Important: ACA resources are for reference only. Please consult your legal, financial or tax professional to determine the best plan for your company.

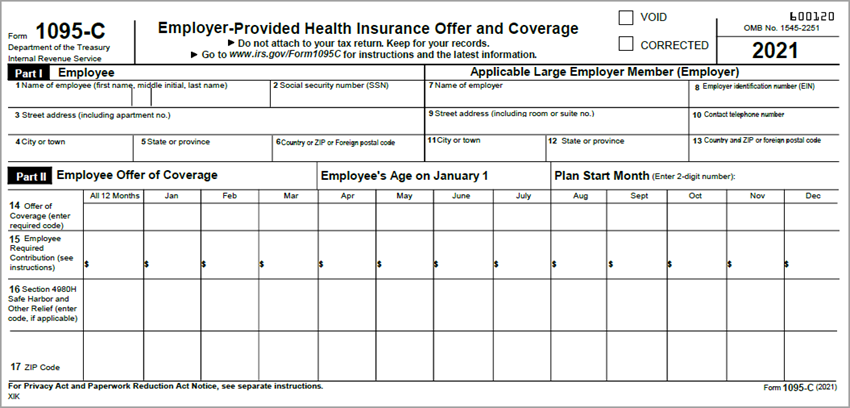

The Patient Protection and Affordable Care Act (ACA), mandates that Applicable Large Employers (ALE), generally with 50 or more full-time employees, comply with health benefit reporting requirements. For the current tax reporting year, companies required to comply must file a Form 1095-C with the IRS for every employee that meets the ACA definition of full-time for any month of the year, and every part-time employee enrolled in a self-insured health benefit. Each employee must also receive a copy of his or her Form 1095-C. More information and instructions are available on the IRS web site.

Example: The 1095-C is similar in concept to the W-2 (which reports an employee's annual wages and the amount of taxes withheld from his or her paycheck). It includes information about the health coverage (if any) offered to the employee, spouse and/or dependents. Employees that purchase health insurance coverage through the Health Insurance Marketplace can use 1095-C information to determine eligibility to claim the premium tax credit.

In general, WinTeam will produce a Form 1095-C for ACA-compliant full-time employees, and part-time employees enrolled in a self-insured insurance benefit. To determine those employees that must receive a Form 1095-C in compliance with the Affordable Care Act (ACA), WinTeam utilizes data from several key areas in the system.

For full-time, over the course of the tax year, the following conditions must be true:

- An Employee's Status (in the Employee Master File Status Info tab) must have been Active or Leave of Absence

- An Employee has had an Insurance Benefits Package that contains at least one ACA-compliant benefit

- An Employee has had an Insurance Benefits Package with a Stability Start Date (Effective Date) or End Date during the tax year, OR

- Employee becomes full-time toward the end of the year and is in a waiting period until the next year.

Example: An employee who passes a full-time test date of 11/1/19, with a Stability Start Date of 1/1/2020, would receive a Form 1095-C for 2019. On the form, the line 14 code would be 1H (no offer of benefits) for November and December 2019, and the line 16 would be 2D (indicating the employee is in a waiting period). As of January 2020, the line 14 code would be 1A, 1B, 1C, 1D, or 1E (depending on the benefits offered) and the line 16 would be 2C, 2F, 2G, or 2H (depending on whether the employee enrolls in or waives benefits).

