Accruing Labor Based on Payroll Batches

Note on Hourly Labor $ and Avg Labor Rate on Labor Distribution Report:

If a user believes the Hourly Labor $ and or Avg Labor Rate on the labor accrual distribution journal are over-stated, this could be a result of salary hours included in the Hourly figure. The Labor figure will always be correct. Salary hours included on a line with hours and hourly labor could throw off the Hourly Labor $ and subsequently the Average Labor Rate. "Backing out" salary dollars from the Hourly Labor $ figure is not permitted as this information must be retained for the Labor Distribution report.

Labor can be accrued based on Timekeeping, Budgets or posted Payroll Batches.

This accrual type allows you to base the labor accrual on selected payroll batches. WinTeam uses all hourly and salary employee wages within the payroll batches selected. Unlike the other types, this type allows you to accrue taxes and Other Compensations/Deductions. Also in this type of accrual you are able to accrue a percentage of all, or a portion of the following items:

Hourly Wages

Hourly Holiday Wages

Salary Wages

Taxes

*Hourly Compensations

*Other Compensations

*Hourly Deductions

*Other Deductions

*Only those compensations and deductions set up to “Include in Accruals” are included when determining the amounts of compensations and deductions to accrue.

To accrue labor based on Payroll batches

Verify that the correct GL Numbers are set up in SYS:Company Setup for Accrued Wages and Taxes.

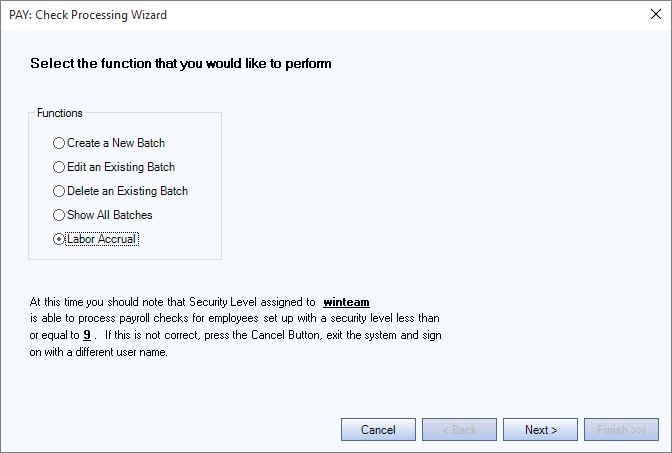

From the Payroll menu, click Check Processing Wizard.

Select Labor Accrual, and then click Next. The screen displays the current logon name and the security level assigned to the user. The user may process payroll for those employees who have a security level equal or less than the level displayed. Click Next.

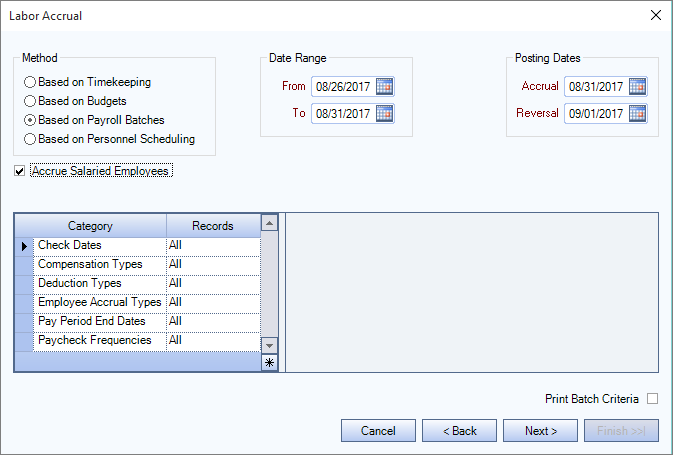

Under Method, select Based on Payroll Batches.

Enter the Date Range.

The Posting Dates default based on the Date Range entered. The Accrual date = To Date. The Reversal date = Accrual Date + 1 day.

Under Category/Records, you must enter either Pay Period End Dates or Check Dates since this information will be used to filter the Payroll Check batches available for selection. You can enter both if you like.

