Overview

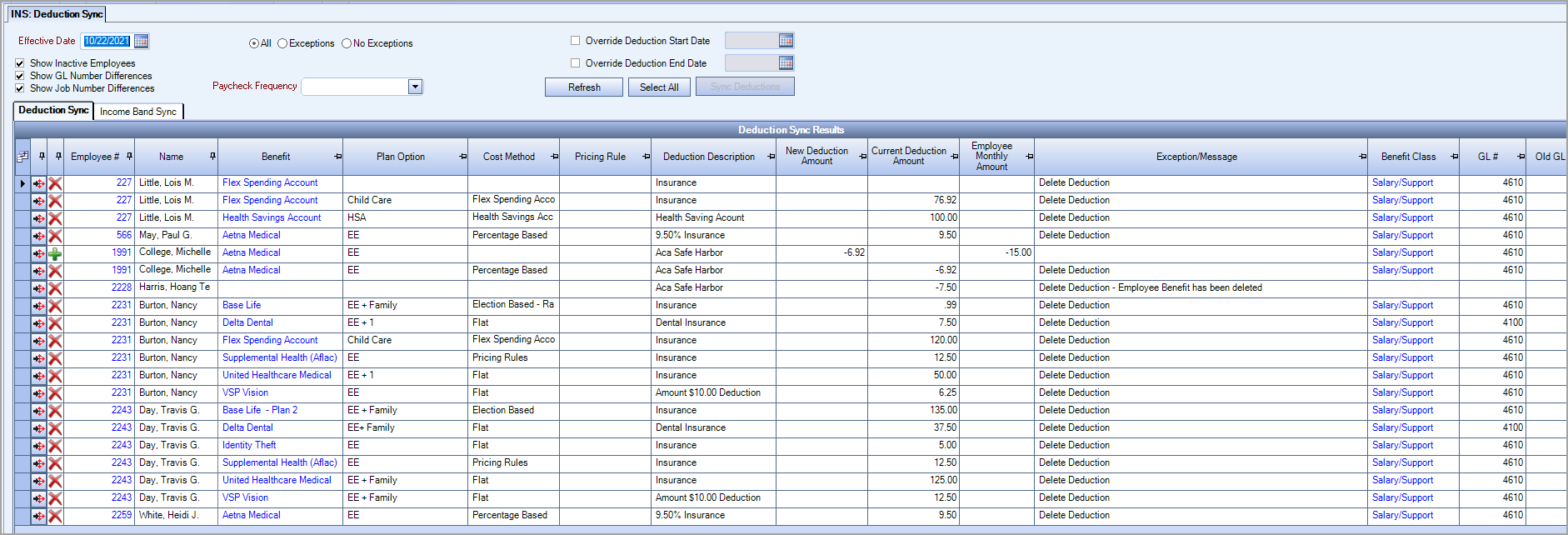

Once you have entered employee benefit elections, Deduction Sync automatically updates the appropriate related Employee Master File Payroll records using the General Ledger and Job numbers you specify. The Deduction Sync window is accessed from the WinTeam Insurance Benefits menu.

Tip: You can use the Payroll Comp/Deduct Review screen to review/delete benefits before syncing deductions here. The Employee Master File history remains; new benefits replace old, and you reduce the risk of creating multiple deductions for the same benefit.

Key Functionality

Once you have chosen your Effective Date, you can choose the employee(s) to whose Employee Master File(s) you wish to sync a deduction (s) by selecting the green + Sync Deduction symbol. You will notice this symbol disappears when selected. You can choose multiple employees by holding down the CTRL button and selecting each row individually. When you are finished selecting employees, click the Sync Deductions button.

Note: The Effective Date refers to that date on which benefits become effective. This date has no bearing on the Employee Master File. It is just the coverage start date for which you are reviewing/syncing deductions. This date differs from the Deduction Start Date, which is the date on which the deduction for those benefits will be taken from the employee's pay. The Deduction Start Date will be recorded in the Employee Master File, and it may fall before or after the benefits Effective Date, depending on how your company has decided to manage the deductions.

Note: The New Deduction Amount is calculated based on the employee’s pay frequency. Benefits are setup using a monthly amount (Benefit Setup>Pricing Details grid) but WinTeam automatically creates the deduction amount per pay frequency for each employee.

General Ledger Syncing

- If there is a GL number set up for the employee in the Payroll module on either the Other Deduction Codes screen or on the Other Compensation Codes screen, Deduction Sync uses that GL number.

- If there is no GL number in Payroll, then Deduction Sync uses the GL number set up on the Benefit Class Setup screen.

Job Number Syncing

- If there is a Job number set up for the employee in the Payroll module on either the Other Deduction Codes screen or on the Other Compensation Codes screen, Deduction Sync uses that Job number.

- If there is no Job number in Payroll, then Deduction Sync uses the Job number set up on the Benefit Class Setup screen.

Enter the benefits Effective Date to review and sync benefits in Employee Master Files. This date has no effect on information in the Employee Master File, rather is used simply to populate the Deduction Sync Results grid.

By default, if you click the Sync Deductions button, the system records today's date as the Deduction Start Date in the Employee Master File. Select the Override Deduction Start Date check box to enter the actual date on which the deduction for the benefit should occur. (When you select the box, it will display today's date by default, which you may then change.) This date will be synced to the Employee Master File payroll deduction record.

To validate the correct Deduction Start Date has been recorded, to go to the Employee Master File Other Comps/Deducts tab, select either the Deductions or Compensation tab, and select the row you want to validate. The Start Date field located on the bottom of the screen will display the Start Date you entered here in the Deduction Start Date field.

