Overview

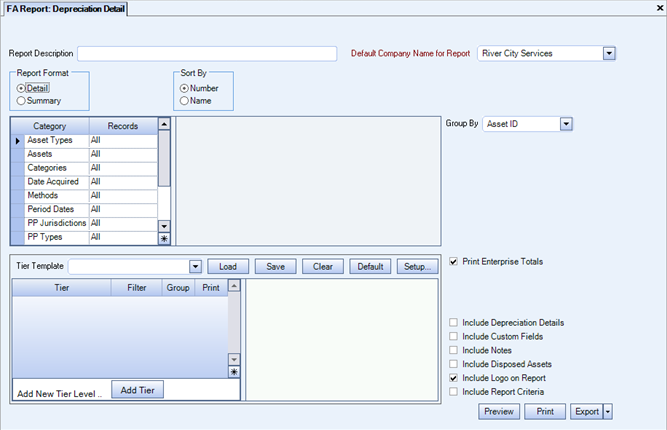

Use the Depreciation Detail report to print the depreciation expense and cumulative depreciation for each asset based upon the report criteria specified. The Depreciation Details can be suppressed for a less detailed report. This report does not include non-depreciable assets. The Tier Parameter is determined by the Primary Depr. Job to which the asset is assigned,

You can filter, group, and print by Tiers, allowing for total customization of the report. To make filtering easier, for any Tier, you can include All, Pick/Create or Exclude parameters. Using Tier Templates to set up and save report templates makes it easy to generate a specific report each time you need it, without having to recreate the criteria. See Using Tier Templates for more information.

Key Functionality

Type a description to name the report. This description prints above the Report Title.

The Default Company Name for Report is populated from the Company Setup screen. The list contains all companies for which you have security permissions to view. If you have permission for only one company, that will be the only one displayed in the list. If you have permissions to multiple companies, the list will display those companies PLUS the default reporting company.

When discernible, WinTeam will print the appropriate company name and logo on each page; otherwise the Default Company Name will print. That is, if a Company level is included in the tiered section and is displayed in the tiered information at the bottom of the page, then that company's Report Name and Logo (if selected) prints on that page.

If there is not a Company identified in the tier area of the page, then the Default Company Name for Reports is used. The default Company Name and Logo is also used for the Total Enterprise report. For more information see Learning about WinTeam Reports.

Use the Report Format option to choose the level of detail for the report.

The Summary report includes the Asset ID #, Description, Type, Serial Number, Category, Method, Date Acquired, Cost of the Asset, Salvage Amount, Depreciable Amount Accumulated Depreciation, Monthly Depreciation, and Net Book Value.

The Detail report contains all items included in the summary report plus the Depreciation Details. This is the default selection.

Use the Sort By option to sort the report data by asset ID or asset description.

Click Number to sort report data by Asset ID. This is the default option.

Click Name to sort report data by Asset Description.

Assets

Use the Assets category to select the assets to include on the report.

Select All to include all asset IDs.

Select Range to define a range of asset IDs for the report. When you select Range, the range fields display. Type the beginning asset ID in the From field and the ending asset ID in the To field, or use the Lookup feature to locate the record.

Select Pick to define specific Assets for the report. When you select Pick, the Assets list displays. Select the check box next to each Asset to include on the report.

Select Create to define your own list of Assets. When you select Create, a small grid displays to the right. Enter the Asset ID Numbers you want to include in the list, or use the Lookup to locate the Asset ID Numbers.

Select Exclude to identify records that should not be included. When you select Exclude, a small grid displays to the right. Enter the Asset ID Numbers you want to exclude in the list, or use the Lookup to locate the Asset ID Numbers.

Categories

Use the Categories category to select the Asset Categories to include on the report.

Select All to include all Hours Categories.

Select Pick to define specific Asset Categories for the report. When you select Pick, the Asset Categories list displays. Select the check box next to each Asset Category to include on the report.

Asset Types

Use the Asset Types category to select the Asset Types to include on the report.

Select All to include all Asset Types.

Select Pick to define specific Asset Types for the report. When you select Pick, the Asset Types list displays. Select the check box next to each Asset Type to include on the report.

Date Acquired

Use the Date Acquired category to filter the report criteria by Asset Acquired Dates.

Select All to include all assets regardless of the Asset Acquired Date.

Select Date Range to define a range of Asset Acquired Dates for the report. When you select Date Range, the date range fields display. Type the beginning date in the From field and the ending date in the To field.

Period Dates

Use the Period Dates category to filter the report criteria by fiscal period end dates. The period end dates only affect the depreciation details section in limiting what is displayed.

The report’s default date is the date that the last period depreciation was updated. However, you can specify a different Period End Date if you choose. The system will find all the fixed asset depreciation details that match the date specified.

Select All to include all assets regardless of the fiscal period end date.

