Overview

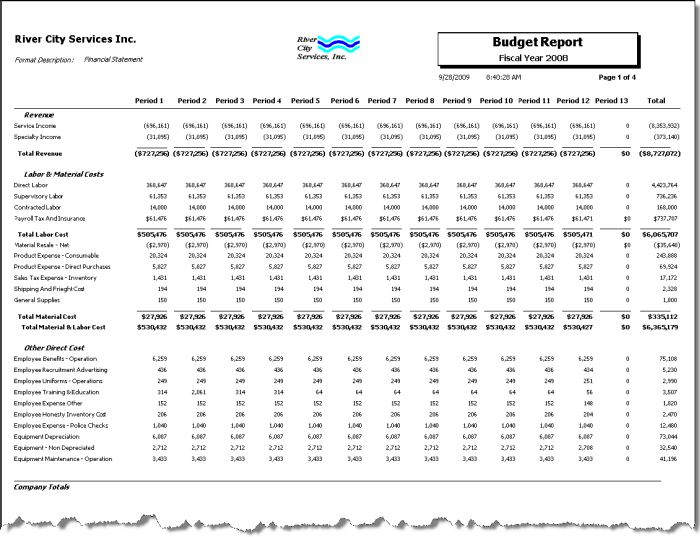

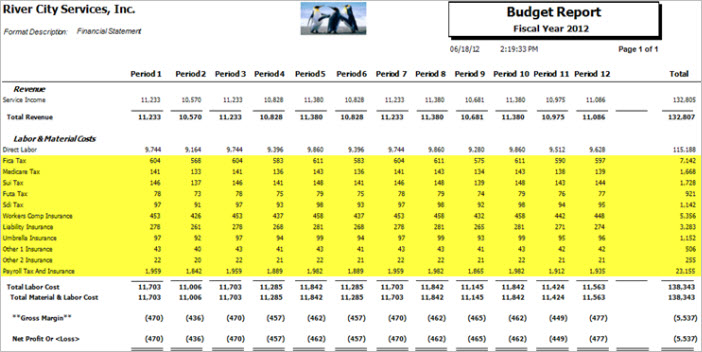

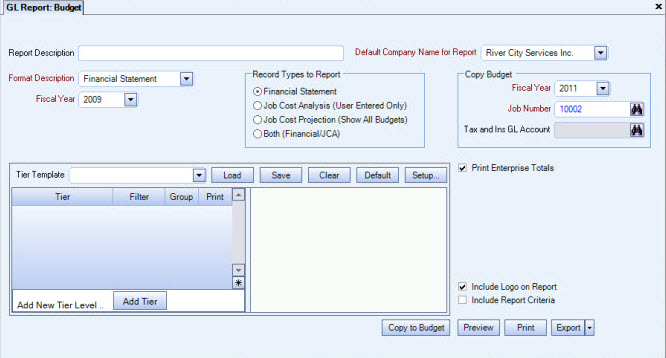

The Budget Report provides the actual budget amounts as they were entered for the selected financial format. If you use the Payroll Tax Allocation program, the Payroll Taxes and Insurance are broke out by each tax code. The Record Types to Report must be a Financial Statement or a Job Cost Projection (Show All Budgets).

You can filter, group, and print by Tiers, allowing for total customization of the report. To make filtering easier, for any Tier, you can include All, Pick/Create or Exclude parameters. Using Tier Templates to set up and save report templates makes it easy to generate a specific report each time you need it, without having to recreate the criteria. See Using Tier Templates for more information.

Key Functionality

Type a description to name the report. This description prints above the Report Title.

The Default Company Name for Report is populated from the Company Setup screen. The list contains all companies for which you have security permissions to view. If you have permission for only one company, that will be the only one displayed in the list. If you have permissions to multiple companies, the list will display those companies PLUS the default reporting company.

When discernible, WinTeam will print the appropriate company name and logo on each page; otherwise the Default Company Name will print. That is, if a Company level is included in the tiered section and is displayed in the tiered information at the bottom of the page, then that company's Report Name and Logo (if selected) prints on that page.

If there is not a Company identified in the tier area of the page, then the Default Company Name for Reports is used. The default Company Name and Logo is also used for the Total Enterprise report. For more information see Learning about WinTeam Reports.

Use the Format Description list to select the Profit and Loss statement from the Formatting of Financial Statements. Only the statements entered in the Formatting of Financial Statements screen as Profit and Loss Format Types will display on the list.

Use the Fiscal Year list to select the fiscal year to use for the report.

Note: Only the fiscal years set up in the Fiscal Year Setup (defaults) are available from the list.

Use the Record Types to Report option group to select the types of budget accounts to include on the report.

When choosing the Record Types to Report it is important to note that the system looks first at the accounts included in the selected Format Description. The system then looks to the Record Types to Report to determine if Financial Statement and/or Job Cost or both will be included. The GL Accounts included in the selected Record Types to Report are determined by the Financial Statement and Job Cost check boxes available in the GL Budgets screen (Budget Details section).

Select Financial Statement to include those accounts with budget information that have the Fin St check box selected.

