The Prorate Salary Calculator calculates salary for a partial pay period based on the days the employee is active during the pay period.

WinTeam calculates the prorated salary based on this formula:

Regular salary X (# of days worked / work days in the period)

The calendars can be used to assist in counting the number of days in the pay period and the number of days worked by the employee. Alternating colors are used to show the different pay periods (based on the Frequency of pay).

On a 'New Hire' the Pay Frequency defaults to what is indicated in PAY: Defaults. Once the Employee record is saved, the calendar will change to be based on the Employee’s Pay Frequency.

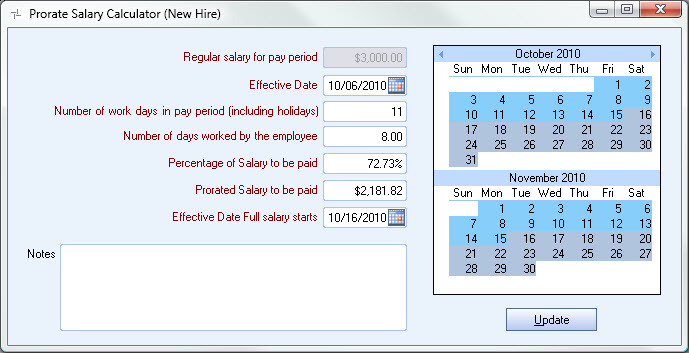

Using the Prorated Salary Calculator for New Hires

Use this procedure when an employee starts employment on a day other than the 1st day of the pay period.

- On a new Employee Master File record, click the Pay Info tab.

- Select Salaried for Pay Type.

- Enter the normal Salaried Pay Rate.

- Click Prorate Salary.

- The Prorate Salary Calculator (New Hire) displays. Since you are not on an existing employee record, then the system assumes this is a New Hire.

- The Regular salary for pay period displays the current pay rate that was entered on the Pay Info tab. It cannot be modified from here.

- The Effective date is populated with the current date. You can modify to enter the Effective Date when the partial pay starts.

- WinTeam calculates the Number of work days in the pay period based on the Frequency. However, you can modify if necessary.

- WinTeam calculates a percentage based on the current date plus the remaining working days in the pay period.

# of days worked / work days in the period = 8 / 11 = 72.73%. You can modify this field. - The system then uses the percentage of salary to be paid times the salary amount to result in the Partial Salary to be paid. The Partial Salary to be paid can be modified.

- Enter the Effective Date Full salary starts. WinTeam defaults to the first day in the next pay period. You can modify this field.

- Once you click Update, the system records the information in the Pay Info History grid.

- For New Hires there will be two lines added to the Pay Info History grid; one for the prorated salary and the second for when the Full Salary goes into effect.

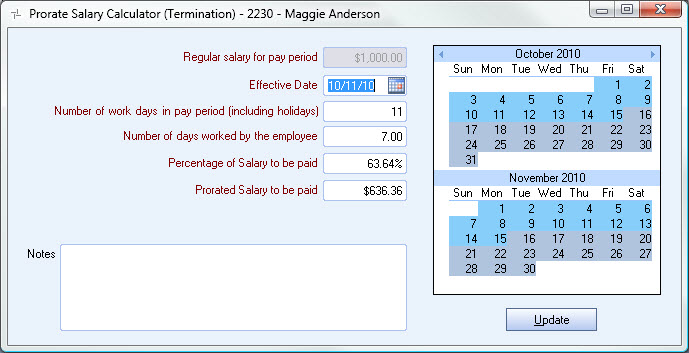

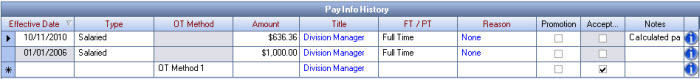

Using the Prorated Salary Calculator for Terminations

Use this procedure when an employee terminates employment on any day other than the last day of a pay period.

- On an existing Employee Master File record whose Pay Type is Salaried, click the Status Info tab.

- Enter an effective Date and change the status to Inactive.

- Click the Pay Info tab, then click Prorate Salary.

- The Prorate Salary Calculator (Termination) displays. Since you are on an existing employee record, and the current Status in Inactive, then the system assumes this is a Termination.

- The Regular salary for pay period displays the current pay rate that was entered on the Pay Info tab. It cannot be modified from here.

- The Effective Date is populated from the effective date of the Inactive Status in the Pay Info History grid. You can modify this.

- WinTeam calculates the Number of work days in the pay period based on the Frequency. However, you can modify if necessary.

- The Number of days worked by the employee includes the Effective Date. It can be modified.

- WinTeam calculates a percentage of salary to be paid by dividing the number of days worked by the number of work days in the pay period.

- The system then uses the percentage of salary to be paid times the salary amount to result in the Partial Salary to be paid. The Partial Salary to be paid can be modified.

- Once you click Update, the system records the information in the Pay Info History grid.

- For terminations only one line is added to the Pay Info History grid.

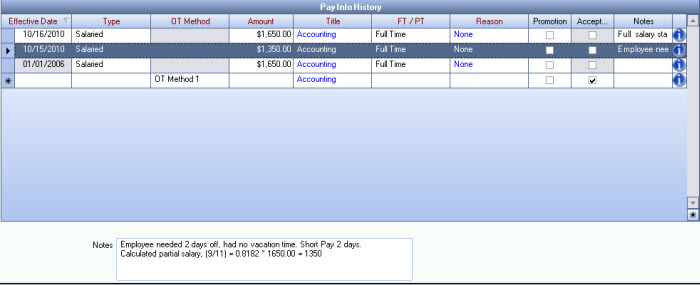

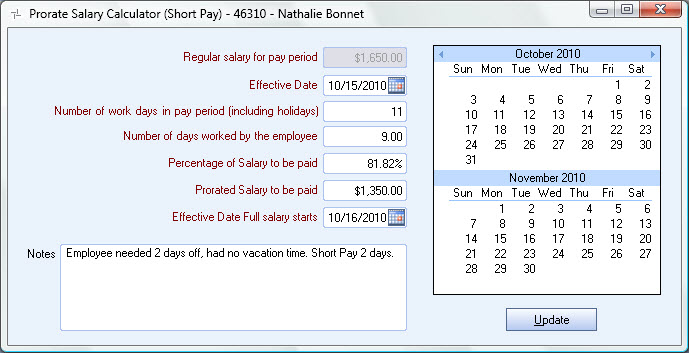

Using the Prorated Salary Calculator for Short Pay

Use this procedure when an employee is absent without pay during the pay period.

- On an existing Employee Master File record whose Pay Type is Salaried, click the Pay Info tab.

- Click the Prorate Salary button.

- Enter the Effective Date. In this example, I used the last day of the pay period.

- Enter the Number of work days in the pay period.

- Enter the Number of days worked by the employee.

- WinTeam calculates a percentage of salary to be paid by dividing the number of days worked by the number of work days in the pay period.

- The system then uses the percentage of salary to be paid times the salary amount to result in the Partial Salary to be paid. The Partial Salary to be paid can be modified.

- Once you click Update, the system records the information in the Pay Info History grid.

- Also, notice that the System Generated Notes are appended to the notes entered in the Prorate Salary Calculator screen.

For Short Pay, two lines are added to the grid; one for the Short Pay and one to resume full salary.