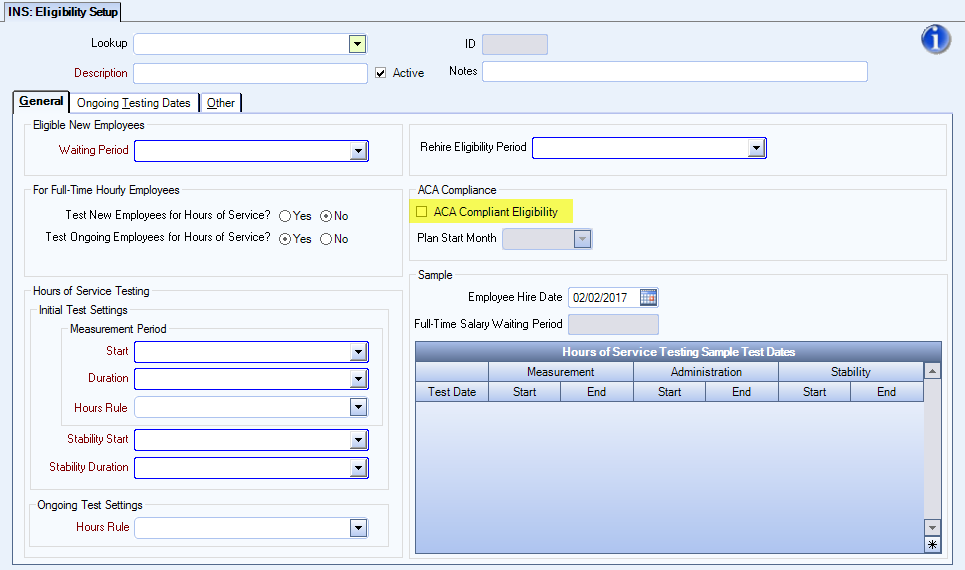

- An Employee must have the Eligibility Setup of ACA = True

- An Employee must have passed an ACA Compliant Eligibility test

A Part-Time self-insured Employee will not have an ACA-compliant Eligibility Setup, but will receive a Form 1095-C if over the course of the tax year:

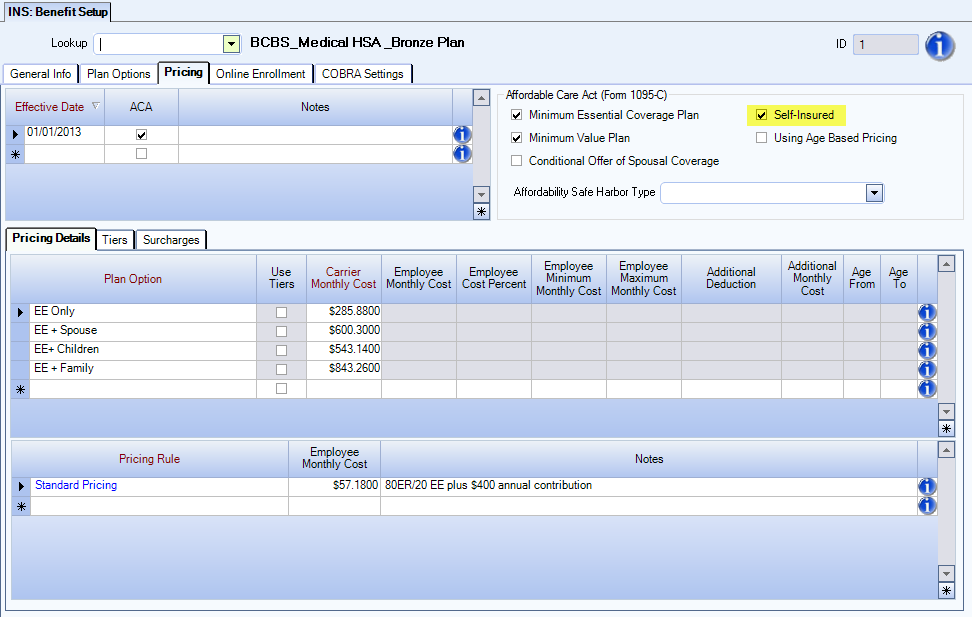

- An Employee has been enrolled in a self-insured benefit, which is noted in the Benefit Setup Pricing tab by selecting the ACA and Self Insured options.

This section of the Form 1095-C will be populated with information contained in the Employee Master File. Applicable Large Employer Member (ALE) information will come from SYS: Company Setup. You can choose for which ALE to generate 1095-C forms at the time of report creation. WinTeam functionality in this process is very similar to that employed during W-2 reporting.

