This article contains information about the steps to take after a payroll batch has been printed and the NACHA file was sent to the bank and the employee’s routing number or account number was incorrect or did not exist.

The option to recreate the timekeeping hours as part of the void process. If timekeeping hours do not need to be recreated, use the PAY: Replacing a Check process.

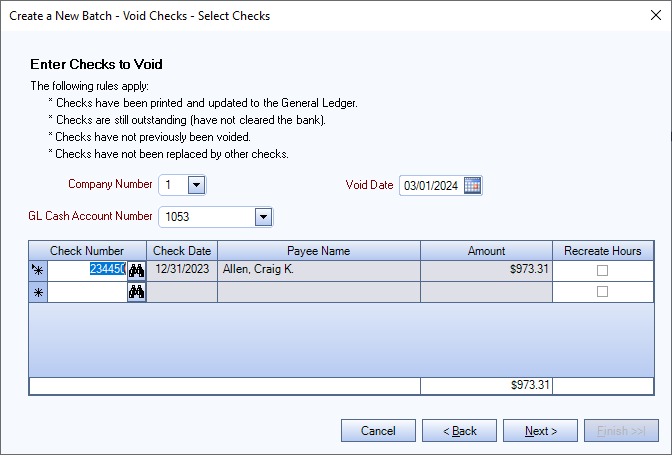

Before voiding a check, the original check must have been printed, updated to the General Ledger, still be outstanding, and not previously voided. Replacement checks are created one at a time. Checks can be voided in batches. WinTeam creates a separate batch for voided checks.

When voiding a payroll check, if the check included one-time or recurring with limit deductions or compensations, review whether these records should be re-entered to be included on the employee's next check. If the Recurring with Limit deduction or compensation row still exists in the Employee Master File for a voided check, the system can properly reduce the cumulative amount, but check to ensure the cumulative amount was adjusted properly.

When a check is printed, the direct deposit information from the Employee Master File (EMF) is saved with the check. If this information is incorrect, it cannot be edited at the check level.

Process to Void and Reissue a Check

- If the check being voided is a direct deposit check, enter the correct direct deposit information in the Employee Master File (EMF).

- Create an equal and opposite negative check using PAY: Check Processing Wizard. The original check must be updated to the General Ledger (GL). The direct deposit information from the original check is copied to the void check (which is not sent to the bank) for reference.

- Recreate the hours to issue a new check that contains the updated direct deposit information from the EMF.

- Include the reissued check in the NACHA file if for direct deposit.

- The voided check and the reissued check are both updated to the GL and included in the employee’s W-2 YTD information.

Creating a Void Check Batch

- Open the Check Processing Wizard from the Payroll module main menu.

- Select Create a New Batch, Void Checks, and then click Next.

- Select the Company Number (on multi-company databases) and then enter the Void Date and the GL Cash Account Number for the check to be voided. The date entered here is assigned to the void check record (not the original check) and is also the default posting date when updating this batch of voided checks to the General Ledger.

- Enter the check number to void or use the Lookup to locate the check number. Tab off of the check number field and the system enters the Check Date, Payee Name, and Amount.

- Select the Recreate Hours check box to immediately reprocess a check for the void. The original hours on the check being voided are recreated, eliminating the need to manually enter the hours again. Leave this check box cleared if a check for the hours does not need to be reprocessed.

- Click Next. When the Void Date and the Check Date for at least one check in the batch are not in the same month and/or year a message box displays to warn this could cause discrepancies in the General Ledger. The void process can be continued or stopped. If the updated tax engine is being used, the system continues to calculate a check even if the year-to-date withheld amount for any of the taxes is currently a negative value. A negative value is typically created when a check from the prior year is voided at the beginning of the new year prior to creating the first check of the new year.

- Enter any Notes that are important for the batch of voided checks and then click Finish.

- A message box displays when the void process is complete. Click OK.