Overview

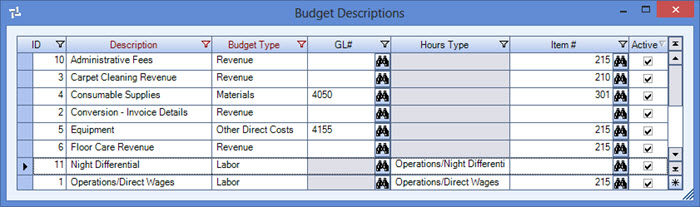

Budget Descriptions define the expense GL # to use when posting line items.

The Budget Descriptions can be accessed from the WS: Ticket Details screen Budget, Billing, and Profit tab by double-clicking the Budget Description cell in either the Ticket Budgets or Ticket Actuals grids.

Key Functionality

WinTeam automatically assigns an ID to each new record, and uses the ID field to identify each record. You may change system-assigned ID Numbers.

Use this field to enter a unique name for the record. After a new record is created, WinTeam displays this Description with the corresponding ID number in the Add/Edit list.

Select the Budget Type to tie to the Description.

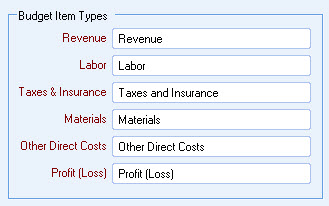

The Budget Type labels display in the fixed list and the labels are created on the WS: Defaults screen.

The Budget Item Types are a fixed list of items that can be tied to a Budget Description:

- Revenue

- Labor

- Taxes and Insurance (only available for Actuals grids)

- Materials

- Other Direct Costs

If the Budget Type is Revenue, the system will look first to the GL# field. If a GL Number is not found, the system will then look at the Item #. The Item # belongs to an Item Category which is linked to an income account.

If a Budget Type is Labor, the expense GL# always comes form the Hours Type record (Wages/Salary).

The GL # field be dimmed, meaning you cannot enter a GL# directly in this field.

If the Labor Description is marked to Include In Revenue, then we will look at the Item # that is stored with this budget description and grab the Income account’s GL number. If none is filled in (since it isn’t required) we of course will not be able to include it as revenue.

If the Budget Type is Materials, the system will use the GL number entered for the expense side. If line items of this type are marked to Include in Revenue, we will use the Item Number to find the Income account (that could be some sort of an offset account they set up) that they want to credit.

If the Budget Type is Other Direct Costs, the system will acquire the GL Number from the system will use the GL number entered for the expense side. If line items of this type are marked to Include in Revenue, we will use the Item Number that is attached to this Budget Description to find the Income Account (that could be some sort of an offset account they set up) that they want to credit.

The GL # field is required for all Budget Types except Revenue and Labor since their associated GL # is pulled from other sources. Enter the GL, or use the Lookup, to locate the Expense GL #.

This field is required if the Budget Type is Labor. Enter the Hours Type record from which you want to acquire the Wages/Salary GL # .

The Item # is required if the Budget Type is Revenue. The Item # must be selected to update Job Cost and also marked as billable.

Select this check box to make the selected record active. Clear the check box to make the record inactive.

Related Information