Warning: This explanation is meant to provide general clarification on FUTA/SUTA subject wages and how they are handled in WinTeam. You should consult a professional tax advisor or each state agency for guidance and specific questions.

Generally, all wages paid to an Employee are reportable for Federal and State Unemployment Insurance (FUTA and SUTA) in order for applicable taxes to be paid. However, certain types of deductions may have a special treatment for tax purposes. For example, Section 125/Cafeteria deductions can be excluded for FUTA. The amount reportable is considered the subject wage. These subject wages are reported on the Employee W-2 Report and the Unemployment Compensation Report as Gross Earnings and Gross Wages respectively.

Note: States do not consistently follow federal unemployment tax rules. More information can be found on the individual state website or the IRS website.

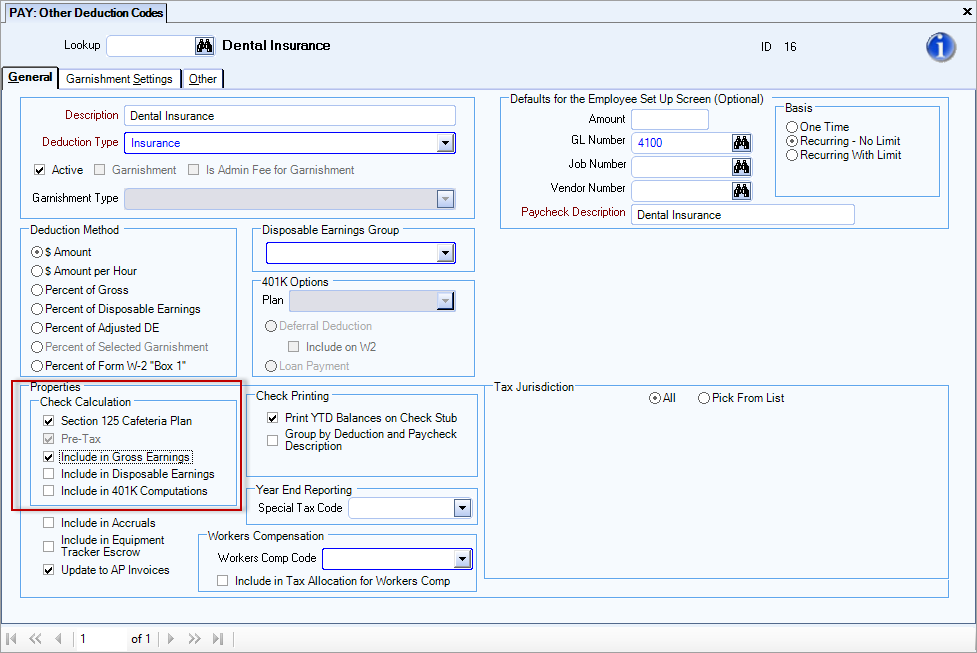

In order to get accurate subject wage numbers, WinTeam has built-in functionality which will impact you only if you are using the Include in Gross Earnings check box for Pre-Tax (Tax Deductible) deductions on the PAY: Other Deduction Codes screen.

For most government types, when Include in Gross Earnings is selected, all Pre-Tax deductions will be included in the Gross Wages/Earnings column on the Employee W-2 and UC reports as a way to see a "true" Gross Wages/Earnings number. However, this would cause a discrepancy between the Gross Wages/Earnings and the Taxable Wages/Earnings for FUTA and SUTA which could get flagged when it is reported for taxes. To handle this, WinTeam will exclude Pre-Tax deductions for FUTA and SUTA in the Gross Wages/Earnings columns even when the Include in Gross Earnings check box is selected. Other government types are not affected by this.

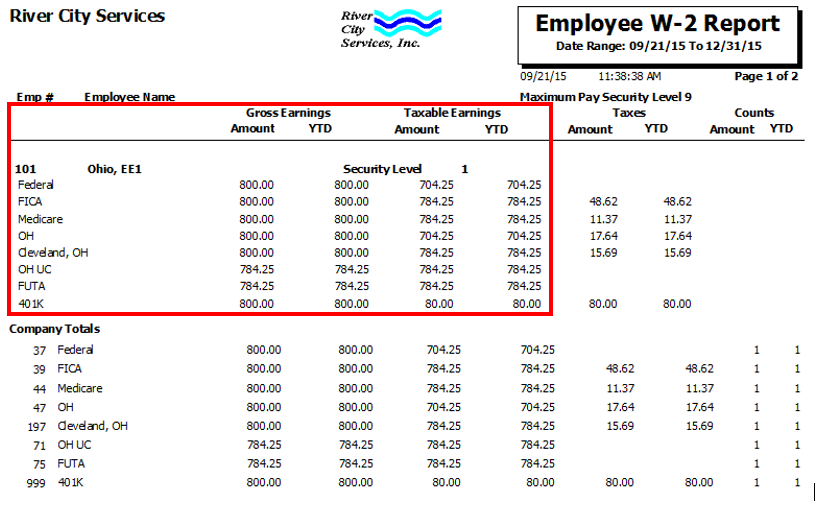

Example: This Employee had Gross Earnings of $800 with a $15.75 Pre-Tax dental deduction. The Employee W-2 Report now displays the OH UC and FUTA Gross Earnings as $784.25. The other Tax Jurisdictions still display Gross Earnings as $800.