Also in SYS: Company Setup, an Insurance Benefits 1095-C Contact Phone field should be used to accommodate the potential need for the Internal Revenue Service or an Employee to contact someone in the organization with specific questions related to Affordable Care Act compliance. The Contact Telephone Number submitted on the 1095-C Report may be different than the phone number that currently exists for the Company. For example, you may wish for those calls to be directed to the phone number of the Benefits Administrator. If this field is blank, the Company Phone number will be used to populate the 1095-C Report.

This section of Form 1095-C contains benefit offer information (Line 14), employee share of lowest cost (Line 15), and affordability safe harbor data (Line 16). WinTeam seamlessly populates the form with this information and all required IRS indicator codes. If the same Code is present in all 12 months of the tax year, WinTeam populates the All 12 Months box with that Code.

Line 14 is reports the What, Who and When of the Offer of Coverage: whether your company made an offer of coverage to the employee in a given month, the type of coverage offered, and all to whom it was made.

There are nine Indicator Codes available to report coverage particulars for each month of the year (1A through 1I; more information and instructions are available on the IRS web site).

In WinTeam, the What offer of coverage is set up in INS:Benefit Setup on the Pricing tab to enable reporting of whether a particular benefit:

- Offered Minimum Essential Coverage, and if so, provided Minimum Value

- Used an Affordability Safe Harbor

- Is Self-Insured

- Contains a Conditional Offer of Spousal Coverage

In WinTeam, the Who received an offer of coverage is set up in INS:Benefit Setup on the Plan Options tab because:

- The IRS requires you to report whether coverage was offered to Spouse and/or Dependents

- To populate 1095-C Line 14 data, WinTeam checks each Plan Option systematically to see what types of relationships are included in the offering

- Relationships are defined in the ACA Benefit's Plan Options > Types > Relation > Spouse and Dependent columns

- In this example, coverage was offered to the Employee, and to Relationship Types of Spouse and Children:

- The system combines this who with the what your company offered to determine the indicator code that will be reported on the Form 1095-C Line 14.

Note: The Child Relation column is not considered for ACA code calculation.

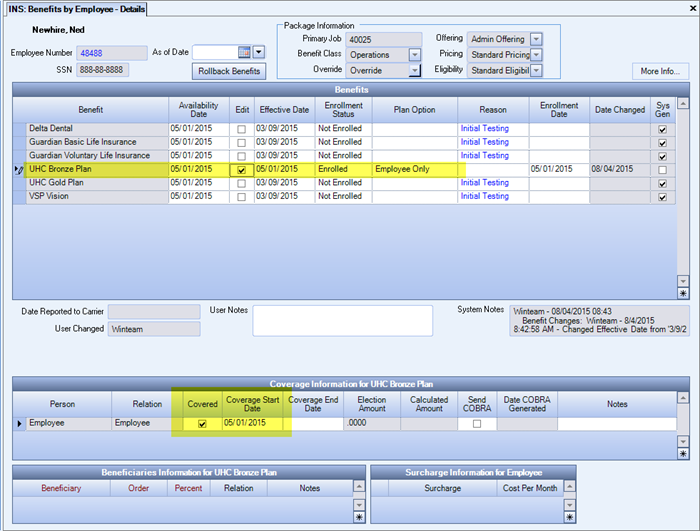

The When the offer of coverage was in force is explained by reviewing Benefits by Employee:

- A key point to keep in mind is Availability Date, typically driven by the start of the Employee's Stability Period

- In this example, the Employee was hired on March 9, as represented by the Current Effective Status/Date. This is also the Package Assignment date. According to the Eligibility Setup in WinTeam, the Employee was eligible for a Stability Start and Availability Dates of May 1. Since the offer of coverage was available to the Employee on May 1, the system will consider that date the start of the Offer of Coverage for the purposes of Line 14 Code calculation.

