Overview

The Reconciliation program can be used to assist you in balancing your accounts. Every entry posted to a Cash Account creates a transaction in the Bank Reconciliation program. This includes AR Payments, AP Checks, Paychecks and any adjusting entries that affect a Cash Account. With the required security permissions, you can enter Check Register Adjustments or Adjusting Journal Entries.

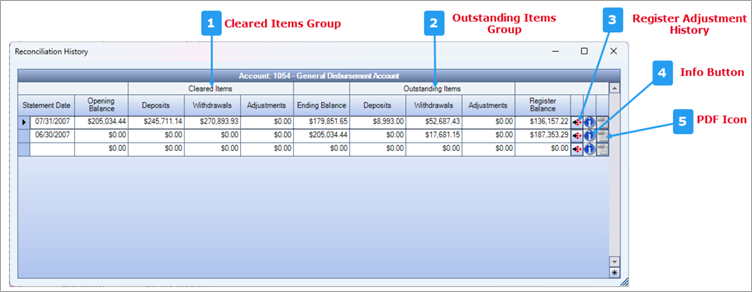

Prior to completing the reconciliation process, WinTeam also verifies that all transactions in the period you are reconciling have been updated to the GL. Transactions that have not been posted to the GL are easily identifiable on the Recaps tab, and you can go directly to the appropriate GL Update screen to post them. Also displayed in the Recaps tab are Statement and Register Differences. Upon completion of a reconciliation, WinTeam creates and saves a .pdf report you can access from the Reconciliation History screen.

Key Functionality

Hover over the Change Information icon to see User Added, Date Added, User Changed and Date Changed information. WinTeam records the logon name of the user entering or changing this record. The Date Added is the original date this record was entered into the system. The Date Changed is the date the record was last changed. Right-click on the Change Info icon to filter for records added or changed by a specific user or date.

When you hover over the User Changed or Date Changed filters, you can:

- Filter By Selection - Filters for all records that match your current records field value.

- Filter by Exclusion - Excludes from your filter all records that match your current records field value.

- Filter For - Filters based on the text/value you enter.

- Sort Ascending - If you already have a filter applied, the Sort Ascending command is available. Also used to include all records in the filter and sort in ascending order based on the current records field value.

- Sort Descending - If you already have a filter applied, the Sort Descending command is available. Also used to include all records in the filter and sort in descending order based on the current records field value.

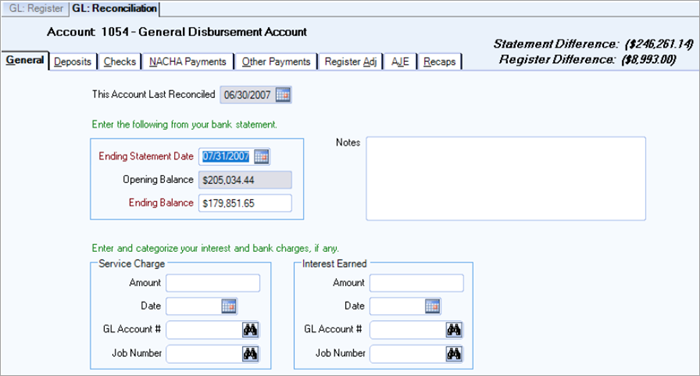

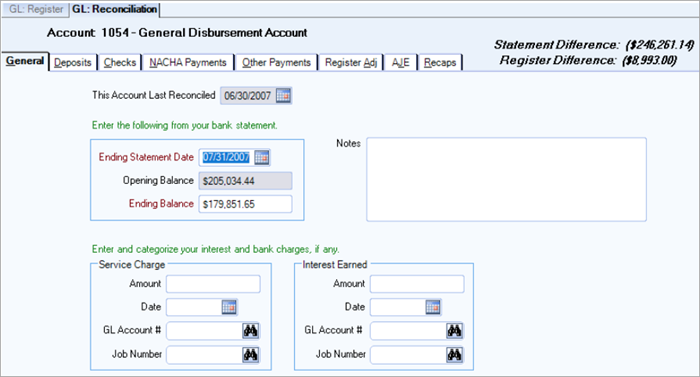

The reconciliation process begins with entering information from your bank statement reflecting the activity in your company's cash account. The statement includes the deposits received by the bank, checks paid by the bank, NACHA Payments, Other Payments (other amounts transferred into and out of the cash account), bank service charges and Interest Earned.

