Use this procedure to create a Bill Code Category to be used with a Job so hours being written into the Billing Review and Edit file will not be billed.

You may want to review the Bill Code Categories topic before setting up a new Bill Code Category.

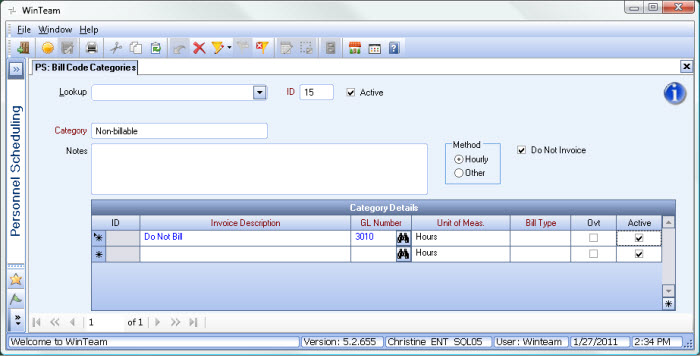

To create a non-billable Bill Code Category

- From the Personnel Scheduling Menu, click Bill Code Categories.

- Leave the Method as Hourly.

- In the Category field, type a unique description for the Bill Code Category. This description is used when setting up Bill Codes By Jobs and during Post Set Up. Typically, this should be something like "Not Invoiced", "Do Not Bill" or "Non-billable".

- Select the Do Not Invoice check box.

- Type an Invoice Description that will display in Personnel Scheduling and on reports. Typically, this should be something like "Not Invoiced", "Do Not Bill" or "Non-billable".

- Enter the GL Number to store with this invoice description. Since it is a Do Not Invoice Bill Category, no details will ever update for billing.

- Enter a Unit of Measure to store with this invoice description. Again, no detail will ever update for this Bill Category, but it is a required field, so an entry must be made.

- Enter a Unit of Measure to store with this invoice description. Again, no detail will ever update for this Bill Category, but it is a required field so an entry must be made.

- Select a Bill Type. You may select either a Fixed $ or Markup % calculation. In this case, it really does not matter since you are not going to bill and are not going to invoice.

- The Active check box is selected by default. Leave this selected.

Note: Records for a Bill Code Category marked as "Do Not Invoice" do not update into the Billing Review and Edit screen. If there are Posts/Shifts that are using a Bill Category that is set up as "Do Not Invoice" you will see an Invoice Description being used on the Detail Cell Info screen.