- The system looks at the ACA Benefit's Coverage Start and Coverage End Dates to populate data showing whether coverage was offered for the entire month.

Note: The IRS only considers an offer of coverage was made for a month if it was available for the entire month. For example, if coverage started on the 15th of the month, that month would not count, which would yield a Code 1H on the 1095-C.

Document: Flow Diagram for Line 14 Codes

Line 15 is reporting on the affordability of coverage offered, and is meant to capture the Employee share of the lowest cost monthly premium. WinTeam populates this line if the coverage offered to the Employee provided Minimum Value.

Note: If the Employee received a qualified offer of Code 1A in Line 14, the IRS does not require a Line 15 Cost.

WinTeam enters the dollar amount of the lowest cost monthly premium for Employee-only Minimum Value coverage.

Recall that WinTeam used Plan Option Relationship Types to determine to whom the plan was offered on Line 14. WinTeam also drills into each Benefit Plan Option to find options offered to the Employee Only, and uses that pricing for Line 15. Once WinTeam determines the Employee Only Plan Option, pricing structure combined with the Benefits Pricing setup yields the pricing on Line 15.

If an employee has multiple ACA plans that yield the same Line 14 code, WinTeam will populate the Form 1095-C with the least expensive plan for Line 15 (fixed and variable).

If an employee's ACA plan included a Benefit Setup with Fixed Cost or Pricing Rule as the Plan Option > Cost Method, this logic will apply. Other cost methods aren't used for medical insurance and therefore are not supported.

The following Cost Methods will have blank Line 15, since they are almost exclusively used for non-medical insurance plans:

- Election Based

- Election Based per $1000

- HSA

- FSA

Note: If the cost of coverage was paid completely by the employer, an amount of $0.00 would be reported on Line 15.

Pricing in WinTeam Benefits Packages is based on the assigned Pricing Structure. Costs that are not percentage-based will be determined from the amounts in Benefit Setup on the Pricing tab. The price reported on Line 15 is driven by the Employee Share of price.

If an Employee's ACA plan uses a Percentage Based Cost Method, just like for fixed cost pricing, WinTeam does not rely on an Employee's Payroll deductions to supply the Line 15 costs, rather looks at the employee's Payroll data to calculate Federal Taxable Earnings (W-2 Box 1) per month:

For each month, WinTeam finds all the Paychecks with a pay date that fell within the month and:

- Sums the Federal Taxable Earnings (FTE) across those paychecks

- If the ACA plan is Pre-Tax, adjusts FTE for any pre-tax deductions

- Checks for any deductions that have the same Benefit Type as the ACA deduction

- If any exist, adds them back into the FTE to get the total FTE before any pre-tax deductions

- For example: An Employee may have enrolled in a richer non-ACA plan that was pre-tax and so must have those payroll deductions added back into FTE to figure what the cost of the ACA plan would have been.

- Calculates what the variable cost would have been

- If the ACA plan is not pre-tax, simply multiplies FTE by the employee cost percent that you set (example: 9.5%).

-

If the ACA plan is pre-tax: ((FTE + any pre-tax adjustments described in #3)/1 plus the employee cost percent that you establish (example: 1 + 9.5% = 1.095) * the employee cost percent (example: .095)).

- If the calculated amount is less than the Benefit Pricing Employee Minimum Cost or more than the Employee Maximum Monthly Cost, uses the Min or Max instead

Why not use Payroll deductions?

An Employee may not have enrolled in the offer of coverage and therefore would not have Payroll deductions. Or, the Employee may have enrolled in a non-ACA or non-Employee-Only Plan Option (i.e., Family), and therefore his/her deduction would not reflect the lowest share of Employee-Only price of the ACA benefit offered.

Line 16 is used to denote Affordability Safe Harbors used, enrollment in Minimum Essential Coverage plans, and several other types of relief for employers. If you have indicated in INS: Benefit Setup on the Pricing tab that an Affordability Safe Harbor was used, WinTeam will populate this section with the appropriate code.

