Overview

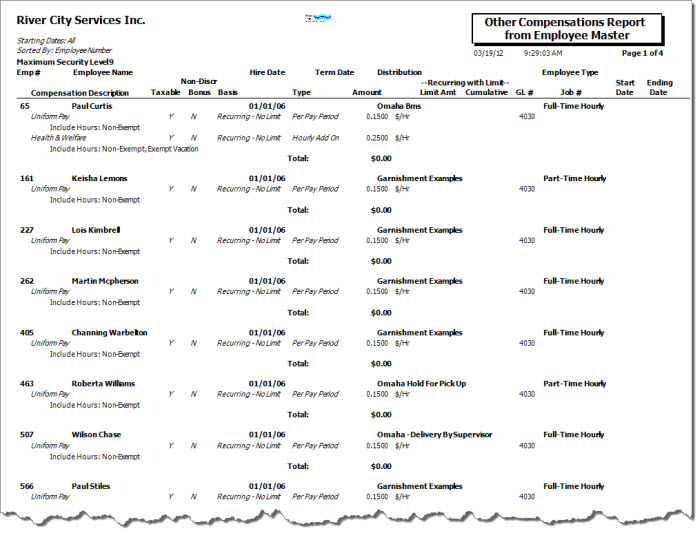

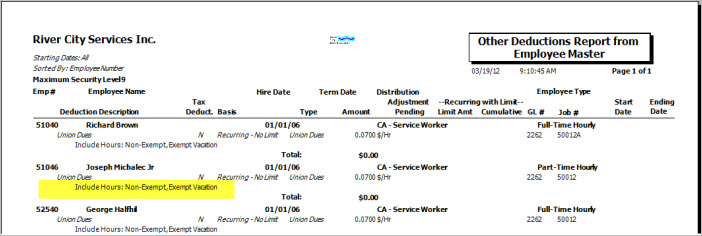

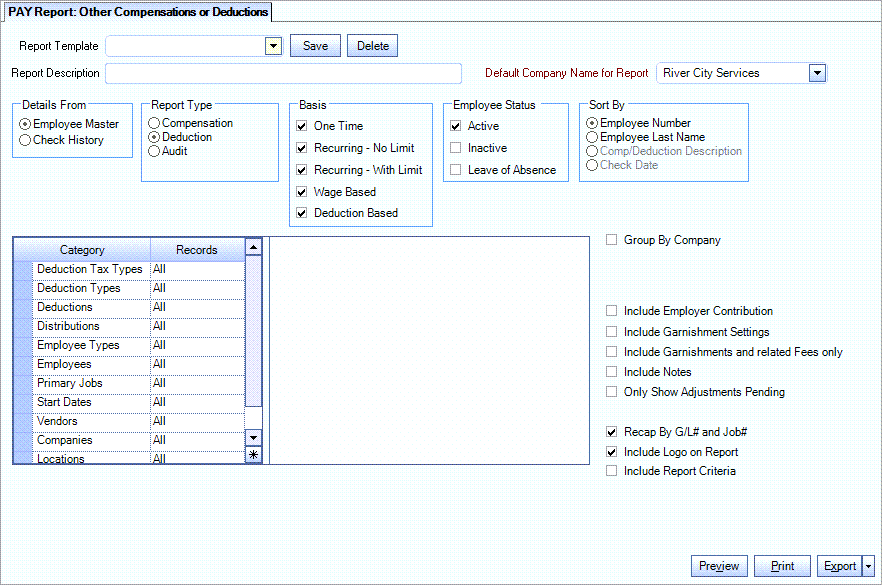

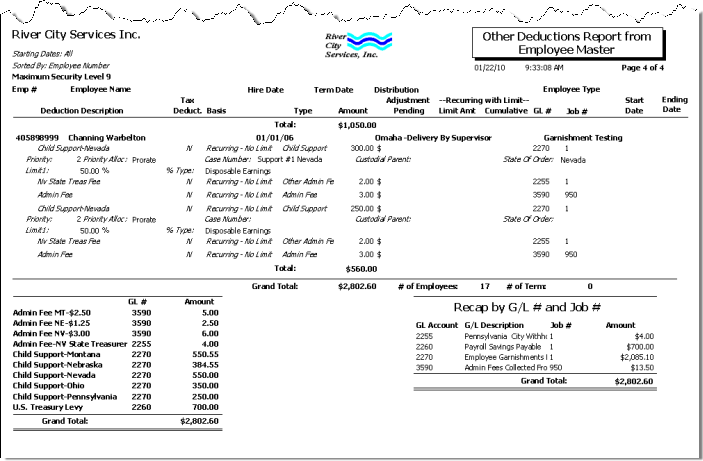

You can use the Other Compensations or Other Deductions report to list the Other Compensations and Deductions and their detail information.

