Job Master File - Validating Taxes

Overview

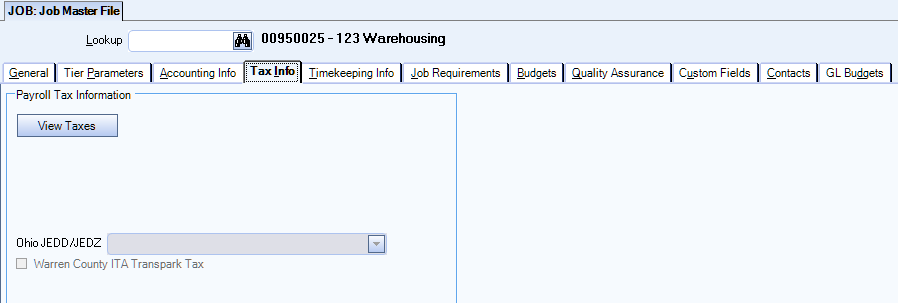

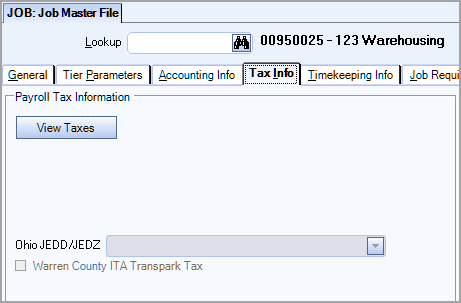

When the updated payroll tax engine is turned on, the Tax Info tab on the Job Master File displays additional fields. You need to use the button to review the taxes for your jobs.

Note: City and County are not used—the State on the Payroll Address is used in place of the Payroll State field for reporting purposes.

Key Functionality

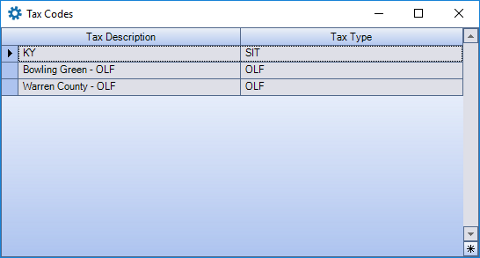

The button is used to see which taxes may be used in payroll processing calculations. When you click this button, a grid displays with the payroll tax codes for that job.

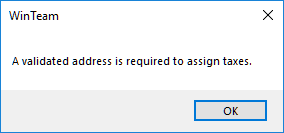

If that address has not been validated a message box displays, stating the record needs a validated address to assign taxes.

- Click to close the message box.

- Open the Payroll Address Validation window.

- Click the Jobs option in the Address Type section.

- Click the button on the Tier Template and choose the Jobs Tier.

- Change the Filter drop down to Create and type in the Job Number field.

- Click the button and the job displays on either the Pending Address Changes tab or the Invalid Addresses tab. See the Address Validation page for information on how to validate the address.

- After the address has been validated, click the button on the Job Master File, Tax Info tab to verify the appropriate taxes for the job.

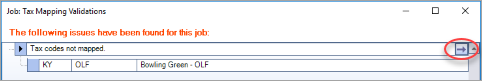

If any of the tax codes (for this job) are not mapped, the Tax Mapping Validations window displays. If this happens you need to map the tax in the Tax Mapping window.

Click the arrow drill-down to open the Tax Mapping window. See the Tax Mapping page for information on how to map the tax.

Once you have mapped the appropriate tax/es, return to the Job Master File and click the button again.

The Ohio JEDD/JEDZ drop down is an employee paid tax for the state of Ohio. Only the taxes mapped display in the drop down. These need to manually be assigned to the appropriate jobs, as there is no address/location code verification on these taxes. Employees can be exempt from a JEDD/JEDZ by not assigning it to the Job Master File (for the jobs they work). However, there is no way to make a specific employee exempt.

Selecting the Warren County ITA Transpark Tax check box assigns the Warren County ITA Transpark Tax to the job. This need to manually be assigned to the appropriate jobs, and only valid if the address/location code is in Warren County.

The following taxes are based on the job work location. For some taxes the employee has to both live and work in the area for the specific tax to calculate.

Note: The following list may not be complete. Check with the appropriate state for their regulations/rules.

State Income Tax

Based on both residence and work location.

City Taxes

The following city taxes are based on where the employee works.

- Yonkers, NY

- Ohio - JEDD/JEDZ

- PA – LST and EIT (determined by both resident and non-resident)

- CO

- AL

- WV City Service Fee

- Michigan (both resident and non-resident)

Percent of Payroll (POP) Taxes

The POP taxes are paid by the employer. TEAM gathers the subject wages. Clients need to calculate the actual tax due based on the state and their rules. This tax only applies to the following states:

- NY - MCTMT – Employer metropolitan community transportation mobility tax

- MO - St. Louis Payroll Expense

- PA - Pittsburgh Payroll Tax

- NJ - Newark Payroll Expense Tax (POP)

Note: There are a few other percent of payroll taxes that we do not currently support (I.e. San Francisco Payroll Tax).

Local Taxes

- AL – city/county/OLF

- CO – city/EHT

- DE – city - also resident

- IN – county - also resident

- KY – OLF/OLTS/MHT/TIF

- MD – county - also resident

- MI – city - also resident

- MO – city - also resident

- NJ – city - Jersey City only

- OH – city - also resident

- OR – transit

- PA – city - Philadelphia only - also resident and EIT/LST.

Note: An employee cannot be exempt from EIT.

- WV – city - service fee

Once the updated tax engine is turned on, the State, County and City fields (on the Tax Info tab of the Job Master File) are no longer used.

As you are working through assigning and validating taxes the following information is helpful to verify if the tax should be on the Employee Master File or Job Master File.

Is the tax a resident based tax (where employee lives)?

- Taxes are assigned on the Employee Master File

- Tax mapping validation is performed on the Employee Master File

- Based on the Tax Type, the employee may or may not be marked as exempt

Is the tax based on where the employee works?

- Taxes are displayed in the Tax Codes window when the button is clicked on the Job Master File

- Tax mapping validation is performed on the Job Master File or the Job Taxes Validation window

- An employee cannot be marked as exempt