In the Line 14 example above, Current Effective Status and Package Assignment signaled the Employee had entered an initial waiting period, for which WinTeam would generate a Limited Non-Assessment period indicator code on Line 16. This type of code is considered by the IRS as relief for these months, and as an explanation for why the Employee was not offered coverage.

WinTeam INS:Defaults include Eligible for 4980h Non-Calendar Plan Year Transition Relief and Plan Year Start Month options (for Employers with non-calendar year plans), which are used by the system to generate Line 16 Code 2I on Part II of the 1095-C Report.

Document: Flow Diagram for Line 16 Codes

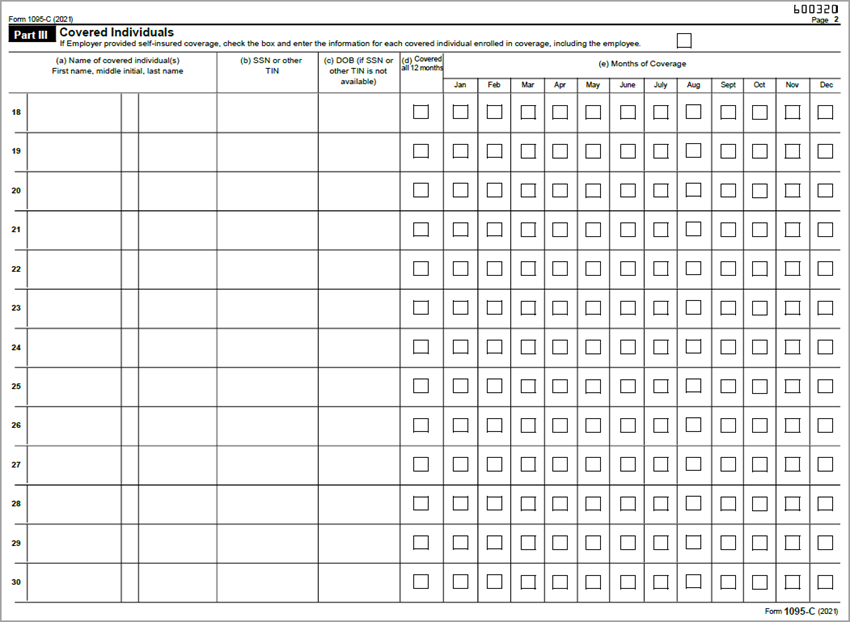

If your company offered a Self-Insured plan, select the Self Insured option in INS: Benefit Setup on the Pricing tab, and WinTeam will populate this section with information for each covered individual and the months during which they were covered.

The Form 1095-C Part III: Covered Individuals reports the employee and dependent(s) that were covered for any day of a month under a company self-insured medical insurance benefit. An employee/dependent name, social security number and date of birth will print for any individual that was selected as covered in the Insurance Benefits module for any day in the reporting month.

An employee/dependent is considered covered for any Benefit that, for the specific dates of reporting, has:

- The ACA: Self Insured option selected in INS:Benefit Setup

- A Benefit Enrollment Status of Enrolled and the Covered option selected in the Coverage grid in Benefit by Employee: Details window, such as in the following example.

In general, an offer of COBRA to an employee is not reported on the 1095-C unless: 1) a former employee enrolled in COBRA, or 2) an employee and/or dependent enrolls in COBRA of a self-insured plan.

1) A former employee enrolled in COBRA

- On Form 1095-C Line 14

- The Code entered is representative of elected coverage

- Code is 1E for family

- Code is 1B for employee only

- The Code entered is representative of elected coverage

- On Form 1095-C Line 15

- Enter COBRA premium for the lowest-cost self-only coverage

- On Form 1095-C Line 16

- Enter Code 2C (denotes that employee enrolled)

2) An employee and/or dependent enrolled in COBRA self-insured plan

- Select months that individuals were covered

For more information, see IRS FAQs on COBRA reporting.