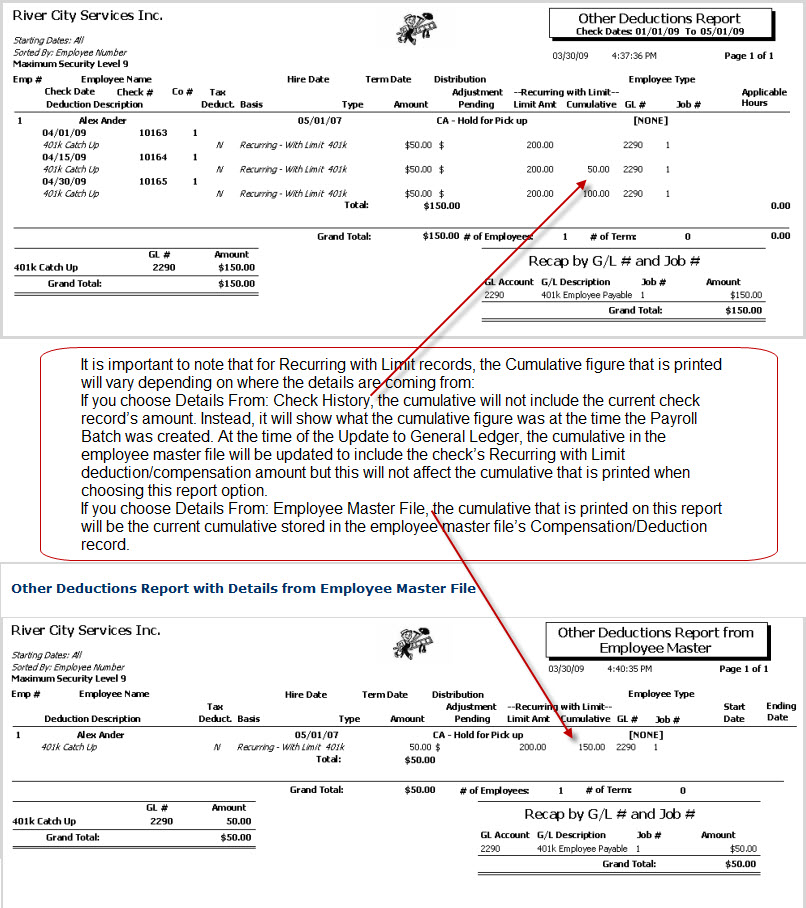

Tip: This is a good report to run if you need to keep an eye on recurring deductions that have a limit.

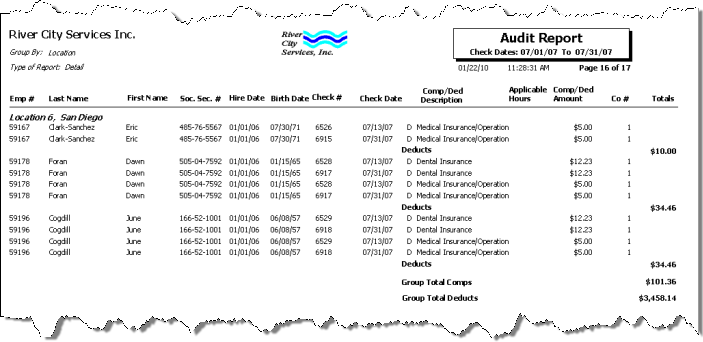

You can pull details from the Employee Master File or actual Check History. This is especially helpful when you need to find historical information on a specific compensation or deduction record. If you choose Check History, there is an additional Audit Report, which allows you to include both deductions and compensations on the same report. The format for the Audit Report is very different from the Compensation and Deduction reports.

Note: It is important to note that for Recurring with Limit records, the Cumulative figure that prints will vary depending on where the details are coming from:

- If you choose Details From: Employee Master File, the cumulative that prints on the report will be the current cumulative stored in the employee master file’s Compensation/Deduction record.

- If you choose Details From: Check History, the cumulative does not include the current check record’s amount. Instead, it shows what the cumulative figure was at the time the Payroll Batch was created. At the time of the Update to General Ledger, the cumulative in the employee master file will be updated to include the check’s Recurring with Limit deduction/compensation amount but this will not affect the cumulative that is printed when choosing this report option.

Key Functionality

Select a report template from the list, or type a description and Save your settings to create a report template for later reuse. You may also select and Delete report templates from the list.

Select the file to get the details from – either the Employee Master or from actual Check History.

When you need to find historical information on a particular deduction or compensation record, choose Check History. Using Check History also allows you to filter records with the Paycheck Companies category.

Note: When Check History is selected in the Details From section and Deduction is selected in the Report Type section, the primary job number assigned to the Employee displays in the grid view of the report.