Displays the date that this account was last reconciled.

Enter the ending date of your bank statement. The Statement Date must be greater than the Last Reconciled Date.

Displays the opening balance of this account based on the ending balance from your last reconciliation.

Enter the Ending Balance from your bank statement.

If you need to enter a negative number, enter the amount first, then click on the - sign.

Enter any Notes pertaining to this reconciliation. If you enter more than one line of information, the system automatically wraps the lines of information for you.

An Accounts Payable payment record will be created using a Service Charge payment Type and will be distributed based on the GL Account and Job Number, and the amount specified here. A notation in the Notes field of the Payment record will state "Service Charge for Account 1054" (or whatever your cash account number is).

Enter any service charge amount shown on your statement. Negative entries are not allowed.

Enter the date the service charge was incurred.

Enter the GL Account # to apply the service charge amount, or use the Lookup to located the GL Account Number.

Enter the Job Number to apply the service charge amount, or use the Lookup to locate the Job Number.

An Accounts Payable payment record will be created using the "Service Charge" Payment Type and will be distributed based on the GL Account and Job Number, and amount specified here. Since this is not really a payment record, but rather an adjustment for interest earned, it will be a negative amount. A notation in the Notes field of the payment record will state "Interest Earned for Account 1054" (or whatever your cash account number is).

Enter any interest earned amount shown on your statement.

Enter the date the interest was earned.

Enter the GL Account # to apply the interest earned amount, or use the Lookup to located the GL Account Number.

Enter the Job Number to apply the interest earned amount, or use the Lookup to locate the Job Number.

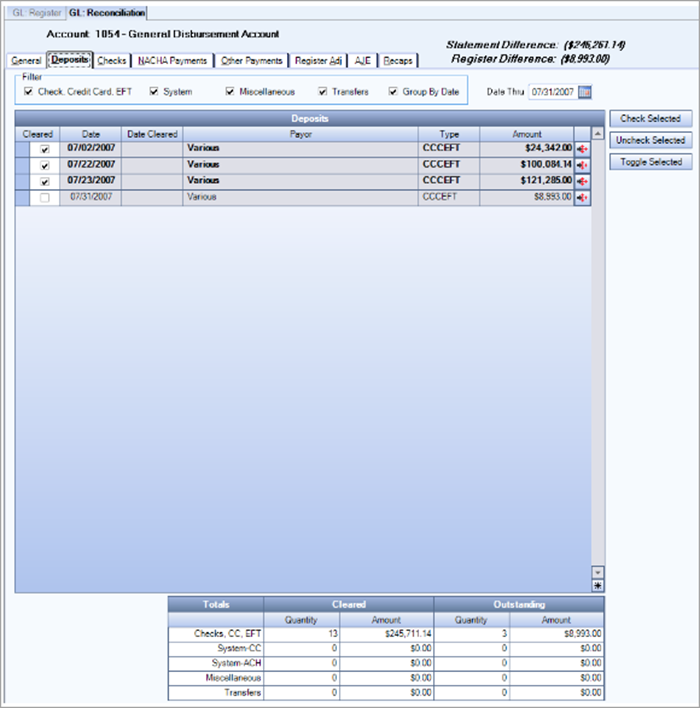

The Deposits tab lists all Deposits from the Register for the period you are reconciling. Deposits are sorted in Date order. Select all the Deposits that show as cleared on your bank statement. Any remaining Deposits are considered "Deposits in Transit,' which indicates that the amounts have been received and recorded by the company, but are not yet recorded by the bank. For example, if your company deposits its cash receipts in the evening of July 31, and the bank does not process this deposit until the morning of August 1, as of July 31 (the bank statement date), this is a deposit in transit.

