Overview

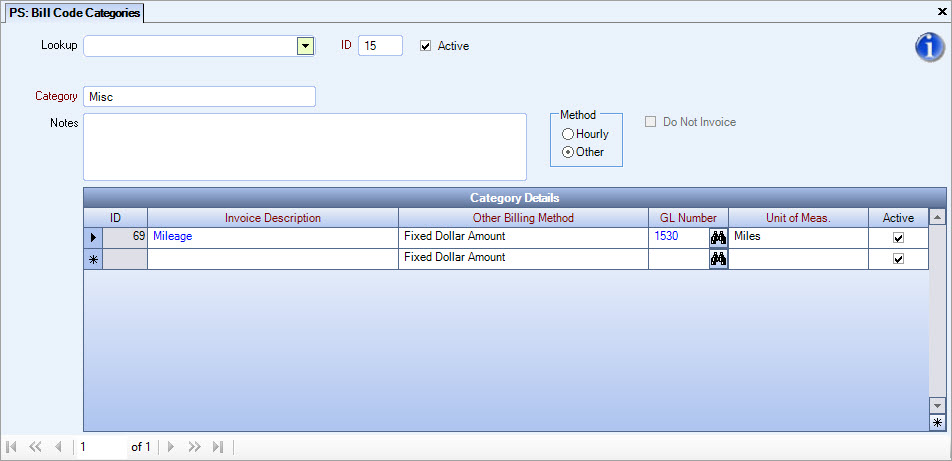

The Bill Code Categories screen can be accessed from the Personnel Scheduling Menu.

You can use the Bill Code Categories screen to group related Invoice Descriptions into a single category. A Bill Code Category may use different combinations of the same Invoice Descriptions. Each Job has a Bill Code Category tied to it. You may add multiple Bill Code Categories to each Job in the PS: Bill Codes by Job screen.

When scheduling, only the Bill Codes that were entered for the Bill Code Category are available for selection.

General Ledger account numbers are assigned to each Invoice Description in order to bill revenue.

You can also set up a non-billable Bill Code Category. Bill Code Categories marked as Do Not Invoice will not have hours written into the Billing Review and Edit file. For more information see Creating a Non-billable Bill Code Category .

There are two Bill Code Category methods:

The Hourly method is used when creating Invoice Descriptions within a Bill Code Category for hourly billing charges. Billing is based on a fixed $ amount or a per hour markup on wages.

Key Functionality

Use the Lookup list to locate existing Bill Code Categories.

The system uses the ID field to identify each Bill Code Category. The system automatically assigns an ID to each new record.

The Active option sets the status of the Bill Code Category to active (selected) or inactive (cleared). For a new Bill Code Category, the system selects the Active check box by default. After you assign a Bill Code Category to a Job, the system does not allow you to delete the Bill Code Category. However, you may make the Bill Code Category inactive by clearing the Active option.

The Category field is used to enter or display a unique description for the Bill Code Category. This description is used when setting up Bill Codes By Jobs and setting up Posts (Post Setup).

The Notes field is used to enter any notes about the Bill Code Category record. If you enter more than one line of information, the system automatically wraps the lines of information for you.

This check box is available if the Method is Hourly. It cannot be selected if Category Details exist in the grid.

When this check box is selected, it indicates that the Job's Bill Category is non-billable. Bill Code Categories marked as Do Not Invoice will not have hours written into the Billing Review and Edit file.

Only one Category Detail record can be added to a non-billable Bill Code Category.

Note: You cannot change a saved Bill Code Category from Non-billable to Billable. You can either delete the Category or make it inactive.

ID

The system automatically assigns an ID number to each new Invoice Description entered.

Invoice Description

Enter a simple description that will default for this ID. You may modify this description for any Job (Bill Codes By Job), however, the ID number will always reference back to the original description entered here.

The description entered corresponds to the General Ledger Number. Changes to this description update to the General Ledger Number displayed.

The Invoice Description defined in the Bill Code Category carries over to the Invoice Details grid on the Bill Codes By Job screen.

This Invoice Description is also used when setting up Sales and Use Tax records.

Type or select the Invoice Description you want to use.

To add a new Description, double-click in the Invoice Description field, or type a new Description and press Enter.

Other Billing Method

The Other Billing Method affects only Bill Code Categories set up with an Other Method. It does not display for the Hourly Method. This is a required field for "Other" methods.

Select how these billing items are calculated. You can select from Fixed Dollar Amount, Percent of Hourly Billing Dollars, or Add On of Hourly Billing Hours. For new records, the default is Fixed Dollar Amount.

GL Number

Enter the General Ledger Number for the system to use when invoicing for the service rendered.

For the Hourly Method, the General Ledger Number corresponds to the labor accounts set up in the General Ledger. You may have multiple detail lines with some Invoice Descriptions corresponding to the same General Ledger Number. Multiple descriptions are for billing purposes, even though revenue is being updated to the same account.

For the Other Method, the General Ledger Number corresponds to the income or expense account to be updated. As with the Hourly Method, multiple descriptions may use the same General Ledger Number, if needed.

Unit Of Measure

The Unit of Measure is used for invoicing. The Unit of Measure prints on the invoice submitted to the customer for payment.