Use the Basis to filter report data by occurrence of the compensation or deduction.

- Select One Time to include one time compensations and deductions on the report.

- Select Recurring - No Limit to include recurring, unlimited compensations and deductions on the report.

- Select Recurring - With Limit to include recurring, limited compensations and deductions on the report.

- Select All to include all compensations and deductions on the report.

- Select Wage Based to include all deductions that are set up as Wage Based.

- Select Deduction Based to include all deductions that are set up as Deduction Based.

Use the Employees Status option to filter the report data by employee status.

- Select Active to include only active employees.

- Select Leave of Absence to include only employees who are on leave of absence. If this options is selected, you may group the report by Inactive Reason.

- Select Inactive to include only inactive employees.

- Select All to include all employees, regardless of their status.

Select a report type to run:

- Click Compensation to run a report of Compensations.

- Click Compensation - NDB to run the Nondiscretionary Bonus Compensation report.

- Click Deduction to run a report of Deductions and Garnishments.

- Click Audit to run a report of Compensations and Deductions.

The Category/Records filter will vary depending on the Report Type.

Note: When Check History is selected in the Details From section and Deduction is selected in the Report Type section, the primary job number assigned to the Employee displays in the grid view of the report.

The Compensation and Deduction Report Types can be sorted by Employer Number or Employee Last Name.

The Audit Report Type can be sorted by Employee Number, Employee Last Name, Comp/Deduction Description, or Check Date.

Note: Check Date is not an available sorting option when the details of the report are coming from the Employee Master File.

Use the Report Format option to choose the level of detail for the report. This is available only when the Report Type is Audit.

This is available if Audit is the Report Type.

You may group the report by Location, Distribution, Employee Type, Employee, Comp/Deduction, None, or Benefit Plan Option.

The Category/Records filter will vary depending on the Report Type.

Benefit Plan Options

The Benefit Plan Options category displays when the Report Type is Audit.

Note: This option filters for benefits set up/managed through the Human Resources module. It does not filter for benefits set up/managed through the Insurance Benefits module.

Select to filter the report to find Other Deductions assigned to an employee through the HR: Benefits By Employee screen (on the Insurance/Other Tab). Other Deduction code activity will be included on this report if the Benefit Plan Option(s) you select include(s) Benefits assigned through HR: Benefits By Employee.

Select All to include all Deductions, regardless of the Benefit Plan Option.

Select Pick to define specific Benefit Plan Options to include. When you select Pick, the Benefit Plan list displays. Select the check box next to each Benefit Plan to include.

Start Dates

Use the Start Dates category to select the Compensation or Deduction start dates to include on the report.

Select All to include all Compensations or Deductions, regardless of the Start Dates.

Select Range to define a range of Start Dates for the report. When you select Range, the range fields display. Type the beginning date in the From field and the ending date in the To field.

Check Dates

This category is available if you selected to get details from Check History.

Use the Check Dates category to select the Check dates to include on the report.

Select All to include all Compensations or Deductions, regardless of the Check Dates.

Select Range to define a range of Check Dates for the report. When you select Range, the range fields display. Type the beginning date in the From field and the ending date in the To field.

Employees

Use the Employees category to select the Employees to include on the report.

Select All to include all Employees on the report.

Select Range to define a range of Employees for the report. Type the beginning Employee Number in the From field and the ending Employee Number in the To field.

Select Create to define your own list of Employees. When you select Create, a small grid displays to the right. Enter the Employee Numbers you want to include in the list, or use the Lookup to locate the Employee Numbers.

Select Exclude to identify records that should not be included. When you select Exclude, a small grid displays to the right. Enter the Employee Numbers you want to exclude in the list, or use the Lookup to locate the Employee Numbers.

Employee Types

Use the Employee Types category to select the Employee Types to include.

Select All to include all Employee Types.

Select Pick to define specific Employee Types. When you select Pick, the Employee Types list displays. Select the check box next to each Employee Type to include.

This Category is available if Details are from Check History.

Distributions

Use the Distributions category to select the Distribution to include.

Select All to include all Distribution types.

Select Pick to define specific Distribution to include. When you select Pick, the Check Distributions add edit list displays. Select the check box next to each Check Distribution to include.

Primary Jobs

The Primary Jobs filter is available for the Deduction and Audit Report Types. Use Primary Jobs to filter the report by Primary Jobs.

Select All to include all Primary Jobs.

Select Range to define a range of Primary Jobs for the report. When you select Range, the range fields display. Type the beginning Primary Job Number in the From field and the ending Primary Job Number in the To field.

Select Pick to select the Primary Job(s) to include.

Select Create to define your own list of records. When you select Create, a small grid displays to the right. Enter the records you want to include in the list, or use the Lookup to locate the records.

