Overview

The Sales Tax Jurisdictions Report is used to review sales and use tax setup, rates, and item taxability.

Key Functionality

The AR Report Sales Tax Jurisdiction screen has its own Security Group, AR Report Sales Tax Jurisdiction.

The AR Report Sales Tax Jurisdiction screen is part of the AR Reports ALL Security Group.

Tip: For more information see Security Groups Overview and Security Groups By Module.

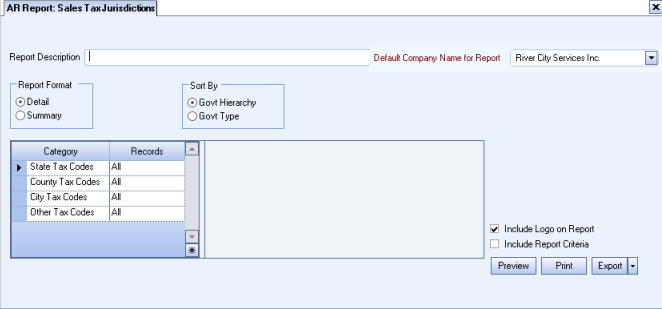

Type a description to name the report. This description prints above the Report Title.

Available for Clients using the Multi-Company feature. The Default Company Name for Report is populated from the Company Setup screen. The list contains all companies you have permission to access. The default company prints on every page of the report.

If the User has permission to only one company, then just that one company will display in the list. If the User has permissions to more than one company, the list will contain all companies the User has rights to PLUS the default reporting company. For more information see Learning about WinTeam Reports.

Use the Report Format option to choose the level of detail for the report.

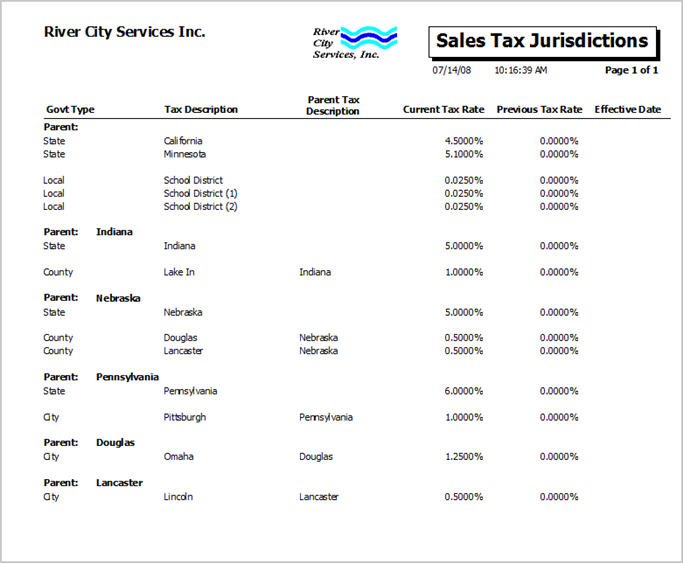

The Summary report lists the Government Type, Tax Description, Parent Tax Description, Current Tax Rate, Previous Tax Rate, and Effective Date.

The Detail report includes all items from the Summary report plus a separate line item for Products, Services, PS Products, PS Services, and Taxable Listing for Items from Inventory for Products and Services and Items from Personnel Scheduling for Hourly and Other based on "All, except" or 'None, except" specific items.

Select to sort by Government Hierarchy or Government Type. Government Hierarchy is the default selection.

Government Hierarchy groups jurisdictions by Parent Jurisdiction.

Government Type lists jurisdictions in State, County, City, Local order.

State Tax Codes

Use the State Tax Codes category to select the invoices that are taxed at a State level.

The list that displays comes from the Government Type add/edit list.

County Tax Codes

Use the County Tax Codes category to select the invoices that are taxed at a County level.

The list that displays comes from the Government Type add/edit list.

City Tax Codes

Use the City Tax Codes category to select the invoices that are taxed at a City level.

The list that displays comes from the Government Type add/edit list.

Other Tax Codes

Use the Other Tax Codes category to select the invoices that are taxed at a Local level.

The list that displays comes from the Government Type add/edit list.

Select the Include Report Criteria check box to include a list of the report options selected for this report. The Report Criteria page includes any ranges specified and each Category/Record selection made for the report. This check box is NOT selected by default.

Note: Multi-Company—WinTeam looks to the Job's Company logo to determine which Company logo to use on the Work Ticket Report and Work Tickets.

Select the Include Logo on Report check box to print the company logo on the report. This check box is selected or cleared by default, based on the option selected in SYS:Defaults. However, you can modify the setting on each report.

Click the Preview button (or use the shortcut key, ALT + V) to view before printing.

Click (or press ALT + P) to send the report to your default printer.

Click the Export button (or press ALT + X) to export to a specified format. Reports may be exported to Adobe Acrobat (PDF), Excel, Comma-Separated Values(CSV), Grid View, and E-mail (for premise-based clients only).