Overview

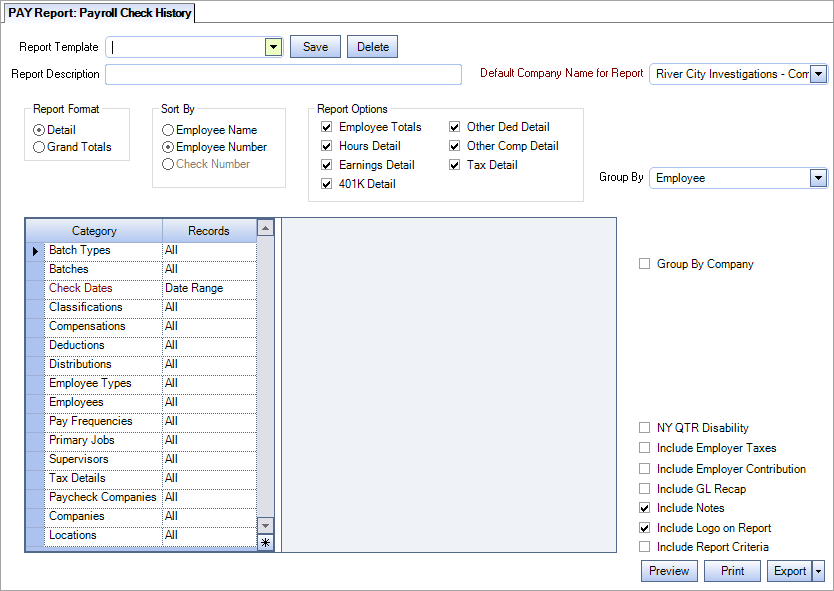

The Payroll Check History report is used to view and print paycheck information for selected employees. The report lists each paycheck issued with a breakdown of hours, earnings and deductions.

Note: This report does not include any Tax Adjustments that may have been made to an employee's W-2 record.

Key Functionality

Select a report template from the list, or type a description and Save your settings to create a report template for later reuse. You may also select and Delete report templates from the list.

Use the Report Format option to select the information to display on the report.

When Detail is selected, you can select the Report Options to display.

When Grand Totals to is selected, the report includes only grand totals.

The Report Options are available when the Report Format is Detail.

All options are selected by default, however you can choose to include any of the following options: Employee Totals, Hours Detail, Earnings Detail, 401K Detail, Other Ded Detail, Other Comp Detail, and Tax Details.

If you clear the Other Ded Detail, Other Comp Detail, or Tax Details check boxes, they will not display in the report.

Select one of the Group By options to group the information in the report. The default grouping selection is Employee. The Show Count check box displays when you select any group by option other than Employee. Select this check box to see a total count for each grouping.

Use the Sort By option to sort report data by Employee Name, Employee Number, or Check Number.

- Click Employee Name to sort report data by Employee Last Name

- Click Employee Number to sort report data by Employee Number

- Click Check Number to sort report data by Check Number. This option is not available when Grouping By Employee.

Batches

Use the Batches category to filter the report by Batches,

Select All to include all Batches.

Select Pick to select the Batch(es) to include.

Note: If the Show report Criteria check box is selected and you use the Pick to select just ONE batch, the batch criteria is included on a separate page. If you select more than 1 batch or do not select the Show Report Criteria check box, the batch criteria is not included in the report.

Batch Types

Use the Batch Types category to filter the report by Batch Types.

Select All to include all Batch Types.

Select Pick to select the Batch Type(s)to include.

Check Dates

Select the Check Dates to include checks based on the Check Dates.

Select All to include all Check Dates.

Select Range to define a range of Check Dates to include. When you select Range, the range fields display. Type the beginning Check Date in the From field and the ending Check Date in the To field.

Classifications

Use the Classifications category to select the Classifications to include on the report.

Select All to include all Classifications.

Select Pick to define specific Classifications for the report. When you select Pick, the Classifications list displays. Select the check box next to each Classification to include on the report.

Compensation Codes

Use the Compensation Codes category to select the Compensation Codes to include on the report.

