Overview

You can use the Update General Ledger screen to print payroll journals and update payroll batches to the General Ledger. During the Update process the Preview, Update, Update/Print, and Close buttons are disabled in order to prevent another User from accidentally stopping the Update process.

The General Ledger Update screen can be accessed from the WinTeam Payroll menu.

Tip: It is important to update the Payroll Batches in a timely manner since this is when the system deletes one-time deduction and compensations that were included in the payroll so they are not deducted or paid again, and also the time where the cumulative totals of Recurring With Limit deduction and compensations are updated. If the payroll is not updated timely, you run the risk of paying one-times more than once and deducting/overpaying Recurring With Limit deductions/compensations.

Here is a detail of what occurs during the update with Other Compensations and Deductions:

- Any one-time deduction and compensation records that are included in the payroll being updated are deleted.

- The Cumulative total for any Recurring With Limit deduction/compensation records is updated, and those that have reached the Limit during the Payroll Batch being updated are deleted.

- Recurring Without Limit deduction/compensation records are deleted if both of the following criteria are met:

- The record is included in the payroll being posted.

- The record has an End Date and the End Date is equal to or less than the payroll batch’s pay period ending date.

Key Functionality

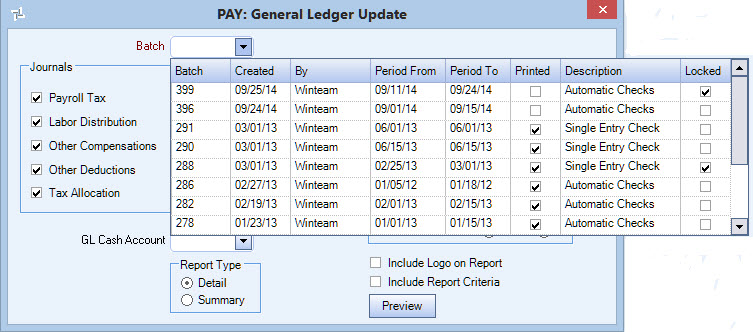

Select a batch # to preview journals for, or update to the general ledger.

When you display the drop down list, notice that batch information displays along with the current print status for the batch and how the batch was created. Only batches that have not been updated to the general ledger will display. Only one batch can be printed or updated at a time. If the batch status is Automatic Checks or Single Entry Check, and the checks have not been printed, you will only have the option to Preview and print the reports. You cannot update the batch to the general ledger until the checks have been printed.

The Journal Dates default based on the pay period dates of the selected batch.

The pay period ending date of the batch displays in the Labor Distribution and Other Compensations date fields.

The check date of the batch displays in the Payroll Tax and Other Deductions date fields.

Payroll Tax

Updates the GL Payroll Tax accounts (Federal, FICA, Medicare, State Taxes, etc) and net payroll is credited. In order to balance, (debits and credits have to equal) the system debits the total amount to the GL Payroll Clearing account. This Payroll Tax Journal shows all payroll taxes related to this payroll. When information is updated to the General Ledger, the posting date is determined from the Payroll Processing Update General Ledger screen. The default for this date is the Check Date of the batch.

ER Tax Portion

Select to use either the Check Date or the Pay Period End Date to update the Employers portion of the payroll taxes. This defaults to the option set up in Payroll Defaults. If you change this date the Tax Allocation Date also changes to match this field.

Labor Distribution

Updates the GL Labor accounts (Wages, Salary, Overtime, Vacation, Holiday, Sick, Training, etc) that are processed with this payroll and creates a debit. In order to balance, (debits and credits have to equal) the system credits the total amount to the GL Payroll Clearing account. The Labor Distribution Journal shows all labor associated down to the job level related to this payroll. When the information is updated to the General Ledger, the posting date is determined from the Payroll Processing Update General Ledger screen. The default for this date is the Pay Period Ending Date of the batch.

Other Compensation

Updates the Other Compensation accounts (Back Pay, Bonuses, Commissions, Car Allowance, Mileage Reimbursements, Severance, Uniform Pay, etc) that are processed with this payroll and creates a debit. In order to balance, (debits and credits have to equal) the system credits the total amount to the GL Payroll Clearing account. The Other Compensations Journal shows all other pay related to this payroll. When this information is updated to the General Ledger, the posting date is determined from the Payroll Processing Update General Ledger screen. The default for this date is the Pay Period Ending Date of the batch.

The cumulative amount that prints on the Journal Report of Other Compensations is BEFORE that check’s Compensations.

Other Deduction Journal

Updates the Other Deductions accounts (Garnishments, Child Support, Insurance, Savings, Union Dues, etc) that are processed with this payroll and creates a debit. In order to balance, (debits and credits have to equal) we debit the total amount to the GL Payroll Clearing account. This Other Deductions Journal shows all Other Deductions related to this payroll. When the system updates this information to the General Ledger, the posting date is determined from the Payroll Processing Update General Ledger screen. The default for this date is the Check Date of the batch.

