Definition and Example

Bonuses paid to employees can broadly fall into two categories; discretionary and nondiscretionary. For a discretionary bonus, the employer has the choice to pay the bonus; for example, a surprise bonus after a very successful month. For a nondiscretionary bonus, the employer does not have a choice to pay the bonus because it is part of an agreement or was pre-arranged; for example, a referral bonus. When a nondiscretionary bonus is paid to an employee, some agencies direct that it must be included as part of the employee’s regular wages which means the calculation of overtime premiums must include the nondiscretionary bonus. In WinTeam, this amount is referred to as the additional amount owed due to the nondiscretionary bonus.

Salaried Employees

A salaried employee always gets their nondiscretionary bonus but does not always get an additional amount. If they were hourly at anytime during the bonus period, and had paid time in Timekeeping, then the additional amount is based on those hours and the Notes for the weeks without paid time show 0.

Since the overtime premium on the wages would have already been calculated and paid, only the additional amount owed for the nondiscretionary bonus needs to be calculated and paid to the employee.

An employee works 50 hours (40 regular and 10 overtime) at a rate of $20.00 per hour

The employee would be paid $1,100:

Regular hours = $800 (40 hours × 20 per hour)

Overtime hours = $300 (10 hours × 30 per hour)

Another way to consider the same amount ($1,100) the employee would be paid:

Regular earnings = $1,000 (50 hours × 20 per hour)

Overtime premiums = $100 (10 hours × 10 per hour)

This employee also received a $200 nondiscretionary bonus with a Bonus Start Date of 12/01/2022 and a Bonus End Date of 12/07/2022

During this same pay week, the employee worked 50 hours (40 regular and 10 overtime).

When the employee’s wages were paid, the overtime premium was calculated and paid on the overtime hours, so the overtime premium pay on the employee’s wages was satisfied.

However, since there was also a nondiscretionary being paid that covers this same pay week that included overtime hours, the employee is owed additional overtime premium.

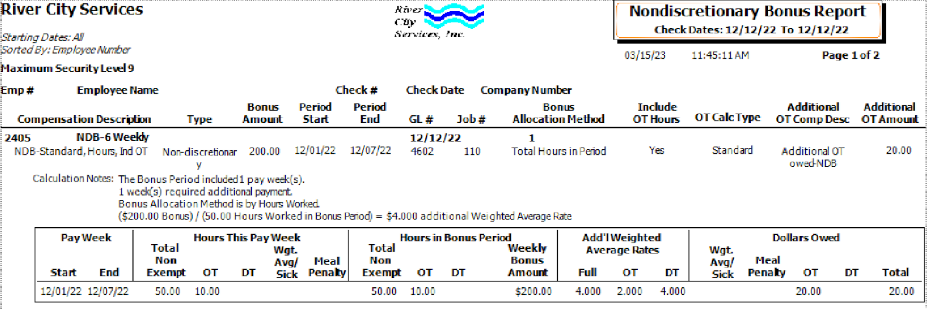

$200.00 nondiscretionary bonus ÷ 50 hours worked during week = $4.00 per hour additional weighted average owed

One half of this weighted average is owed for each of the 10 overtime hours. If there had been any doubletime, the full $4.00 per doubletime hour would be owed.

10 overtime hours x $2.00 per hour = $20.00 additional overtime premium owed for the nondiscretionary bonus that was paid

