Overview

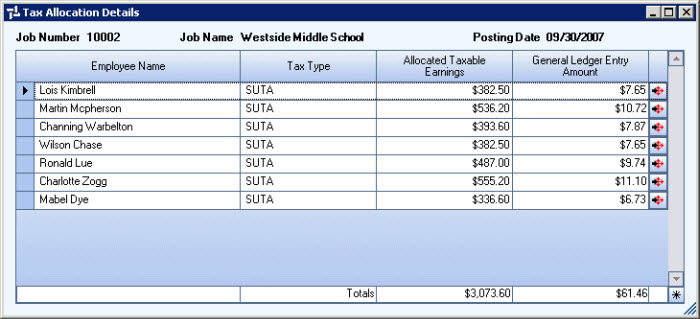

The Tax Allocation Details screen displays transactions that were part of the selected update. From this screen you may click the Detail button to view additional detail for a selected transaction.

Standard grid functionality applies to this screen. For information on grid functionality see Understanding Grids and Using the Filter Row Feature.

The Tax Allocation Details screen may be accessed from the Transaction Details Log screen by clicking the Detail button for any transaction.

Key Functionality

Employee Name

Displays the Employee Name.

Tax Type

Displays the Tax Type of the transaction.

Allocated Taxable Earnings

Displays the Allocated Taxable Earnings.

For Group A Accounts (FICA, Medicare, FUTA, SUTA, and SDI) Allocated Taxable Earnings were computed during payroll processing.

General Ledger Entry Amount

Displays the calculated withholding amount.

Detail button

Click the Detail button to display the Review and Edit Paycheck screen for the selected transaction.

Totals

Displays the total Allocated Taxable Earnings and General Ledger amounts for the selected transaction.