Select the Print Batch Criteria check box if you want to print the batch criteria as soon as the labor accrual batch is done processing.

Click Next. The Labor Accrual Batch Selection screen displays a listing of payroll batches that have a Pay Period End date within the Pay Period End Dates range and that have a Check Date within the Check Dates range previously entered. To view the GL Log# with which the transaction was posted and/or speed the process of un-posting and/or reprinting GL entries, the GL: Journal Update Log screen may be accessed by double-clicking a record's blue Posted status.

Enter the percentages you want to accrue for each labor related expense. At least one of the items must have a percentage greater than 0%.

Hourly Wages – This applies to all Hourly Wages being paid that are non-holiday hours types.

Holiday Hourly Wages – This applies to Hours in the batch that are attached to Hours Types that are selected as “Are these Hours considered Holiday.”

Hourly Compensations – This applies to Other Compensation Codes set up to “Include in Accruals” and that are based on an Amount per Hour Compensation Method. This percentage is applied to both the Hours and the Amount, independently.

Note: Since we are basing our percentage on a posted batch, we have already taken into consideration the amount of hours that the Hourly Compensation applies to (as part of the normal payroll processing).

Other Compensations – This applies to all Other Compensations being paid that are not set up using a Compensation method of amount per Hour, and that are set up to “Include in Accruals”.

Hourly Deductions – Normally deductions are not accrued, but can be accrued if you have Deductions set up to Include in Accruals. This applies to Other Deduction Codes set up to “Include in Accruals” and that are based on an Amount per Hour Deduction Method. This percentage is applied to both the Hours and the Amount, independently.

Note: Since we are basing our percentage on a posted batch, we have already taken into consideration the amount of hours that the Hourly Deduction applies to (as part of the normal payroll processing).

Other Deductions – Normally deductions are not accrued, but can be if you have Deductions set up to Include in Accruals. This applies to all Other Deductions being deducted that are not set up using a Deduction Method of Amount per Hour, and that are set up to “Include in Accruals”.

Taxes – If the Tax Allocation Program is being used then the Tax Allocation Journal entries from the Payroll batches will be accrued. If not using the Tax Allocation Program, the Payroll Journal entries will be used for the accrual to accrue for the Employer’s tax expense.

Select the batch or batches you want to accrue, and then click Next.

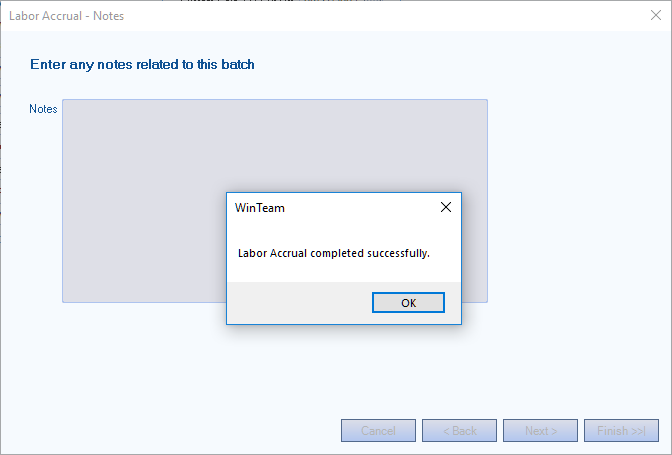

Enter any Notes that are applicable to this Labor Accrual, and then click Finish.

Once the batch is done processing and if you selected the Print Batch Criteria check box, the Payroll Wizard Criteria displays in Preview mode. At this point you can print the criteria page and/or close the preview.

A message displays that the accrual is successful, and the record has been created.

Click .