Because deposits in transit are already included in the company's cash account, there is no need to adjust the company's records. However, deposits in transit are not yet on the bank statement. Therefore, they need to be listed on the bank reconciliation as an increase to the balance per bank in order to report the true amount of cash.

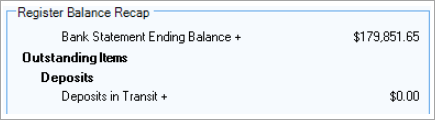

Cleared Deposits will display on the Bank Statement Recap area on the Recaps tab.

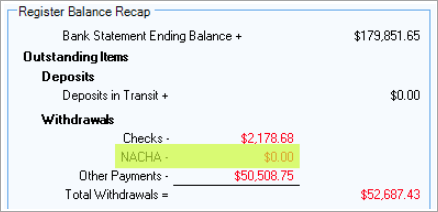

Uncleared Deposits (Deposits in transit) will display on the Register Balance Recap on the Recaps tab.

Select the Filters to apply to the Deposits. You may select from Check, Credit Card, EFT, Miscellaneous, and Transfers. You may group the Deposits by date.

Note: The System-CC filter displays if your database is authorized to use the Online Payments feature. See Understanding the System Deposit Type for details.

The Date Thru field defaults from the Ending Statement Date. The grid displays all transactions dated through this date.

The Deposits grid displays all deposits, along with the supporting details (Date, Date Cleared (if applicable), Payor, Type, and Amount). Click the Detail button to view the Deposit Details screen.

The Totals fields display the quantity and amount of each type of deposits, for both cleared and outstanding deposits.

Click the Check Selected button to mark all records in the grid as selected.

Click the Uncheck Selected button to clear all records selected in the grid.

Click the Toggle Selected button to toggle the marked selections on or off each time you click.

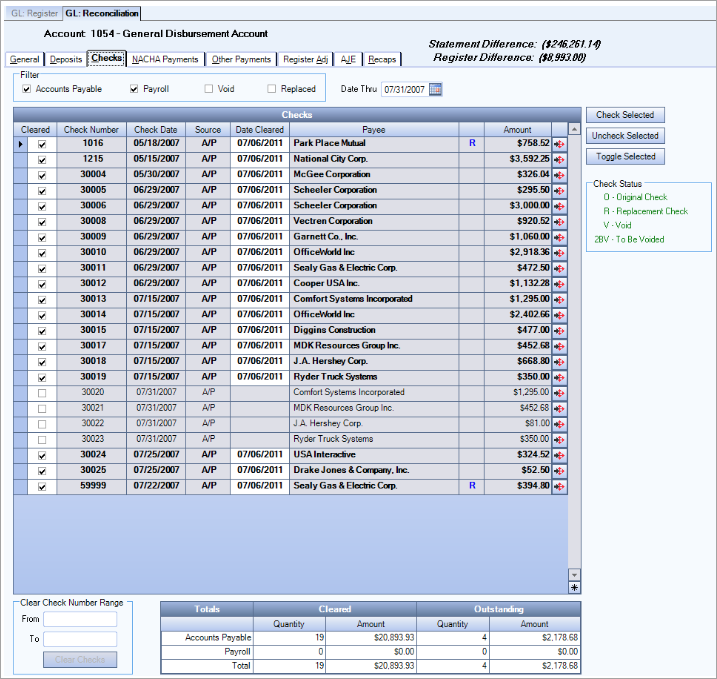

The Checks tab lists all Checks from the Register for the period you are reconciling. Select all the Checks that show as cleared on your bank statement. Any remaining checks are considered Outstanding checks. Outstanding checks are checks that have been written and recorded in the company's Cash account, but have not yet cleared the bank account. Checks written during the last few days of the month plus a few older checks are likely to be among the outstanding checks.

