Accruing Labor Based on Timekeeping

Labor can be accrued based on Timekeeping, Budgets, posted Payroll Batches, and Personnel Scheduling. For information on Labor Accrual based on Budgets, Timekeeping or Payroll Batches see Accruing Labor.

In order to use this accrual type effectively, you need to ensure that daily hours are entered. Meaning, all timekeeping hours for a week are not entered as a lump sum under one day, but the hours are separated by the day the hours were worked.

All types of salaried hours are not included in this type of accrual even if you select the Include Salaried Hours check box on the Labor Accrual step of the wizard. The salaried dollars are included in the Labor Distribution Journal based on the Percentage of Salary to Accrue value.

All Other Compensations/Deductions, employee/employer taxes are not included in this type of accrual.

To create labor accruals based on Timekeeping records

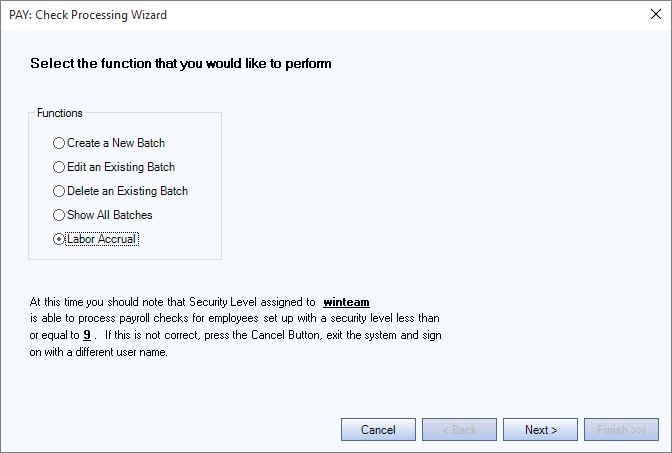

- From the Payroll menu, click Check Processing Wizard.

- Select the Labor Accrual option in the Functions group, and click the Next button.

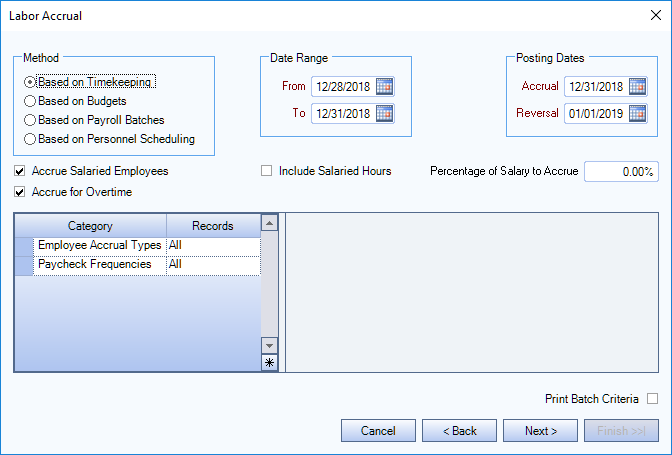

- Select the Based on Timekeeping option in the Method group.

- Enter the appropriate Date Range From and To fields.

- The Posting Dates default based on the Date Range entered. The Accrual date = To Date. The Reversal date = Accrual Date + 1 day.

- The Accrue Salaried Employees check box is selected by default. If selected, you need to enter a percentage of the salary to accrue.

- The Accrue for Overtime check box is selected by default. If selected, overtime is calculated.

- The Include Salaried Hours check box is available, but is not selected by default.

- Any employee who has hours in Timekeeping whose pay type is salaried as of the To date entered in the accrual date range (From and To dates) are picked up on the labor accrual.

- If there is no hourly Pay Rate attached to the hours, WinTeam will accrue the hours but the labor dollars will be zero for that timekeeping record.

- If there is an hourly rate stored with the timekeeping record (one was put in with the timekeeping record, either updated from PS Schedules or entered within Timekeeping), that rate will be used to calculate the labor dollars for the accrual of that timekeeping record.

- If you select the Print Batch Criteria check box the batch displays the batch criteria page in preview mode once the processing is complete. Print and/or close the preview when displayed.

- Use the Category filter to filter the records, if appropriate, and click the button.

- Use the Jobs Tier Template to filter the appropriate records, and click the button.

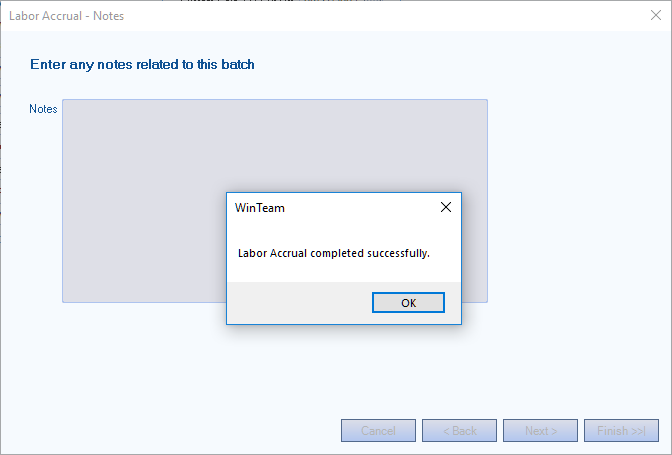

- Enter any Notes that are applicable to this accrual, and click the Finish button.

- Once the batch is finished a labor accrual completed successful message displays. Click the button.

- To view your Labor Accrual batch results use the Update to GL process to Preview and Update your Labor Distribution Journal.

Note: If an employee has a combination of both hourly and salary Pay Types for the same accrual date range, the system uses the type listed on the last day of the accrual period as the Pay Type for the calculation.

Security

For a labor accrual based on timekeeping, the system uses the Basic Read Security level to identify which employees to include.