Select Date Range to define a range of Period Dates for the report. When you select Date Range, the date range fields display. Type the beginning date in the From field and the ending date in the To field.

Methods

Use the Methods category to select the Depreciation Methods to include on the report.

Select All to include all Methods on the report.

Select Pick to define specific Methods for the report. When you select Pick, a list of Methods displays. Select the check box next to each Depreciation Method you want to include the on the report.

Vendors

Use the Vendors category to select the Vendors to include on the report. (On the HR: and INS: Benefit Insurance/Other Analysis Reports, this Category is available when the Report Type is Vendor Billing.)

Select All to include all Vendors.

Select Range to define a range of Vendors for the report. When you select Range, the range fields display. Type the beginning Vendor Number in the From field and the ending Vendor Number in the to field, or use the Lookup to locate the Vendor Number.

Select Pick to define specific Vendors for the report. When you select Pick, the Vendor list displays. Select the check box next to each Vendor to include on the report.

Select Create to define your own list of Vendors. When you select Create, a small grid displays to the right. Enter the Vendor Numbers you want to include in the list, or use the Lookup to locate the Vendor Numbers.

Select Exclude to identify records that should not be included. When you select Exclude, a small grid displays to the right. Enter the Vendor Numbers you want to exclude in the list, or use the Lookup to locate the Vendor Numbers.

PP Types

Use the PP Types category to select the Person Property Types to include on the report. P.O. Types are defined on the Types add/edit List.

Select All to include all PP Types on the report.

Select Pick to define specific PP Types for the report. When you select Pick, a list off PP Types displays. Select the check box next to each PP Type you want to include on the report.

PP Jurisdictions

Use the PP Jurisdictions category to select the Personal Property Jurisdictions to include on the report. Personal Property Jurisdictions are defined on the PP Jurisdictions add/edit list.

Select All to include all PP Jurisdictions on the report.

Select Pick to define specific PP Jurisdictions for the report. When you select Pick, a list of PP Jurisdictions displays. Select the check box next to each PP Jurisdiction you want to include the on the report.

Tax Class Life

Use the Tax Class Life category to select the Tax Life Types to include on the report. Tax Life Types are defined on the Tax Life Types add/edit list.

Select All to include all Tax Life Types on the report.

Select Pick to define specific Tax Life Types for the report.When you select Pick, a list of Tax Life Types displays. Select the check box next to each Tax Life type you want to include on the report.

You may group this report by Asset ID, Asset Type, Category, Method, Period Dates, PP Jurisdiction, PP Type, Tax Class Life, or Vendor.

Use the Tier Template to define and save customized settings for a report. To use an existing template, select the template from the list and click Load.

To create a new template, you can load an existing template, make the necessary modifications, click Save, and define a new template name in the Save As dialog box. Alternatively, you can start with a blank template by clicking the Clear button.

To modify an existing template, load the template, make the necessary modifications, and then click Save. The name of the existing template display in the Save As dialog box. Click OK.

For more information see Using Tier Templates and Using Tier Parameters.

The Print Company Totals check box is available to users who have only one company, and may be selected to print company totals on the report.

The Print Enterprise Totals check box is available to users who have more than one company, and may be selected to print enterprise totals on the report. This check box is selected by default.

If this is not selected, the report prints only the tiered reports that are marked for printing.

Select the Include Depreciation Details check box to include Depreciation Details on the report.

This option is NOT selected by default.

If this check box is NOT selected, the grid of the depreciation details does not print. It also does not print the sub total or grand total depreciation detail grid information.

Select the Include Custom Fields check box to include the Custom Fields on the report. Only the Custom Fields that are used will display on the report. You could print all 26 Custom Fields, if used.

This check box is not selected by default.

Select the Include Notes check box to include Notes (from the FA: Master File) in the report.

This check box is NOT selected by default.

Select the Include Disposed Assets check box to include disposed assets on the report.

This check box is NOT selected by default.

Select this check box to print the company logo on the report. It is selected or cleared by default based on the option selected in SYS:Defaults. However, you can modify the setting on each report.

Select this check box to include a list of the report options selected for the report. The Report Criteria page includes any ranges specified and each Category/Record selection made for the report. This check box is cleared selected by default.

Preview

Click the Preview button (or use the shortcut key, ALT + V) to view the report before printing.

Click the Print button (or press ALT + P) to send the report to your default printer.

Export

Click the Export button (or press ALT + X) to export the report to a specified format. Reports may be exported to Adobe Acrobat (PDF), Excel, Comma-Separated Values (CSV), Grid View and E-mail (available for premise-based clients only).

The Depreciation Details amounts are based on values from the last time the General Ledger was updated.

Do not use this report to tie out Trial Balance. Use the Schedule of Depreciation Report to tie out Trial Balance.