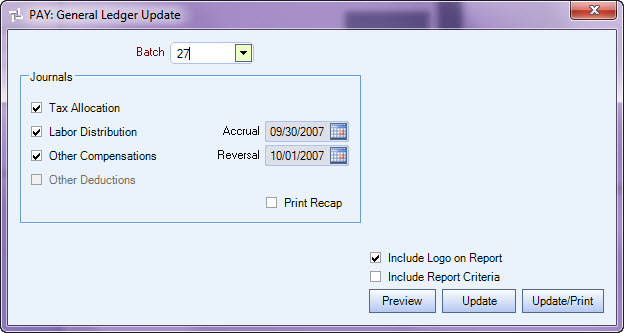

To view your Labor Accrual batch results use the Update to GL process to Preview and Update your Labor Distribution Journal.

Understanding what happens during the General Ledger Update for Labor Accrual

When a Labor Accrual Batch is selected for updating to the General Ledger, only the applicable Journals that have a percentage greater than 0% will update.

Example: If 0% was entered in the Labor Accrual process for Other Compensations, then the Other Compensations on the General Ledger Update screen is unavailable (disabled). Journals are also unavailable if there is no activity to accrue.

When updating Wages, the system uses the Accrued Wages GL Number, instead of the Payroll Clearing Account Number.

When updating Compensations and Deductions, the system uses the Accrued Wages GL Number.

When updating Taxes, you will see either Payroll Tax or Tax Allocation, whether or not you are using the Tax Allocation Program.

If the accrual is based on the Payroll Journal, only Group A accounts will post. The Debit will post to the Payroll Tax Job Number and the Expense GL Numbers pulled from the Tax Tables. The Credit will post to the Accrued Taxes GL Number and Balance Sheet Job Number.

If the accrual is based on the Tax Allocation, both Group A and B accounts will post. The Debit will post to the Jobs and GL Number in the Taxes and Insurance screen. The Credit will post to the Accrued Taxes GL Number and Balance Sheet Job Number.

The calculations will occur based on the entries in the Payroll Tax Journal, Labor Distribution Journal, Other Compensations Journal, Other Deductions Journal, and the Tax Allocation Journal AND the percentages selected during the Labor Accrual process.

Labor Distribution Journal consists of Hourly Wages, Holiday Hourly Wages, and Salary Wages.

Other Compensations Journal consists of Hourly Compensations and Other Compensations.

Other Deductions Journal consists of Hourly Deductions and Other Deductions.

Payroll Journal consists of the Employer's portion of Group A Accounts, if not using the Tax Allocation Program.

Taxes consists of the Employer's portion of Group A and Group B Accounts.

Example: Let's assume we are using the Tax Allocation Program and the following selections were made:

Hourly Wages - 10%

Holiday Wages - 50%

Taxes - 10%

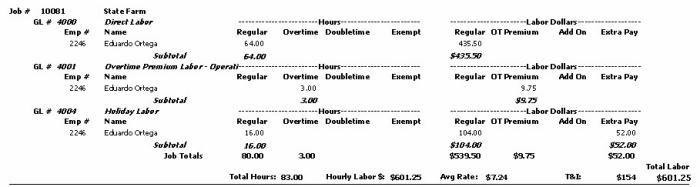

If the Labor Distribution Journal, after payroll processing, reflects these amounts:

Based on the percentages entered during the labor accrual process, the Labor Accrual Batch will reflect this:

Direct Labor

Notice the GL # 4000 had Hours - Regular of 64. Based on 10%, the accrual hours are 6.40.

Notice the GL # 4000 had Labor Dollars - Regular in the amount of $435.50. Based on 10%, the accrual amount is $43.55.

Holiday Labor

Notice the GL # 4004 had Hours - Regular of 16. Based on 50%, the accrual hours are 8.00.

Notice the GL # 4004 had Labor Dollars - Regular in the amount of $104.00. Based on 50%, the accrual amount is $52.00

When you Preview or Update/Print, the last Journal included is the Payroll Journals Recap. This Journal displays an overall recap by G/L # for all Journals in this batch.

Note: If an employee has a combination of both hourly and salary Pay Types for the same accrual date range, the system uses the type listed on the last day of the accrual period as the Pay Type for the calculation.

For information on Labor Accrual based on Timekeeping, Personnel Scheduling or Budgets, see Accruing Labor.

Security

For a labor accrual based on payroll batches, the system bypasses all security level checking and includes all records in the selected batch.