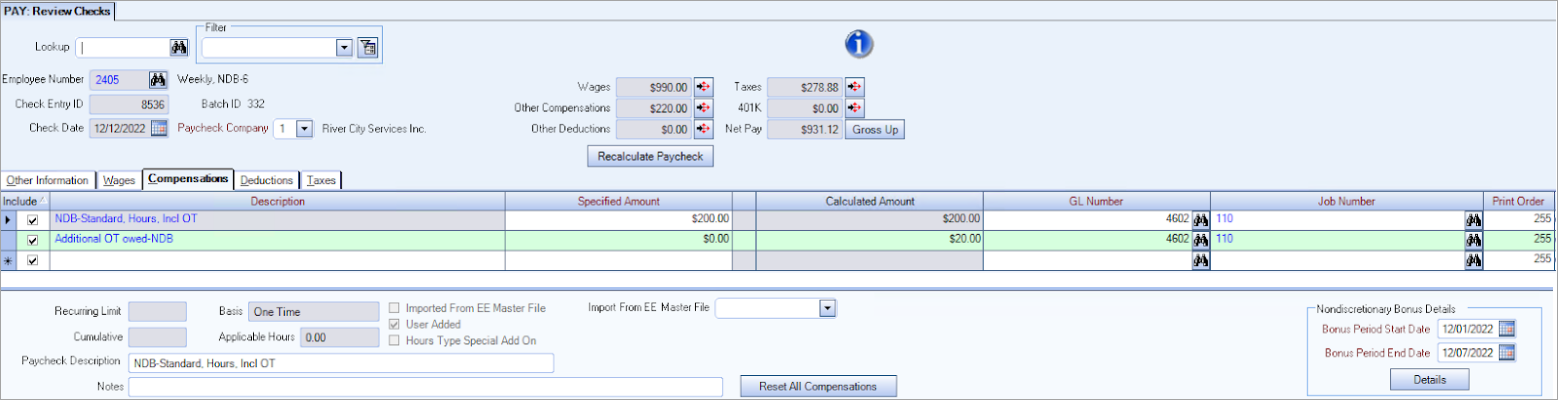

The $20.00 is paid as an additional line of Other Compensation on the check in which the nondiscretionary bonus is paid.

Example on Review Checks Window

Example in Nondiscretionary Bonus Compensation Report

From the United States Department of Labor Fact Sheet #56C: Bonuses under the Fair Labor Standards Act (FLSA):

Discretionary Bonuses are excludable from the regular rate of pay. Discretionary bonuses are not considered overtime-eligible. A bonus is discretionary only if all the statutory requirements are met:

- The employer has the sole discretion, until at or near the end of the period that corresponds to the bonus, to determine whether to pay the bonus;

- The employer has the sole discretion, until at or near the end of the period that corresponds to the bonus, to determine the amount of the bonus; and

- The bonus payment is not made according to any prior contract, agreement, or promise causing an employee to expect such payments regularly.

Examples of some common bonuses that may be excludable discretionary bonuses if they meet the statutory requirements include:

- Bonuses for overcoming a challenging or stressful situation;

- Bonuses to employees who made unique or extraordinary efforts not awarded according to pre-established criteria;

- Employee-of-the-month bonuses;

- Severance bonuses; and

- Referral bonuses to employees not primarily engaged in recruiting activities (subject to additional criteria).

The label assigned to the bonus and the reason for the bonus do not conclusively determine whether the bonus is discretionary. While a bonus may be labeled discretionary, if it does not comply with the provisions of the statute, then the bonus is not an excludable discretionary bonus. The determination must be made on a case-by-case basis depending on the specific circumstances.

A discretionary bonus may not be credited towards overtime compensation due under the FLSA.

A nondiscretionary bonus is a bonus that fails to meet the statutory requirements of a discretionary bonus. Nondiscretionary bonuses are included in the regular rate of pay, unless they qualify as excludable under another statutory provision (see below). Nondiscretionary bonuses must be included in overtime pay calculations.

Examples of nondiscretionary bonuses that must be included in the regular rate include:

- Bonuses based on a predetermined formula, such as individual or group production bonuses;

- Bonuses for quality and accuracy of work;

- Bonuses announced to employees to induce them to work more efficiently;

- Attendance bonuses; and

- Safety bonuses (i.e., number of days without safety incidents).

Such bonuses are nondiscretionary because the employees know about and expect the bonus. The understanding of how an employee earns one may lead to an expectation to receive the bonus regularly. The fact that the employer has the option not to pay the promised bonus does not make the bonus discretionary.

Steps to Set Up Nondiscretionary Bonuses in WinTeam

- Enter the default thresholds.

- Create an Other Compensation Code for the nondiscretionary bonus

- Assign the nondiscretionary bonus to employee(s) using one of the following methods; manually in the Employee Master File Compensations window, by running a Payroll Batch, or by importing in the Compensation Creator window.

- Review the checks the checks in the Review and Edit Checks window.

- Run the Nondiscretionary Bonus Compensation Report to identify additional amounts that need further review.

- Adjust the Additional Amount Owed, if necessary.

- Print the checks.