ACA resources are for reference only. Please consult your legal, financial or tax professional to determine the best plan for your company.

Overview

TEAM continues development of an integrated solution to Affordable Care Act (ACA) compliance. A key component of that solution addresses Internal Revenue Service 1095-C requirements, with requisite reporting, Employee Form 1095-C generating, PDF archival and electronic filing, and a detailed audit log and optional distribution of 1095-C forms to employees via eHub.

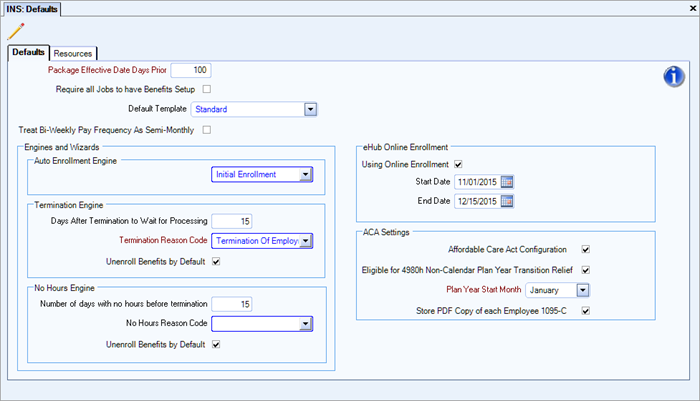

Set up ACA Settings on INS: Defaults.

Select Affordable Care Act Configuration to enable all of the ACA settings in the Insurance Benefits Module.

(Optional) Eligible for 4980h Non-Calendar Plan Year Transition Relief. Select if your company is eligible for this ACA relief. For guidelines on eligibility, see the IRS web site. For any Line 16 codes that would have been blank on the 1095-C report, WinTeam will instead populate a Code 2I, signifying the transition relief.

The option is not available as of tax year 2017. Options in the Transmitter Information window have been updated to reflect this change when you create a 1094-C Electronic File for tax year 2017 or greater. If you create a file for tax year 2016 and prior, the transition relief options are still available.

Plan Year Start Month (for 4980h Non-Calendar Year only). If you select Eligible for 4980h Non-Calendar Plan Year Transition Relief, this field becomes available and is a required field. In the future, the Plan Start Month on Employee 1095-C forms will be based on this month.

If your company uses eHub, select the Store PDF Copy of each Employee 1095-C option to store a PDF copy of each generated Employee Form 1095-C so that employees may access their forms online via eHub.

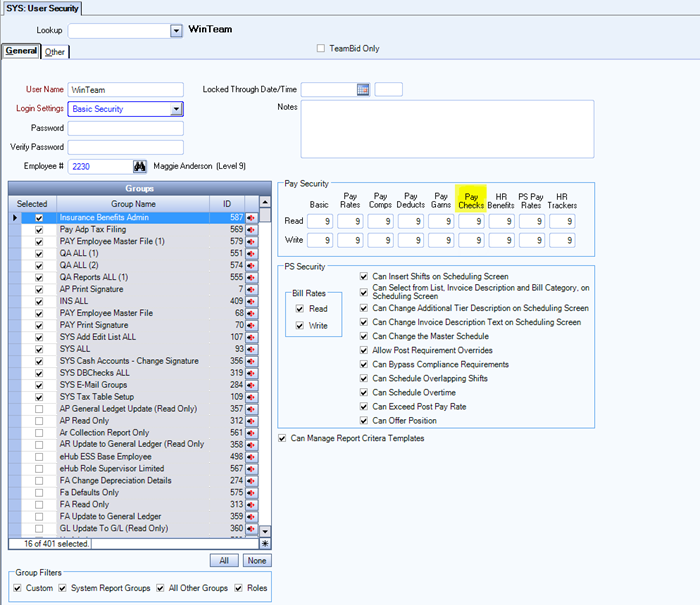

Set up required security permissions on SYS: Security.

To administer INS Report: 1095-C reporting, the following user Security permissions must be set appropriately:

INS Reports ALL or

INS Report 1095-C

To create a 1095-C Form for an Employee, you must have Pay Checks User Security equal to or greater than the Security Level in his/her Employee Master File.

In order to see the Employee 1095-C Report, you must have one of the following System security groups:

- SYS ALL

- INS ALL

- A custom security group that contains the screen INS Report 1095-C

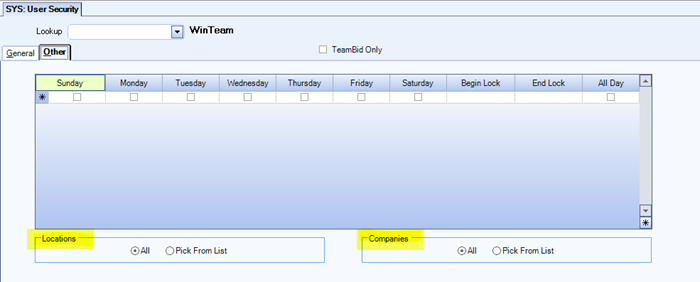

You must also have access to the Employee's Location and Company Number. In this example, the user has access to everything:

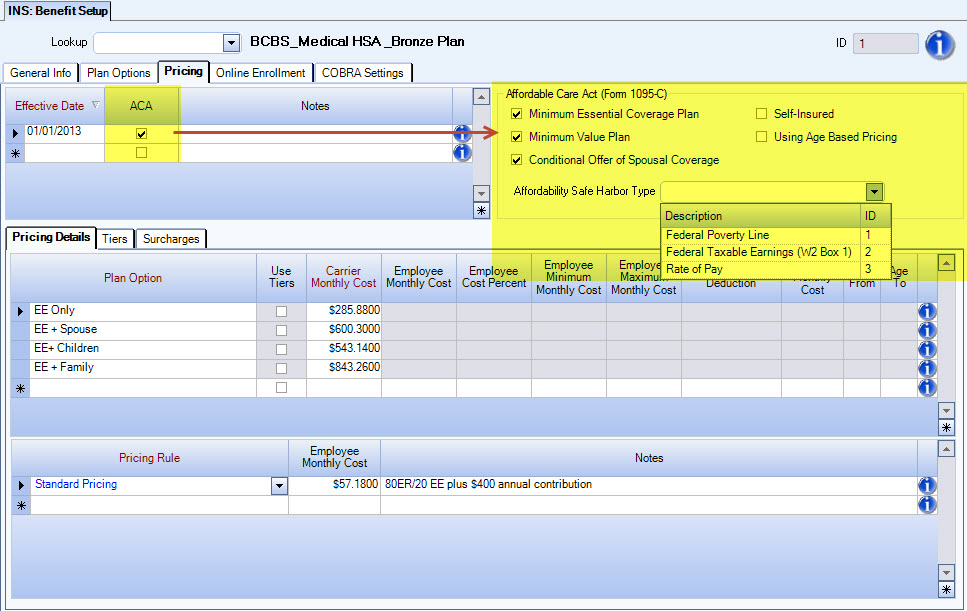

In the Insurance Benefits module, on the Benefit Setup screen's Pricing tab, when you select the ACA check box, the system displays additional settings. For benefits already set up (or when setting up new benefits), begin populating these settings in preparation for future Form 1095-C reporting. The system generates Form 1095-C reporting codes based in part on these settings.

Minimum Essential Coverage Plan

Minimum Value Plan

Self-Insured

Using Age Based Pricing

Affordability Safe Harbor Type

Federal Poverty Line

Federal Taxable Earnings (W2 Box 1)

Rate of Pay

Conditional Offer of Spousal Coverage is an offer of coverage that is subject to one or more reasonable, objective conditions (for example, and offer to cover an employee’s spouse only if the spouse is not eligible for coverage under Medicare or a group health plan sponsored by another employer. For more information see Instructions for Forms 1094-C and 1095-C.

For more information on how 1095-C codes are determined, please review our Line 14 and Line 16 code flow diagrams.

Note: Consult with your insurance broker, attorney, and/or financial professional to determine which benefits meet the 1095-C ACA reporting requirements.

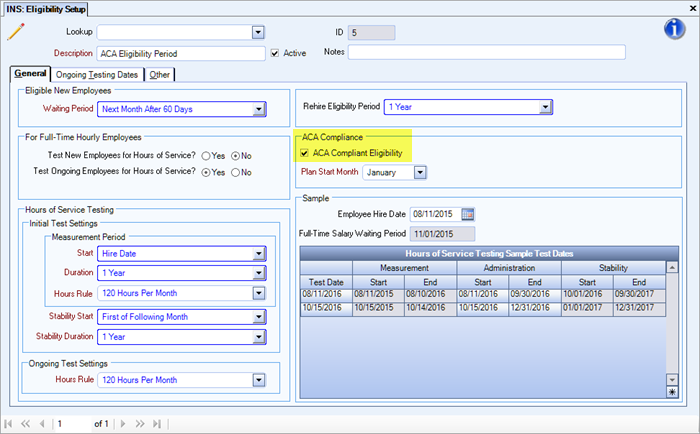

Select the ACA Compliant Eligibility option on the INS: Eligibility Setup screen. The reason for this is that eligibility for benefits is not always ACA-compliant. Some companies have eligibility rules for non-ACA testing. For instance, a company might offer dental and vision benefits to employees who work 20 hours per month. Tracking which eligibilities are ACA-compliant drives the generation of 1095-C Forms. WinTeam checks for passed Eligibility Tests to determine ACA full time status. Selecting the ACA Compliant Eligibility option tells the system the Eligibility is meant to be ACA-compliant.

When you select this option, Plan Start Month becomes available and is a required field. The month entered here will be included on Form 1095-C between Parts I and II. For the health plan in which the employee is offered coverage (or would be offered coverage if eligible to participate in the plan), select the calendar month during which the plan year begins. If more than one plan year could apply (for example, the plan year is changed during the year), enter the earliest applicable month. See the latest instructions for rules on multiple plan start months.

Fill in the Insurance Benefits 1095-C Contact Phone field on the SYS: Company Setup screen to accommodate any potential need for the Internal Revenue Service to contact someone in the organization with specific questions related to Affordable Care Act compliance. The Contact Telephone Number submitted on the 1095-C Report may be different than the phone number that currently exists for the Company. For example, you may wish for those calls to be directed to the phone number of the Benefits Administrator. If this field is blank, the Company Phone number will be used to populate the 1095-C Report.

Select to track employees whose ACA compliance information will be reported by a different employer or labor union. Selecting this option will yield a Line 16 Code 2E on 1095-C reporting.

If your company is subject to the multi-emplorer interim rule, you can use INS: Benefit Offerings to track employees whose compliance information will be reported by a different employer or labor union. Selecting the Apply Multi-Employer Interim Rule option will yield a Line 16 Code 2E on the IRS Form 1095-C when it would have otherwise yielded a blank code.