The cumulative amount that prints on the Journal Report of Other Deductions is BEFORE that check’s Deductions.

When the deduction code is duplicated, this breaks down the calculated amount between the employee deduction and employer contribution.

Tax Allocation Journal

The Tax Allocation Journal displays for all Payroll batch types with the exception of Labor Accrual batches. Only those labor accrual batches that were created using the Method: Based on Payroll Batches and where a percentage of Taxes was entered for the accrual will show this journal when updating to the General Ledger.

Allocates and updates the Employers portion of payroll taxes and insurance down to the Job level.

Group A accounts (FICA, Medicare, FUTA, SUTA and SDI) - The expense accounts and Job number that was posted for the Payroll Taxes when the Payroll Journal posted, will be reversed with this Tax Allocation Journal and this expense allocated down to the Job level.

The Tax Allocation program includes any City or County tax set up with a calculation method that included an Employer portion for expensing. Any local tax that has an employer portion will update with the other Payroll Taxes when the Tax Allocation Journal is posted. The General Ledger number under the SDI (State Disability Insurance) column will be used to determine where the employer's portion of Local taxes will post.

Group B accounts (W/C, G/L, Umbrella, Other 1, and Other 2) - The Employer’s expense for Group B accounts are calculated and posted with the Tax Allocation Journal based on the percentages and G/L #’s set up in the Job’s Tax and Insurance screen.

The date defaults with the date used in the ER Tax Portion field.

ER Benefits Insurance premiums are also included on the PR TAJ.

Select to include the Overall Company Recap by GL Number and Job Number.

The system defaults the cash account from the Cash Accounts Setup screen. If a Cash Account is not designated the system will display a warning message.

The Report Type options are available if the Tax Allocation Journal is used.

The Summary Report does not include employee detail, but it does print the Debit Expense GL # row by Job.

The Detail Report includes employee detail and prints the Debit Expense GL # row by Job.

Available if the payroll check batch has NOT been printed.

This allows you to Preview the Payroll Journal (and Other Comp and Deduct journals as well). Once the batch has been printed, the Group By and Sort By options do not display.

Select the Include Logo on Report check box to print the company logo on the report. This check box is selected or cleared by default, based on the option selected in SYS:Defaults. However, you can modify the setting on each report.

Select the Include Report Criteria check box to include a list of the report options selected for this report. The Report Criteria page includes any ranges specified and each Category/Record selection made for the report. This check box is NOT selected by default.

Note: Multi-Company: WinTeam looks to the Job's Company logo to determine which Company logo to use on the Work Ticket Report and Work Tickets. The option to "Include report Criteria" is only applicable from the General Ledger Update screen. This information does not print when reprinting a Journal Log from the General Ledger Journal Log screen. WinTeam does not save the criteria that is selected when the update is performed, which means it can't be used later when reprinting a journal.)

Update Options

During the Update process the Preview, Update, Update/Print, and Close buttons are disabled in order to prevent a User from accidentally stopping the Update process.

The Preview button generates the Payroll Tax, Labor Distribution, Other Compensations, Other Deductions, and Tax Allocation Journals, if applicable.

Each of the selected reports will display on the screen one at a time. Once you preview the first report you may Close the report or send it to the printer. Once you close the first journal, the second report will generate and display. When you close the second journal, WinTeam generates the next report and so on until all of the selected reports have been previewed and/or printed. WinTeam then returns you to the Payroll General Ledger Update screen.

At that time you may make changes to the checks (Check Processing Wizard - Edit an Existing Batch screen) or continue to the Print Checks screen.

Click Update to start the General Ledger update, without printing the Entries To Post report. Click Update/Print to update the General Ledger and print the Entries To Post report. The system does not allow you to post a payroll that is out of balance. If the debits and credits for a journal do not match, the entire payroll batch (including all journals–there are up to five separate journals in Payroll), are rolled back and not posted.

Important: The update process cannot be stopped once it is started.

Security

This screen has the Read-Only Feature. For more information see Learning about Read-Only Security.

Custom Settings

| Section | Item | Value | Module and Purpose |

|---|---|---|---|

| GLUpdate | AutoPostTime | 10 | This setting determines how many seconds the system will wait when a General Ledger update is taking place before it will commit the update. The default is 8 seconds. |

| LaborDistribution | PageBreak | Yes | This setting inserts Page Break after each Job on the Labor Distribution Journal for all Payroll Batch Types. |

| PayrollTAJ | GenLiabExcludePremDollars | Yes | Due to the fact that some insurance policies may require General Liability Insurance to apply to straight wages only (and not any overtime premium dollars), a Custom Setting was created so that when updating the Tax Allocation Journal for each payroll, the wages used for calculating the General Liability payroll tax will exclude premium dollars from its calculation. If your insurance carrier considers premium dollars exempt from general liability insurance, use this Custom Setting. |

For more information see Custom Settings and List of Custom Settings.