Administrative Fees (Admin Fees) are costs associated with processing an income withholding order.

Employers may charge the employee an administrative fee for processing the wage withholding order each pay period. The maximum amount is set by state law, and the fee must be withheld from the employee’s other wages, not the child support payment. However, the total of the child support payment and the administrative fee cannot exceed the maximum for child support withholding set by the CCPA (or a lower maximum set by state law).

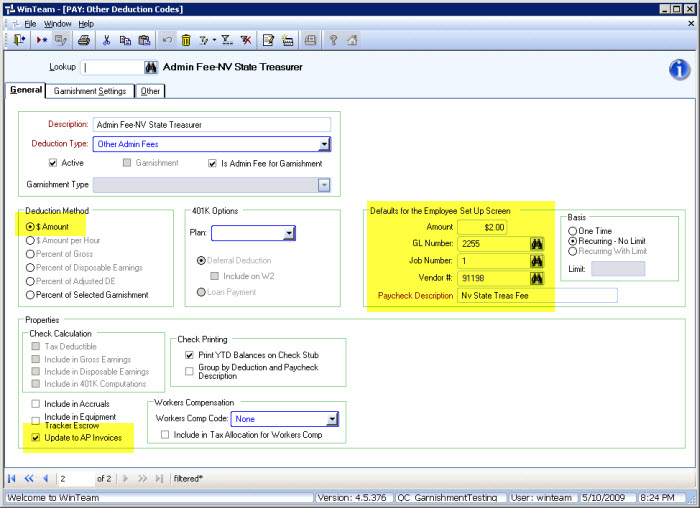

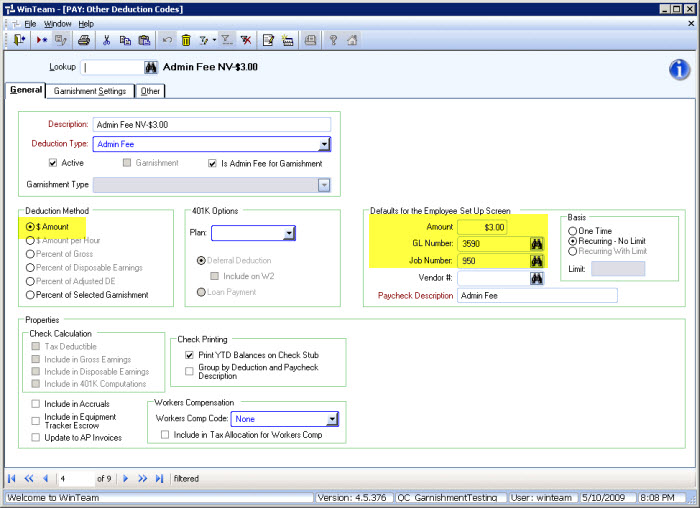

Administrative Fees are set up in WinTeam as an Other Deduction Code. Admin Fees can be a set $ amount or a % of the garnishment.

- From the Payroll Main Menu (or Payroll menu tree), click Other Deductions.

- Enter a unique Description for the Administrative Fee.

- Type or select a Deduction Type.

- Select the Is Admin Fee for Garnishment check box to associate an administrative fee for a specific garnishment.

- If the Is Admin Fee for Garnishment check box is selected, the Deduction Method must be either a $ Amount of a Percent of Selected Garnishments.

- Enter the Amount (if the Deduction Method is $ Amount) or Percent (if the Deducted Method is % of Selected Garnishment).

- Enter the GL Number and Job Number.

- Enter or select a default Vendor # for the system to use when pulling this Other Deduction Code into the Employee Master File, Other Compensations and Deductions (Other Deductions tab) screen, or use the Lookup Vendors window to locate the vendor number.

- Review the Paycheck Description that will print on employee paychecks. The Description field defaults to this field; however, you may modify it.

- Save the record.

Note: Only Other Deductions Codes with the Update to AP Invoices option selected, allow a Vendor # to be entered (or defaulted) to the Employee Master File, Other Compensations and Deductions screen. If defaulted, the Vendor Number displays in the footer section of the Other Deductions tab.

Dollar Amount Administrative Fee Retained by Employer

If you, the employer, are going to keep the fee, then you would not select the Update to AP Invoices check box, and you would not add a Vendor #.

Dollar Amount Administrative Fee Paid to a Third Party

If the fee is not going to you, the employer, then select the Update to AP Invoices check box, and enter a Vendor # of the agency or court the payment will be remitted to.