Overview

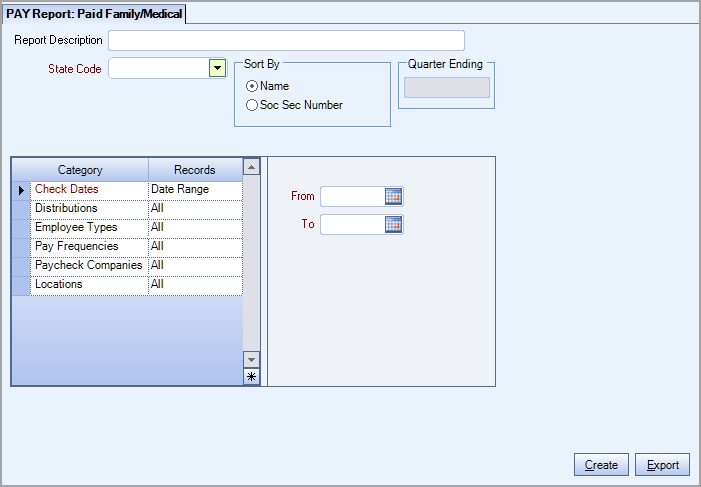

The Paid Family/Medical report is accessed from Payroll Reports. Use it to gather details about paid family and medical leave benefits that are paid to employees.

- Annual = 2080

- Monthly = 173

- Semi-Monthly = 87

- Bi-Weekly = 80

- Weekly = 40

- Daily = 8

Note: There is a difference in the Family Leave and Medical Leave total amounts between the Paid Family/Medical (PFM) and Employee W-2 reports because the PFM report contains both the employee and employer amounts combined, and the W-2 report contains only the employee amount.

Key Functionality

Type a description to name the report. This description prints above the Report Title.

Use the State Code drop-down list to select a state that has a paid family/medical leave tax.

Note: The Special Reporting Tax Type (set in PAY Defaults) must be FLI, PFL, PML or PFML to be included

Use the Sort By option to sort the report data by Employee Name or Social Security Number. The default selection is to sort by Employee Name.

The Quarter Ending field defaults to the To date entered in the Check Dates category. The system does not validate that the To date is the last day of a quarter.

Check Dates

Select the Check Dates to include checks based on the Check Dates.

Select All to include all Check Dates.

Select Range to define a range of Check Dates to include. When you select Range, the range fields display. Type the beginning Check Date in the From field and the ending Check Date in the To field.

Distributions

Use the Distribution Types category to select the Distribution Types to include.

Select All to include all Distribution types.

Select Pick to define specific Distribution Types to include. When you select Pick, the Distribution Type list displays. Select the check box next to each Distribution Type to include.

Employee Types

Use the Employee Types category to select the Employee Types to include.

Select All to include all Employee Types.

Select Pick to define specific Employee Types. When you select Pick, the Employee Types list displays. Select the check box next to each Employee Type to include.

Pay Frequencies

Select the Pay Frequencies to include on the report.

Paycheck Companies

This category is available to users who have more than one company.

Use the Paycheck Companies category to select the Paycheck Companies to include.

Select All to include all Paycheck Companies.

Select Pick to define specific Paycheck Companies. When you select Pick, the Paycheck Companies list displays. Select the check box next to each Paycheck company to include.

Locations

The Locations category is available for Clients using the Multi-Location feature.

Use the Locations category to select the Locations to include on the report.

Select All to include all Locations on the report.

Select Pick to define specific Locations for the report. When you select Pick, the Locations list displays. Select the check box next to each Location to include on the report.

Create

The Create button is available when you are running the report for Colorado (CO), Massachusetts (MA), or Washington (WA). Use this option to generate an electronic file for submission.

Export

Click the Export button to open the standard grid view.

Important: Only use a text editor (such as Notepad) to open a .csv file so the formatting of the date fields remains unchanged. Do not open it in Excel because this can cause the date format to be changed which will cause the file upload to fail.

Security

The PAY Report Paid Family/Medical screen is under the PAY ALL security group. For more information see Security Groups.