Because all checks that have been written are immediately recorded in the company's Cash account, there is no need to adjust the company's records for the outstanding checks. However, the outstanding checks have not yet reached the bank and the bank statement. Therefore, outstanding checks are listed on the bank reconciliation as a decrease in the balance per bank.

The total of the Cleared checks will display on the Bank Statement Recap area of the Recaps tab.

The total of the uncleared checks (Outstanding checks) will display on the Register Balance Recap area on the Recaps tab.

Select the Filters to apply to the Checks. You may select from Accounts Payable, Payroll, Void, or Replaced.

The Date Thru field defaults from the Ending Statement Date. The grid displays all transactions dated through this date.

The Checks grid displays all checks that have not been reconciled, along with the supporting details (Check Date, Source, Date Cleared (if applicable), Payee, Check Status, and Amount).

Note: The Payee field and the drill-down feature are controlled by the Pay Security level. The payee's name does not display in the field and the drill-down is unavailable when the logged in user's pay security level is less than the payee's pay security level. For example, if the logged in user has a security level of 4, they will not see information for employees who have a security level of 5 or higher.

The Check Status field will display O for Original Check, R for Replacement Check, V for void and 2BV for To Be Voided checks. You can double-click on the status to see more information.

For Payroll checks, click the Detail button to view the actual check in the Review and Edit screen.

For AP Checks, click the Detail button to view the payment record.

The Totals fields display the quantity and amount of each type of check, for both cleared and outstanding checks.

Enter a beginning Check Number and an Ending Check Number, then click Clear Checks to clear an entire range of checks.

Click the Check Selected button to mark all records in the grid as selected.

Click the Uncheck Selected button to clear all records selected in the grid.

Click the Toggle Selected button to toggle the marked selections on or off each time you click.

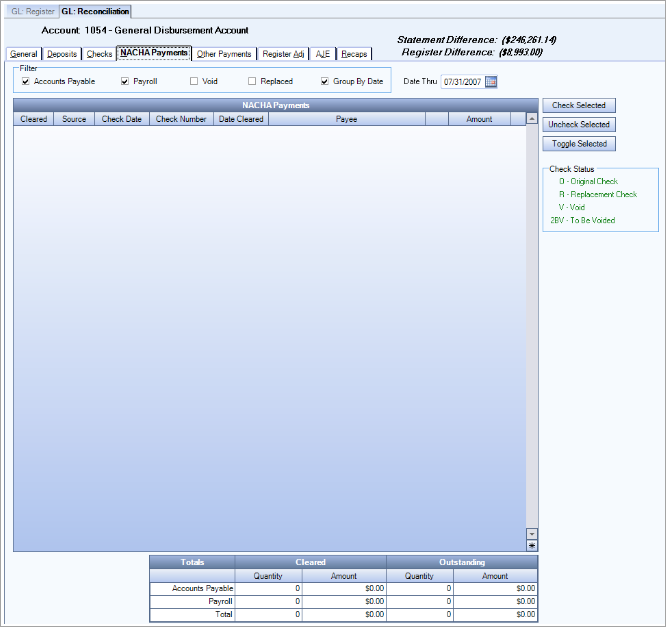

The NACHA tab lists all NACHA payments (AP, Payroll, Void, and Replaced) from the Register for the period you are reconciling. Select all payments that show as cleared on your bank statement. Any remaining payments are considered Outstanding, which have been written and recorded in the company's Cash account, but have not yet cleared the bank account.

Because all NACHA payments that have been made are immediately recorded in the company's Cash account, there is no need to adjust the company's records for the outstanding NACHA payments. However, the NACHA payments have not yet reached the bank and the bank statement. Therefore, outstanding NACHA payments are listed on the bank reconciliation as a decrease in the balance per bank.

The total of the cleared NACHA Payments will display on the Bank Statement Recap area of the Recaps tab.

The total of the uncleared NACHA Payments will display on the Register Balance Recap area on the Recaps tab.