Select Exclude to identify records that should not be included. When you select Exclude, a small grid displays to the right. Enter the records you want to exclude in the list, or use the Lookup to locate the records.

Vendors

Use the Vendors category to select the Vendors to include on the report. (On the HR: and INS: Benefit Insurance/Other Analysis Reports, this Category is available when the Report Type is Vendor Billing.)

Select All to include all Vendors.

Select Range to define a range of Vendors for the report. When you select Range, the range fields display. Type the beginning Vendor Number in the From field and the ending Vendor Number in the to field, or use the Lookup to locate the Vendor Number.

Select Pick to define specific Vendors for the report. When you select Pick, the Vendor list displays. Select the check box next to each Vendor to include on the report.

Select Create to define your own list of Vendors. When you select Create, a small grid displays to the right. Enter the Vendor Numbers you want to include in the list, or use the Lookup to locate the Vendor Numbers.

Select Exclude to identify records that should not be included. When you select Exclude, a small grid displays to the right. Enter the Vendor Numbers you want to exclude in the list, or use the Lookup to locate the Vendor Numbers.

Companies

The Company Pick option filters for AR Invoice and Payment records. The Companies category is available for Clients using the Multi-Company feature.

Select the Companies to include on the report.

Select All to include all companies on the report.

Select Pick to define specific Companies for the report. When you select Pick, the Companies list displays. Select the check box next to each Company to include on the report.

Note: When running reports using the Company Category/Record Pick and the company name exceeds the maximum number of characters, WinTeam will truncate the name.

Locations

The Locations category is available for Clients using the Multi-Location feature.

Use the Locations category to select the Locations to include on the report.

Select All to include all Locations on the report.

Select Pick to define specific Locations for the report. When you select Pick, the Locations list displays. Select the check box next to each Location to include on the report.

Paycheck Companies

This Category is available if Details are from Check History, and to users who have more than one company.

Use the Paycheck Companies category to select the Paycheck Companies to include.

Select All to include all Paycheck Companies.

Select Pick to define specific Paycheck Companies. When you select Pick, the Paycheck Companies list displays. Select the check box next to each Paycheck company to include.

This option is available to users who have more than one company, but is not selected by default. If selected, the default company prints on the Grand Total Page and the Report Criteria page. All other pages print the applicable company name. If not selected, the default company prints on every page of the report.

Select the Include Employer Contribution check box to include the Employer Share on the report.

This check box is available when running the Deduction Report Type.

Select the Include Garnishment Settings check box to include garnishment settings and limits on the report.

This check box is available when running the Deduction Report Type.

Select this check box to Include Garnishment Settings and related Fees only. When this is selected, no other Deductions will display.

Select the Include Notes check box to include in the report any Notes entered in the Notes field on the Other Compensations or Other Deductions screen.

This check box is available if the Report Type is Deduction.

Select the Only Show Adjustments Pending check box to only show pending adjustments on the report.

This check box is available when running the Employee Master Deduction report, with the Basis of Recurring - With Limit selected. It enables you to look at the limits of a parent deduction when the check box Always Use Limits from Parent Deduction is selected on the Payroll: Employee Master File Other Comps/Deducts screen, Deductions Tab Garnishments View.

Select the Recap by G/L # and Job # to have the system provide a recap of G/L # and Job # totals at the end of the report.

This is selected by default.

Select the Include Logo on Report check box to print the company logo on the report.

This check box is selected or cleared by default based on the option selected in SYS:Defaults. However, you can modify the setting on each report. Report Criteria cannot be created for the Audit Report Type.

Select the Include Report Criteria check box to include a list of the report options selected for this report.

The Report Criteria page includes any ranges specified and each Category/Record selection made for the report. This check box is NOT selected by default. Report Criteria cannot be created for the Audit Report Type.

Preview button

Click the Preview button (or use the shortcut key, ALT + V) to view the report before printing.

Print button

Click the Print button (or press ALT + P) to send the report to your default printer.

Export button

Click the Export button (or press ALT + X) to export the report to a specified format.

Reports may be exported to Adobe Acrobat (PDF), Excel, Comma-Separated Values (CSV), Grid View and E-mail (available for premise-based clients only).

The Grid View Export also includes Vendor Name and Vendor Number.

This report includes Garnishments and related Fees only and Garnishment Settings

Security

This report compares the security levels entered in the Pay Comps and Pay Deducts Read fields to the Security Level field found in the Employee Master File for all employees. The system allows the logged in user to view information for any employee that has a security level less than or equal to user security levels.

The PAY Report Other Compensations or Deductions screen has its own Security Group, PAY Report Other Compensations or Deductions.

The PAY Report Other Compensations or Deductions screen is part of the PAY Reports All Employees Security Group.

Tip: For more information see Security Groups Overview and Security Groups By Module.