Show Inactive Employees

This check box is marked by default to include inactive employees (as of the Effective Date) in the display. If you want to filter out the inactive employees, clear this check box and then click Refresh.

Deduction Sync Tab

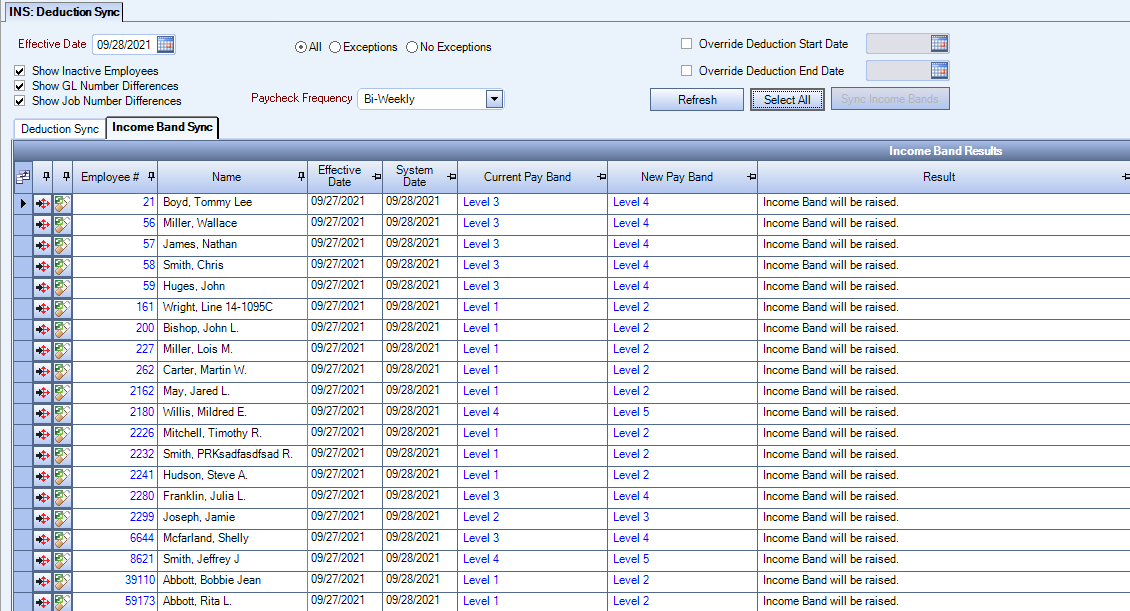

Income Band Sync Tab

After you click Refresh on this tab, a list of employees and their current income band and what it could be updated to displays.

You can select individual employees by clicking on each employee, or select multiple employees by clicking Select All. You update the records by clicking Sync Income Bands–the band is then updated for each employee in the Benefits by Employee window.

The Income Band Sync uses the Effective Date and Pay Rate from the Pay Info tab of the Employee Master File to determine if a change may be necessary.

- If pay rate caused a change in the band, Benefits by Employee is updated with the new band

- If the employee received a pay decrease and is already in the lowest band, then they remain in that band

- If the employee received a pay decrease and there is a lower band, Benefits by Employee is updated with the new band

- If then employee received a pay increase that moves them to a higher band, Benefits by Employee is updated with the new band

Before Sync Income Bands Updated

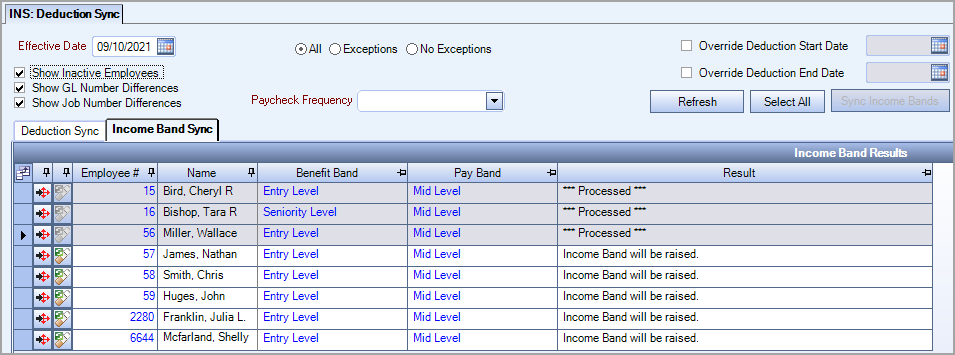

After Sync Income Bands Updated

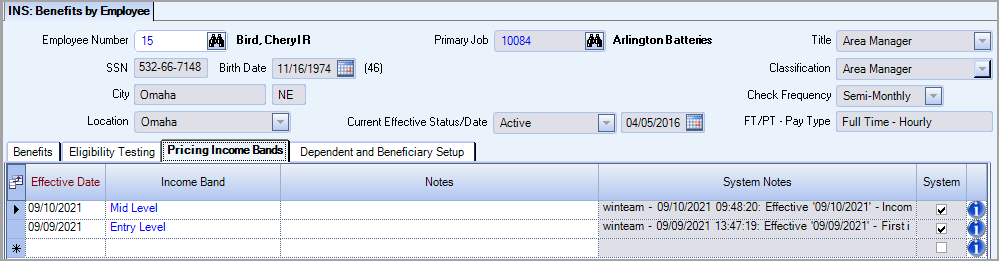

Benefits By Employee Updated with New Income Band