Normal Unit Of Measures include, Hours, Each, Miles, etc. This is a text only field and does not affect calculations. For Other billing Methods you could use something like "Fees".

Bill Type

The Bill Type field affects only Bill Code Categories set up with an Hourly Method. It does not display for Other Methods.

The Bill Type may be selected as a Fixed $ or Markup % calculation.

If Fixed $ is selected, the Dollar per Hour Bill Rate is entered for this Invoice Description when Bill Codes By Job are set up. This is a fixed dollar per hour amount.

If Markup % is selected, the markup percentage is added in the Bill Rate field for this Invoice Description when the Bill Codes By Job are set up. This is a percentage markup on the Hourly rate of the employee whose time is billed with this Invoice Description.

Example: If a $6.00/hour employee works and the Markup % is 50%, the job will be charged $9.00 per hour. Likewise if the normal employee cannot work the shift and an $8.00/hour employee has to work the shift, the charge to the job will be $12.00 per hour.

Ovt

The Overtime option is used to differentiate the hours that are billed as regular hours vs. those billed as overtime hours. This is also used to create the ratio between the overtime hours billed and the overtime hours paid on certain reports.

The Overtime check box is used specifically in the Overtime Warning Report to indicate billable overtime.

Active

The Active check box is used to set the status of the Invoice Description to active (selected) or inactive (cleared). After you assign an Invoice Description to a Bill Code Category, the system does not allow you to delete the Invoice Description. However, you may make it inactive by clearing the Active option.

Many companies perform work that requires additional fees and those fees need to be added to invoices. A good example of this would be Airport Fees. The fees may or may not be subject to tax. Using the Other method, these fees can show as separate line items on invoices. For more information see Adding Other Billing Methods to AR Invoices.

Key Functionality

Use the Lookup list to locate existing Bill Code Categories.

The system uses the ID field to identify each Bill Code Category. The system automatically assigns an ID to each new record.

The Active option sets the status of the Bill Code Category to active (selected) or inactive (cleared). For a new Bill Code Category, the system selects the Active check box by default. After you assign a Bill Code Category to a Job, the system does not allow you to delete the Bill Code Category. However, you may make the Bill Code Category inactive by clearing the Active option.

The Category field is used to enter or display a unique description for the Bill Code Category. This description is used when setting up Bill Codes By Jobs and setting up Posts (Post Setup).

The Notes field is used to enter any notes about the Bill Code Category record. If you enter more than one line of information, the system automatically wraps the lines of information for you.

This check box is available if the Method is Hourly. It cannot be selected if Category Details exist in the grid.

When this check box is selected, it indicates that the Job's Bill Category is non-billable. Bill Code Categories marked as Do Not Invoice will not have hours written into the Billing Review and Edit file.

Only one Category Detail record can be added to a non-billable Bill Code Category.

Note: You cannot change a saved Bill Code Category from Non-billable to Billable. You can either delete the Category or make it inactive.

ID

The system automatically assigns an ID number to each new Invoice Description entered.

Invoice Description

Enter a simple description that will default for this ID. You may modify this description for any Job (Bill Codes By Job), however, the ID number will always refer back to the original description entered here.

The description entered corresponds to the General Ledger Number. Changes to this description update to the General Ledger Number displayed.

The Invoice Description defined in the Bill Code Category carries over to the Invoice Details grid on the Bill Codes By Job screen.

This Invoice Description is also used when setting up Sales and Use Tax records.

Type or select the Invoice Description you want to use.

To add a new Description, double-click in the Invoice Description field, or type a new Description and press Enter.

Other Billing Method

The Other Billing Method affects only Bill Code Categories set up with an Other Method. It does not display for the Hourly Method. This is a required field for "Other" methods.

Select how these billing items are calculated. You can select from Fixed Dollar Amount, Percent of Hourly Billing Dollars, or Add On of Hourly Billing Hours. For new records, the default is Fixed Dollar Amount.

GL Number

Enter the General Ledger Number for the system to use when invoicing for the service rendered.

For the Hourly Method, the General Ledger Number corresponds to the labor accounts set up in the General Ledger. You may have multiple detail lines with some Invoice Descriptions corresponding to the same General Ledger Number. Multiple descriptions are for billing purposes, even though revenue is being updated to the same account.

For the Other Method, the General Ledger Number corresponds to the income or expense account to be updated. As with the Hourly Method, multiple descriptions may use the same General Ledger Number, if needed.

Unit Of Measure

The Unit of Measure is used for invoicing. The Unit of Measure prints on the invoice submitted to the customer for payment.

Normal Unit Of Measures include, Hours, Each, Miles, etc. This is a text only field and does not affect calculations. For Other billing Methods you could use something like "Fees".

Active

The Active check box is used to set the status of the Invoice Description to active (selected) or inactive (cleared). After you assign an Invoice Description to a Bill Code Category, the system does not allow you to delete the Invoice Description. However, you may make it inactive by clearing the Active option.

Security

The PS Bill Codes screen has its own Security Group, PS Bill Codes.

The PS Bill Codes screen is part of the PS ALL Security Group.