Accruing Labor Based on Personnel Scheduling

Labor can be accrued based on Timekeeping, Budgets, posted Payroll Batches, and Personnel Scheduling. For information on Labor Accrual based on Timekeeping, Budgets, or Payroll Batches see Accruing Labor.

This option should be used in conjunction with the Timekeeping option to get a full accrual.

This option allows you to base the labor accrual on Personnel Scheduling. WinTeam uses the hours in the Schedule to calculate. This type is beneficial when you want to complete your labor accrual prior to running the Personnel Scheduling Wizard. When using this method, the overtime is calculated using the entire pay week and then accrual is only for the date range entered.

Also, this type is beneficial if you outsource payroll and import an adjusting journal entry to log the transactions in WinTeam.

For the Personnel Scheduling accrual type:

Employee vacation, holiday, sick and overtime hours are only included if they are recorded in the schedule.

Overtime is calculated using the entire pay week and the accrual is only for the date range entered.

Salary employees' hours display on the Labor Distribution Journal but not the dollars.

All Other Compensations/Deductions, and taxes are not included.

Run a timekeeping labor accrual for everything that already exists in Timekeeping, but has not been updated from Personnel Scheduling. You also want to catch adjustment records, PTO, or any other type of timekeeping records that have not been updated. Also, you can process labor accruals for salaried employees.

Next, run a separate accrual using the method of Personnel Scheduling. This is run this through the same PS Wizard (Compute Schedules) logic to split shifts and get pay rates.

Next, WinTeam processes overtime through the Overtime Engine.

From this point forward, the logic inside the labor accrual is the same as if it came from timekeeping, except that we only include the records that came from Personnel Schedules. This creates a Payroll batch with all of the summarized data needed to create and post the accrual.

For detailed steps on this type see Accruing Labor based on Personnel Scheduling.

To create labor accruals based on Schedules

- Verify that the correct GL Numbers are set up in SYS:Company Setup for Accrued Wages and Taxes.

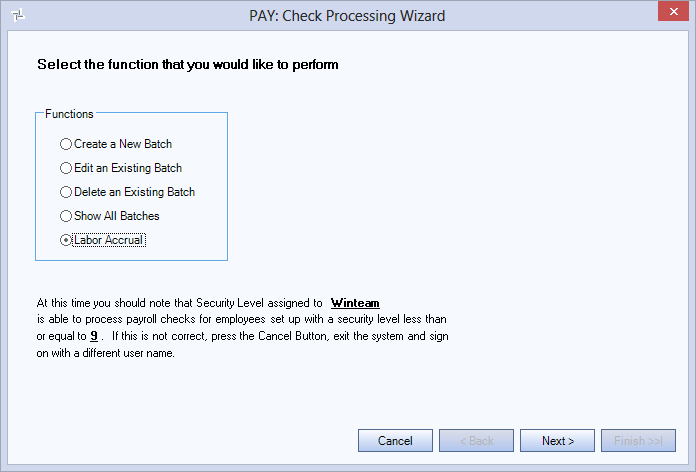

- From the Payroll menu, click Check Processing Wizard.

- Select Labor Accrual, and then click Next. The screen displays the current logon name and the security level assigned to the user. The user may process payroll for those employees who have a security level equal or less than the level displayed. Click Next.

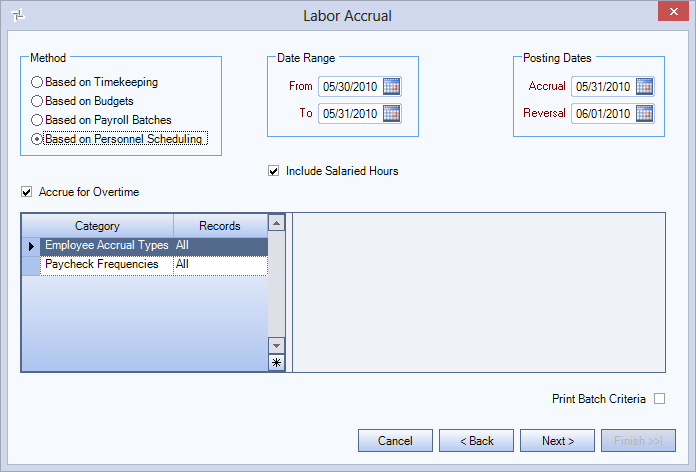

- Under Method, select Based on Personnel Scheduling.

- Select the Print Batch Criteriacheck box to print the batch criteria as soon as the labor accrual batch is done processing.

- Click Next.

- Select Jobs, if applicable, and then click Next.

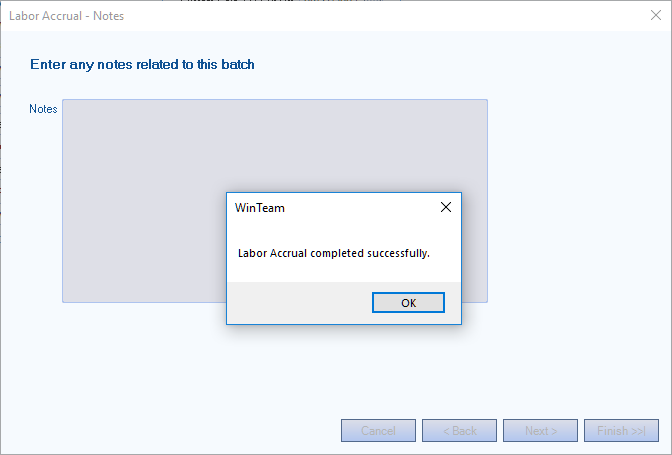

- Enter any Notes relevant to this batch, and then click Finish.

- Once the batch is done processing, and if you selected the Print Batch Criteria check box, the Check Processing Wizard Criteria displays in Preview mode. At this point you can print the criteria page and/or close the preview.

- A message displays that the accrual is successful, and the record has been created.

- Click OK.

- To view your Labor Accrual batch results use the Update to GL process to Preview and Update your Labor Distribution Journal.

Note: If an employee has a combination of both hourly and salary Pay Types for the same accrual date range, the system uses the type listed on the last day of the accrual period as the Pay Type for the calculation.

Security

For a labor accrual based on personnel scheduling, the system uses the Basic Read Security level to identify which employees to include.