Select All to include all Compensations.

Select Pick to define specific Compensations Codes for the report. When you select Pick From List, the Compensation Codes list displays. Select the check box next to each Compensation Code to include on the report.

This Category is not available for the Grand Totals Report Format.

Deduction Codes

Use the Deduction Codes category to select the Deduction Codes to include on the report.

Select All to include all Deduction Codes.

Select Pick to define specific Deduction Codes for the report. When you select Pick From List, the Deduction Codes list displays. Select the check box next to each Deduction Code to include on the report.

This Category is not available for the Grand Totals Report Format.

Distributions

Use the Distributions category to select the Distribution to include.

Select All to include all Distribution types.

Select Pick to define specific Distribution to include. When you select Pick, the Check Distributions add edit list displays. Select the check box next to each Check Distribution to include.

Employee Types

Use the Employee Types category to select the Employee Types to include.

Select All to include all Employee Types.

Select Pick to define specific Employee Types. When you select Pick, the Employee Types list displays. Select the check box next to each Employee Type to include.

Employees

Use the Employees category to select the Employees to include on the report.

Select All to include all Employees on the report.

Select Range to define a range of Employees for the report. Type the beginning Employee Number in the From field and the ending Employee Number in the To field.

Select Create to define your own list of Employees. When you select Create, a small grid displays to the right. Enter the Employee Numbers you want to include in the list, or use the Lookup to locate the Employee Numbers.

Select Exclude to identify records that should not be included. When you select Exclude, a small grid displays to the right. Enter the Employee Numbers you want to exclude in the list, or use the Lookup to locate the Employee Numbers.

Primary Jobs

Use Primary Jobs to filter the report by Primary Jobs.

Select All to include all Primary Jobs.

Select Range to define a range of Primary Jobs for the report. When you select Range, the range fields display. Type the beginning Primary Job Number in the From field and the ending Primary Job Number in the To field.

Select Pick to select the Primary Job(s) to include.

Select Create to define your own list of records. When you select Create, a small grid displays to the right. Enter the records you want to include in the list, or use the Lookup to locate the records.

Select Exclude to identify records that should not be included. When you select Exclude, a small grid displays to the right. Enter the records you want to exclude in the list, or use the Lookup to locate the records.

Pay Frequencies

Select the Pay Frequencies to include on the report.

If using the Pick from List option, the system determines the check records to include by the Employee's current Pay Frequency set up in the Employee Master File. The only exception is when running the report for Format: Report and Report Type: Detail by Check.

Note: When running the report for Format: Report and Report Type: Detail by Check and limiting the pay frequency using the Pay Frequencies category, the system will look at the pay frequency of the batch instead of the Employee's current pay frequency. All Batch Types have a Pay Frequency defined except for Void and Tax Adjustment Batches. For Void and Tax Adjustment batches, the current pay frequency of the Employee (as indicated in the Employee Master File) will determine whether the void or tax adjustment record is included.

Supervisors

Use the Supervisors category to filter the report by Supervisors.

Select All to include all Supervisors.

Select Pick to select the Supervisor(s) to include.

Tax Details

Use the Tax Details category to select the Tax Details to include on the report.

Select All to include all Tax Details.

Select Pick to define specific Tax Details for the report. When you select Pick, the Tax Details list displays. Select the check box next to each taxing authority to include on the report.

This Category is not available for the Grand Totals Report Format.

Paycheck Companies

This category is available to users who have more than one company.

Use the Paycheck Companies category to select the Paycheck Companies to include.

Select All to include all Paycheck Companies.

Select Pick to define specific Paycheck Companies. When you select Pick, the Paycheck Companies list displays. Select the check box next to each Paycheck company to include.

This Category is not available for the Grand Totals Report Format.

Companies

The Company Pick option filters for AR Invoice and Payment records. The Companies category is available for Clients using the Multi-Company feature.

Select the Companies to include on the report.

Select All to include all companies on the report.