Select the Filters to apply to the NACHA payments. Select from Accounts Payable, Payroll, Void, or Replaced. You can also Group the NACHA Payments by date.

The Date Thru field defaults from the Ending Statement Date. The grid displays all transactions dated through this date.

The NACHA Payments grid displays all payments that have not been reconciled, along with the supporting details (Source, Check (Payment) Date, Check #, Date Cleared (if applicable), Payee and Amount).

You may use the Detail button to view the payment in the appropriate Review and Edit screen.

The Totals grid displays the quantity and amount of each type of payment, for both cleared and outstanding NACHA Payments.

Check Selected button

Click the Check selected button to mark all records in the grid as selected.

Uncheck Selected button

Click the Uncheck Selected button to clear all records selected in the grid.

Toggle Selected button

Click the Toggle Selected button to toggle the marked selections on or off each time you click.

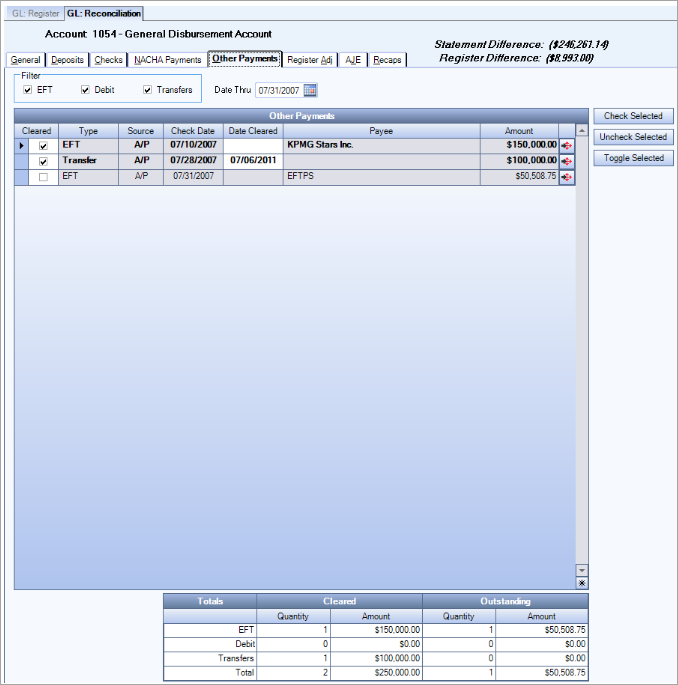

The Other Payments tab lists all EFT, Debits and Transfers from the Register for the period you are reconciling. Select all the Other Payments that show as cleared on your bank statement. Any remaining payments are considered Outstanding. Outstanding Other Payments are payments that have been written and recorded in the company's Cash account, but have not yet cleared the bank account.

Because all payments that have been written are immediately recorded in the company's Cash account, there is no need to adjust the company's records for the outstanding payments. However, the outstanding payments have not yet reached the bank and the bank statement. Therefore, outstanding payments are listed on the bank reconciliation as a decrease in the balance per bank.

The Other Payments tab displays EFT, Debits, and Transfers.

Totals display in the footer area.

The total of the cleared Other Payments will display on the Bank Statement Recap area of the Recaps tab.

The total of the uncleared Other Payments will display on the Register Balance Recap area on the Recaps tab.

Select the Filters to apply to Other Payments. You may select from EFT, Debit, or Transfers.

The Date Thru field defaults from the Ending Statement Date. The grid displays all transactions dated through this date.

The Other Payments grid displays all EFT, Debit, and Transfer payments that have not been reconciled, along with the supporting details (Type, Source, Check (Payment) Date, Cleared Date (if applicable), Payee and Amount).

Click the Detail button to view the payment in the appropriate Payment or Cash Transfer record..

Totals

The Totals fields display the quantity and amount of each type of payment, for both cleared and outstanding payments.

Check Selected button

Click the Check selected button to mark all records in the grid as selected.

