the Avg Days Pay Max Hours and For Part Time employees who worked < 15 days of the 30 days then divide by 15 days and check boxes are enabled.

This calculation method ignores any day the employee worked only overtime hours (zero non-overtime hours) when determining if they met the requirement for the number of days they needed to work.

If an employee only worked a total of 15 days in the date range (06/01/2022 thru 07/04/2022), but one of those 15 days were just overtime hours, they would not be considered for holiday pay.

Average Daily Rate

This calculation method is used for Alberta only. When this calculation method is selected, the Daily Rate field is enabled.

Enter the number of days an employee must be employed and how many days the employee must have worked to be eligible for holiday pay based on your province or territory. The default settings are based on the province/territory field in the Company Name and Address section of the SYS: Company Setup window.

| Province/Territory | Hired for at Least xx Days | Worked at Least xx Days |

|---|---|---|

| AB (Alberta) | 0 | 30 |

|

BC (British Columbia) PE (Prince Edward Island) |

30 | 15 |

|

MB (Manitoba) ON (Ontario) QC (Quebec) SK (Saskatchewan) |

0 | 0 |

|

NS (Nova Scotia) NL (Newfoundland) YT (Yukon) |

30 | 0 |

|

NT Northwest Territories NU Nunavat |

0 | 30 |

| NB (New Brunswick) | 90 | 90 |

This is a required field when the calculation method is Average Daily Rate. It is used to support the 5.00% average daily rate used in Alberta. The field defaults to 5.00%, but you can change it to another percentage to support the average daily rate used in another province or territory.

Note: WinTeam does not support multi-jurisdictional holiday pay in Canada which means that if an employee lives in Saskatchewan, and works for a company with head quarters in Alberta, the Alberta rules apply.

Enter the date of the holiday, or use the date control to select a date.

Enter either a zero (default) or a batch identification number (excluding the batch for calculating holiday pay).

Example: You create a batch for annual vacation pay–this batch should be excluded when calculating holiday pay.

The Average Days Pay Maximum Hours field displays when the calculation method is Avg Based on Days Worked.Typically the maximum hours for full time employees is eight. The value may be less for part time employees.

You can filter the report using tier which makes it easy to create a specific report each time you need one without recreating the criteria. See Using Tier Templates and Using Tier Parameters for more information.

Note: The job range uses the employee's primary job to filter.

This check box is selected by default when the calculation method is Avg Based on Days Worked. It allows part time employees to be included in the calculation for holiday pay. This option is intended to be used for part time employees, but this report can be run using full time employees, if you clear this check box.

Warning: In Ontario, this rule is not applicable. Do not select this check box for Ontario.

The Use TK Dates instead of PR Week Ending Dates check box is selected and disabled so if a part time employee only works X number of days in the date range, WinTeam will use the actual number of days worked to calculate their holiday pay based on the eligibility criteria entered.

Select this check box to identify employees to whom the Alberta 5 of 9 rule applies when determining holiday compensation. This rule states that if in the last nine weeks before a holiday, the employee worked five of the same weekday, then that weekday is considered a regular day of work for holiday pay calculations.

Example: If a holiday falls on a Monday, and the employee has worked five Mondays in the last nine weeks before the holiday, then Monday is a regular day of work for them, and is included in the holiday pay calculation.

Employees who have not worked 30 days in the last 12 months before the holiday are excluded from holiday pay.

Select this check box to use the timekeeping dates instead of the pay week ending dates. You must enter the timekeeping Dates in the Category/Records filters.

When this check box is cleared, the required Dates in the Category/Records filters are the pay week ending dates.

Important: The other compensation record of vacation pay is included in the calculation (you must pick all vacation pay comp codes from the Category/Records list).

Select this check box to include only those records where an employee worked the day before or day after a holiday. This is for jurisdictions that require employees to work the day preceding or following the holiday.

Select this check box to print the company logo on the report. It is selected or cleared by default based on the option selected in SYS:Defaults. However, you can modify the setting on each report.

Select this check box to include a list of the report options selected for the report. The Report Criteria page includes any ranges specified and each Category/Record selection made for the report. This check box is cleared selected by default.

Use the Purge function to delete all existing holiday pay compensation records in the Employee Master File. This is useful if you are unsure if there are records left in the EMF from the last holiday, if you selected the wrong holiday date, or used incorrect criteria.

The Holiday Pay screen has its own security group, PR Canada Holiday Pay and is also included in the PAY ALL security group.

Tip: For more information see Security Groups Overview and Security Groups By Module.