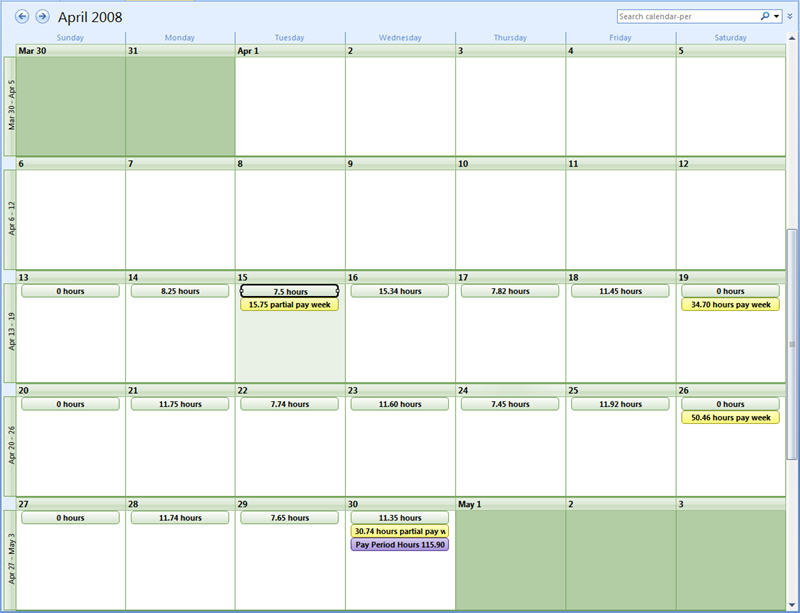

In this scenario we will assume that the Pay Week for Overtime Calculations is Sunday and the OT Method is set to 1. These are set up in PAY: Defaults. OT Method 1 calculates any hours worked over 40 in a pay week will be paid at time and 1/2 for all employees. We will look at a payroll for 04/16/08 through 04/30/08.

An hourly employee has the following hours for this pay period:

1st week

Wed April 16 – 15.34 hours

Thur April 17 – 7.82 hours

Fri April 18 – 11.54 hours

Sat April 19 – 0 hours

Total Hours – 34.70

2nd Week

Sun April 20 – 0 hours

Mon April 21 – 11.75 hours

Tue April 22 – 7.74 hours

Wed April 23 – 11.60 hours

Thur April 24 – 7.45 hours

Fri April 25 - 11.92 hours

Sat April 26 – 0 hours

Total hours – 50.46

3rd Week

Sun April 27 – 0 hours

Mon April 28 – 11.74 hours

Tues April 29 – 7.65 hours

Wed April 30 – 11.35 hours

Total Hours - 30.74

Total hours 115.90

In order to calculate the OT for the 1st week we need to look at the entire pay week.

Sun April 13 – 0 hours

Mon April 14 – 8.25 hours

Tues April 15 – 7.50

Total Hours – 15.75

1st week

15.75 (hours from the previous pay period) + 34.70 current pay period = 50.45 total hours

50.45 total hours minus 40.00 reg hours = 10.45 Overtime hours

2nd week

50.46 total hours minus 40.00 reg hours = 10.46 Overtime hours

3rd week

30.74 total hours (will be paid at straight time, these hours will be used to calculate OT for next payroll)

Total OT hours paid 20.91