Uncheck Selected button

Click the Uncheck Selected button to clear all records selected in the grid.

Toggle Selected button

Click the Toggle Selected button to toggle the marked selections on or off each time you click.

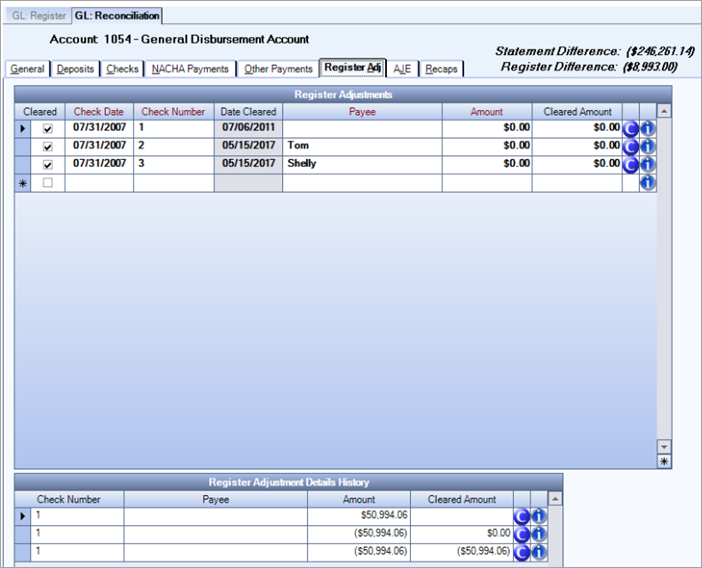

Special Security is required to make register adjustments. The 'Allow Register Adjustments' Feature is available for this screen, and is selected if you belong to the SYS ALL Security Group. It is not selected by default in the GL ALL Security Group.

Entries made on the Adjustments tab do not effect the General Ledger.

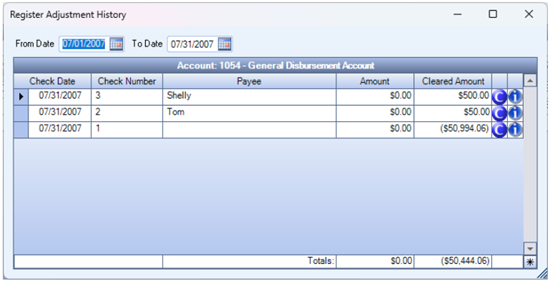

Generally, Register Adjustments are the result of items found on the bank statement but have not yet been entered in the Register. To adjust an outstanding payment, enter the amount as positive. If the total amount is not cleared, enter the partial amount to clear. For partial amounts, do not select the Cleared check box (unless this is last partial amount to clear). To adjust an outstanding Deposit, enter the amount as negative.

When an Register Adjustment is created during a bank reconciliation, the entry will display immediately in the Bank Recaps tab. Once it is marked as 'cleared', the register entry will display the amount in the Bank Statement Recap area under cleared Adjustments.

The cleared Register Adjustments will display on the Bank Statement Recap area on the Recaps tab.

The Outstanding Adjustments will display on the Register Balance Recap on the Recaps tab.

The Register Adjustment Details History grid displays all register adjustments that have been reconciled.

When you are finished reconciling, the Register Adjustment Details can be viewed from the Reconciliation History screen by clicking the Detail button.