This setting must be in place when the Financial Statement option for Record Types to Report is selected in order to use the Daily Labor Budgets.

| Section | Item | Value |

|---|---|---|

| GLReport | UseDailyBudgets | Yes |

Select Job Cost Analysis (JCA) to include those accounts with budget information that have the Job Cst check box selected.

Select Job Cost Projection to include those accounts with budget information that have Job Cost check box selected and how All Budget details (Labor Dollar Budgets and Taxes and Insurance).WinTeam will include the Daily Job Labor, Daily Job Revenue, Work Completed and Not Completed, and the Taxes and Insurance budgets.

Select Both to include all accounts with the Financial Statement and Job Cost Analysis check boxes selected.

Note: The Job Cost Projection option is equivalent to the GL Budgets screen with all budget details showing.

For customers using the tax allocation program, both the Financial Statement and the Job Cost Projections will show the Payroll Taxes and Insurance amounts separately by the GL number that they are associated within the Payroll Taxes and Insurance Table.

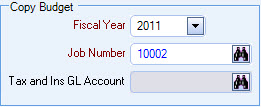

The Copy to Budget area is available when the Financial Statement or Job Cost Projections options are selected.

This feature allows multiple job budgets to be consolidated and saved to a new GL budget under a separate existing Job Number.

Example: Six Jobs may have the same Tier setting. The Budget Report can show the totals by GL Number for the entire tier. With this new feature, the result can be saved as a Tier budget to a different Job Number.

The Fiscal Year will default to the same Fiscal Year in the header area of the report options screen.

The Tax and Ins GL Account field is disabled when:

- Record Typed to Report = Financial Statement and

- Use Daily Labor Budgets Custom Setting is not in place

If the Tax Allocation program is NOT being used, the Tax and Ins GL Account field will be enabled in order to specify a GL Number for the Payroll Taxes and Insurance amount. This will copy the report results as Financial Statement budget records for the Job and Fiscal Year that are entered.

It is important to note than when using the Copy Budget feature, any Tiers marked for Grouping, will be ignored.

The 'Copy to Budget' button cannot function until the required fields on the Copy to Budget area are completed.

The Copy Budget button is then used to complete the copy process.

Use the Tier Template to define and save customized settings for a report. To use an existing template, select the template from the list and click Load.

To create a new template, you can load an existing template, make the necessary modifications, click Save, and define a new template name in the Save As dialog box. Alternatively, you can start with a blank template by clicking the Clear button.

To modify an existing template, load the template, make the necessary modifications, and then click Save. The name of the existing template display in the Save As dialog box. Click OK.

For more information see Using Tier Templates and Using Tier Parameters.

It is important to note than when using the Copy Budget feature, any Tiers marked for Grouping, will be ignored.

The Print Company Totals check box is available to users who have only one company, and may be selected to print company totals on the report.

The Print Enterprise Totals check box is available to users who have more than one company, and may be selected to print enterprise totals on the report. This check box is selected by default.

If this is not selected, the report prints only the tiered reports that are marked for printing.

This check box displays only if you have this Custom Setting in place:

| Section | Item | Value |

|---|---|---|

| GLReport | UseDailyBudgets | Yes |

When the Financial Statement option is selected, the Daily Labor Budgets check box is selected by default.

Selecting this check box will force the system to use daily labor budgets, system calculated Tax and Insurance budgets, and Work Scheduling budgets (if applicable).

For more information, see Using Daily Labor Budgets for Financial Reporting.

In addition, if this Custom Setting is in place, an additional check box displays that allows you to Include Work Scheduling Hours in Labor Budgets. This check box is selected by default.

Select this check box to print the company logo on the report. It is selected or cleared by default based on the option selected in SYS:Defaults. However, you can modify the setting on each report.

Select this check box to include a list of the report options selected for the report. The Report Criteria page includes any ranges specified and each Category/Record selection made for the report. This check box is cleared selected by default.

This button is available when the Financial Statement or Job Cost Projections options are selected. When clicked, WinTeam checks for existing budget records for the Fiscal Year and Job Number specified in the Copy Budget area. If records exist, the system displays a message letting you know how many budget details already exist. b.

Select Cancel to abort the copy process.

Select No to import only new budgets.

Select Yes to append the new budget records and replace existing records with the new GL number specified.

All GL accounts specified in the Financial Statement Format are copied to the new budget, including the ones that are not selected to print.

It is important to note than when using the Copy Budget feature, any Tiers marked for Grouping, will be ignored.

Preview

Click the Preview button (or use the shortcut key, ALT + V) to view the report before printing.

Click the Print button (or press ALT + P) to send the report to your default printer.

Export

Click the Export button (or press ALT + X) to export the report to a specified format. Reports may be exported to Adobe Acrobat (PDF), Excel, Comma-Separated Values (CSV), Grid View and E-mail (available for premise-based clients only).

| Section | Item | Value | Description |

|---|---|---|---|

| GLReport | SortybyTierDescription | Yes |

This setting will sort by Tier Descriptions (instead of the Tier ID). The Tier Descriptions will also display when previewing and using the Toggle Group Tree. |

| GLReport | UseDailyBudgets | Yes |

This setting will cause the Budget Income Statement and Budget Report to use daily labor budgets, system calculated tax and insurance budgets, and Work Scheduling budgets, you will need to add this Custom Setting. For more information, see Use Daily Labor Budgets.

|