Select Pick to define specific Companies for the report. When you select Pick, the Companies list displays. Select the check box next to each Company to include on the report.

Note: When running reports using the Company Category/Record Pick and the company name exceeds the maximum number of characters, WinTeam will truncate the name.

This Category is not available for the Grand Totals Report Format.

Locations

The Locations category is available for Clients using the Multi-Location feature.

Use the Locations category to select the Locations to include on the report.

Select All to include all Locations on the report.

Select Pick to define specific Locations for the report. When you select Pick, the Locations list displays. Select the check box next to each Location to include on the report.

This Category is not available for the Grand Totals Report Format.

The NY QTR Disability check box is used to assist New York Employees with filling out their quarterly report for NY Disability. If checked, an Earnings Limit field will display and default to 340, which is the typical weekly taxable earnings limit. You may need to change this number if you pay bi-weekly or semi monthly. For example:

Weekly = $340

Bi-Weekly = $680

Semi-Monthly = $720

The report will detail out wages by Check Date, separating Males from Females. It will provide all of the details you will need to complete your quarterly reporting.

This option is available to users who have more than one company, but is not selected by default. If selected, the default company prints on the Grand Total Page and the Report Criteria page. All other pages print the applicable company name. If not selected, the default company prints on every page of the report.

Select the Include GL Recap check box to include an Overall Recap by GL Number on the report.

The batch must have been updated to the General Ledger in order to be included in the report.

It is important to note that when running this report and selecting to include GL Recap, the data displays by batch. So even if the report was ran for only one employee, the repot displays the recap for all employees for that month.

Select the Include Employer Taxes to include the Employer portion of taxes on the report.

This field is not selected by default.

If it is selected, the Taxes breakdown in the Grand Total will include FICA ER and Med ER tax amounts.

Select the Include Employer Contribution check box to include the amount the employer contributed to this deduction on the report. This amount displays when the Other Deduction Code is setup with an Employer Contribution.

This field is not selected by default.

Select the Include Notes check box to print any Notes that exist within an individual check record.

This option is selected by default.

Select the Include Logo on Report check box to print the company logo on the report.

This check box is selected or cleared by default based on the option selected in SYS:Defaults. However, you can modify the setting on each report.

Select the Include Report Criteria check box to include a list of the report options selected for this report.

The Report Criteria page includes any ranges specified and each Category/Record selection made for the report.This check box is NOT selected by default.

Note: If this check box is selected and you use the Pick to select just ONE batch, the batch criteria is included on a separate page. If you select more than 1 batch or do not select the Show Report Criteria check box, the batch criteria is not included in the report.

Preview

Click the Preview button (or use the shortcut key, ALT + V) to view the report before printing.

Click the Print button (or press ALT + P) to send the report to your default printer.

Export

Click the Export button (or press ALT + X) to export the report to a specified format. Reports may be exported to Adobe Acrobat (PDF), Excel, Comma-Separated Values (CSV), Grid View and E-mail (available for premise-based clients only).

The following fields are available in the grid view export of the report to help in reporting the overtime wages and the number of employees with overtime wages for the state of Alabama:

- ALOvertimeEarnings – The total overtime wages earned by each employee on the current check. This includes overtime wages earned in Alabama (both residents and non-residents) or overtime wages earned in Alabama AND any non-SIT states where the employee worked (Alabama residents only). For example, if an Alabama resident works overtime in Tennessee (a state that does not withhold taxes), the overtime wages in Tennessee are also reported and excluded from the Alabama state income tax calculation.

- HasALOvertimeEarnings – This field is set to 1 for each employee who has overtime wages in Alabama or a non-SIT work location (AL resident only). After this field has been set to 1 for an employee, it is not set again for the same employee within the same date range. This allows the column to be totaled and the correct number of employees reported for the selected date range.

Security

The system includes only those records where the logged in user has a Paycheck Read Security level equal or greater than the employee security level.

The PAY Report Payroll Check History screen has its own Security Group, PAY Report Payroll Check History.

The PAY Report Payroll Check History is part of the PAY Reports All Employees Security Group.