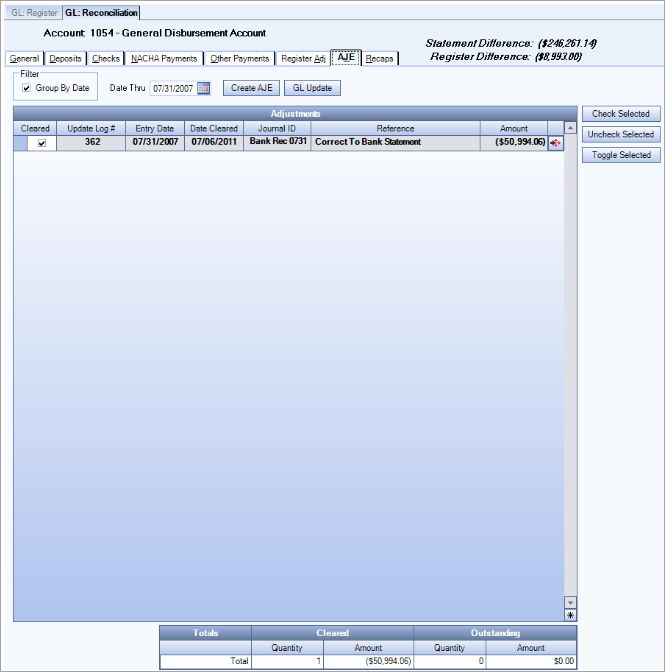

The AJE tab displays all Adjusting Journal Entries that effect cash accounts during the specified period. You can also create an Adjusting Journal Entry directly from this tab. Adjustments to increase the cash balance will require a journal entry that debits Cash and credits another account. Adjustments to decrease the cash balance will require a credit to Cash and a debit to another account.

When you create an Adjusting Journal Entry during a bank reconciliation, the entry will display immediately in the Bank Recaps tab. The adjusting entry displays in the Register Balance Recap - Transactions in Register, Not Yet posted area. The Recaps tab displays a visual indicator that indicates that there are Adjusting Journal transactions that need updated to the GL.

You can update the adjusting entry directly from the AJE tab by clicking the GL Update button. Once it is updated to the GL (which you can also perform directly from this screen), and marked as cleared, the adjusting journal entry will display the amount in the Bank Statement Recap area under cleared Adjustments.

If you have several entries, you can select to Group By Date.

The Date Thru field defaults from the Ending Statement Date. The grid displays all transactions dated through this date.

The Adjustments grid displays all adjusting journal entries that have been made for the reconciliation period. Select all entries that have cleared.

If there are any adjustments for the reconciliation period that have not been posted, they will display in the Register Balance Recap - Transactions in Register, Not Yet posted area. These must be updated in order to Finish the reconciliation.

Click the Check Selected button to mark all records in the grid as selected.

Click the Uncheck Selected button to clear all records selected in the grid.

Click the Toggle Selected button to toggle the marked selections on or off each time you click.

