In order to streamline the process for creating invoices for Other Deductions, WinTeam has the ability to assign multiple Vendors to an Other Deductions Code. This is accomplished by adding (storing) a Vendor # in the Employee Master File, Other Deductions record, rather than with the Other Deductions Code. This allows you to create an Other Deduction Code, and then assign a vendor to the line record in the Employee Master File, Other Deductions screen.

Example: Assume you have 20 employees who have Other Deductions taken for child support. The deduction payments need sent to 20 different court systems. You only need to create one Other Deduction Code and then assign a Vendor in the Employee Master File, Other Compensations and Deductions screen.

How to set this up:

Create an Other Deductions Code

- From the Payroll Menu, click Other Deductions.

- Create an Other Deductions Code.

- Select the option Update to AP Invoices. Only those deductions that have this option selected enable the ability to enter (or default) a Vendor # in the Employee Master File, Other Compensations and Deductions screen.

- Enter a default Vendor Number. This will carry over to the Employee Master File, Other Compensations and Deductions screen when this Other Deduction Code is added to an employee pay record. You may overwrite the Vendor # in the Employee Master File, Other Compensations and Deductions screen.

- Save the Other Deduction Code.

Add an Other Deduction to an Employee Pay record

- From the Payroll Menu, click Employee Master File. Lookup the applicable Employee record.

- Click the Other Comp/Ded button.

- In the Other Deductions area (grid), click New.

- From the Description list, select the appropriate Other Deduction Code.

- Enter the Vendor # this payment will be remitted to. This field is required if the Other Deduction Code is set up to Update to AP Invoices.

- Enter additional information in the A/P Memo Line field. For more information on this field, see Other Compensations and Deductions.

Update to Invoice Entry

- From the Accounts Payable Menu, click Update to Invoice Entry.

- Under Type, select Payroll Other Deductions.

- Select the Vendors to update.

- You may also filter your update by Deduction Types and Deduction Codes.

- Enter a payroll Check Date range to update. Any payroll check within this range that have Other Deductions that have not been invoiced will be included.

- Enter an Invoice Date. The system uses this date when creating the invoice for payment. Normally, this will be the last payroll check date.

- The Posting Date defaults from the date entered in the Invoice Date. The system uses this date when creating the invoice for payment. You may modify this field if needed.

- Click Preview to review the information to be updated. Make any necessary changes. If the information is correct, click Update or Update/Print to update the Payroll Deductions to Invoice Entry.

- Based on the criteria selected, the system finds all Payroll Deductions that have not been updated to Accounts Payable. Once the deduction has been updated and an AP invoice created, it cannot be updated again (unless the entire AP Invoice is deleted).

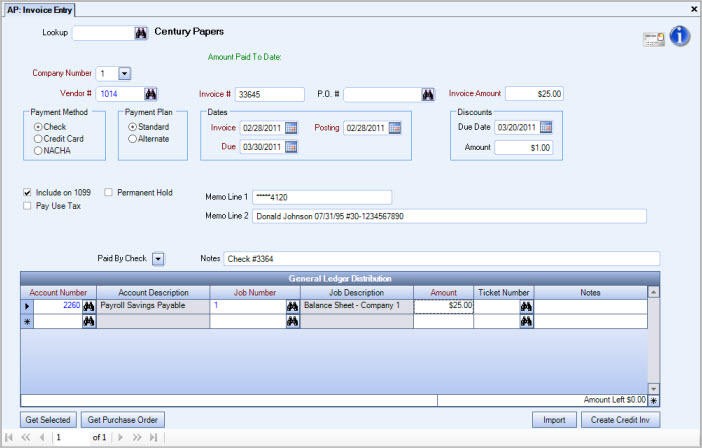

- The Employee SSN will update to Memo Line 1 of the AP Invoice.

- Memo Line 2 will contain: Employee Name, Check Date, space, then the AP Memo Line from the Employee Master File, Other Compensations and Deductions screen. This information will print in its entirety on the Update to Invoice Entry report.

- The system creates an invoice number using the Check number plus a unique identifier, if necessary, in those instances where there is more than one deduction for the same check # and vendor number.

- The invoices are now available for payment and may be edited in Invoice Entry.

If there was only one Other Deduction that was created for Vendor #1014 from Check #33645, the invoice is assigned invoice #: 33645.

If there were two Other Deductions created for Vendor #1014 from Check # 33645, the second invoice is assigned invoice #: 33645-1.

We can assign up to 10 instances for the same check and vendor #.

Notice the Social Security Number in Memo Line 1.

Notice Memo Line 2: Employee Name, Check Date: "AP Memo Line from Employee Master File, Other Deductions".

Note: The AP Memo Line reflects what was set up in the Employee Master File, Other Compensations and Deductions screen at the time the Payroll batch was updated to the General Ledger.

What happens if there are deduction amounts that are not selected to be Included on the paycheck?

If there are any line items that are marked to Not Include on the check, these are not included in the AP Update to Invoices when creating Payroll Deduction invoices.(The system does not record the Vendor Number and memo line information when the Payroll batch is updated to the General Ledger if the deduction line was not selected to be Included on the paycheck. If for some reason the deduction line was previously selected to be included, and somehow the deduction line became marked to NOT include, the AP Update to Invoices program will not pick this up. It ignores any paycheck deduction line where the Include box was not selected.

What happens if a check is voided and was not previously imported into AP Invoices?

If a payroll check is voided and was not previously imported into AP Invoices, it will never be imported through AP Invoices. The system does not import any check that has a check status of being voided.

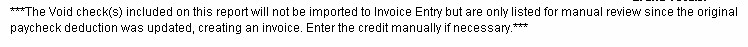

If the AP invoice for the original check’s deduction was created prior to the void happening, the system shows the Void (negative) deduction amount on the previewed report, but it will never be imported into AP Invoice Entry since this is something that needs to be handled manually.

If the previewed report includes any void check deductions (negative check number records), a message prints at the bottom of the report.

What happens if a check is replaced?

The Replaced check’s deduction will still be picked up on the AP Update to Invoices – Payroll Deductions update report.

For information on voiding payroll checks, see Voiding Payroll Checks.