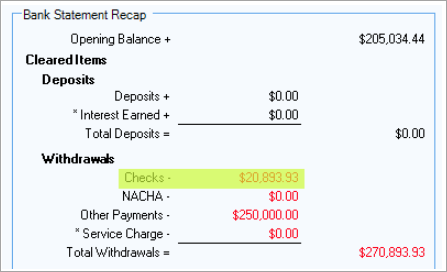

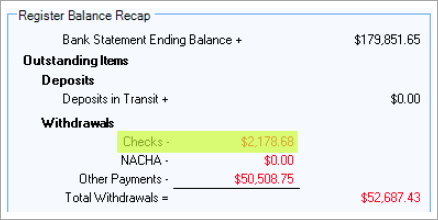

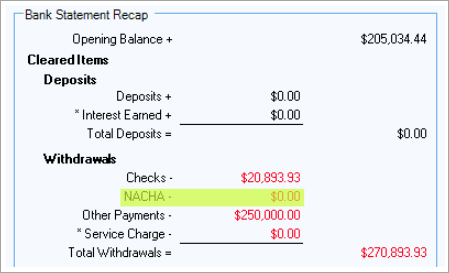

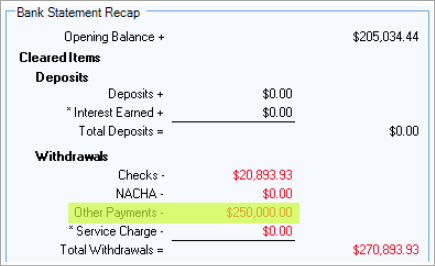

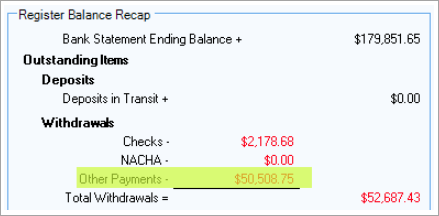

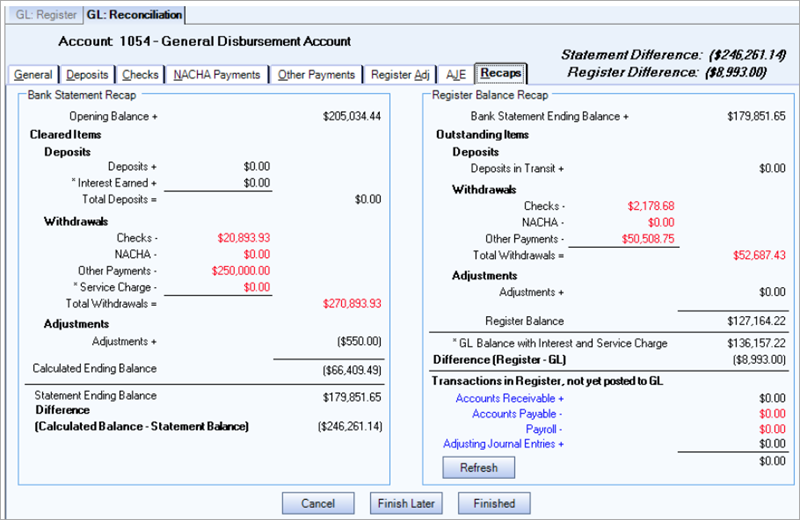

The Recaps tab displays a summary of information from the Reconciliation tabs. You can tie back the information on the Recaps screen to each tab of the reconciliation process.

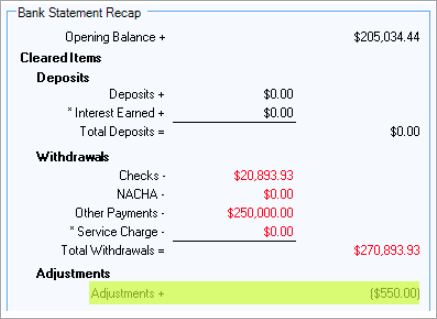

The Bank Statement Recap section displays a summary of the items on the bank statement being reconciled and accounts for the differences between the register balance and the bank statement.

The Opening Balance is derived from the General tab.

The Cleared Deposits come from the Deposits tab.

The Cleared Withdrawals come from the Checks, NACHA Payments, and Other Payments tab.

The Cleared Adjustments come from the Register Adj tab.

The Service Charge comes from the General tab.

Adjustments come from the Register AJE tab.

The Register Balance Recap section displays the amounts of each item that make up the register balance. These would be the uncleared items from the tabs above.

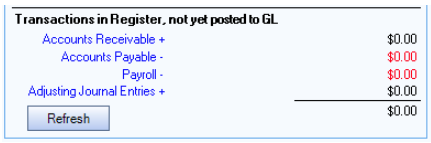

Transaction in Register not yet posted to GL

If there are entries that are in the Register, but not posted to the GL, there will be an amount listed other than $0.00. You can double-click on the blue text to open the Update to GL screen for each.

Click Refresh to update the Recaps tab.

Click Cancel to exit the bank reconciliation program without saving your work.

Click to save a reconciliation that is in progress. A temporary pdf report is created and saved. It can be accessed at any time directly from the Reconciliation History screen. This temporary pdf will be overwritten each time you click Finish Later.

Click the Finished button when the Difference amounts are $0.00. If your account is not reconciled, make the necessary adjustments. The system will display a message if you are not in balance.

Once the Finished button is pressed, all items will then be marked as Cleared and Reconciled. A pdf report is created and saved. It can be accessed at any time directly from the Reconciliation History screen.