Shared Tax Types for Payroll Tax Automation

Overview

There are two types of shared taxes and each require a different setup.

If an original WinTeam tax has a shared calculation method, you may need to map the original WinTeam tax to two tax codes; one for the employer tax and the other for the employee tax portion. If both tax codes are the same tax type, they can be mapped to the same tax.

If both taxes codes are not the same tax type this requires setting up additional taxes in the Payroll Taxes window. The original tax in WinTeam should no longer be used. Instead, create two new WinTeam taxes, one for the employer and one for the employee portion. Both taxes then need to be mapped to the appropriate updated payroll tax engine tax codes.

Key Functionality

Same tax type

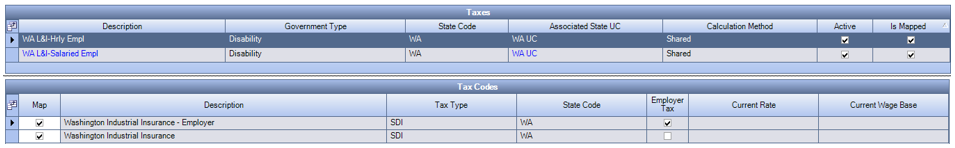

If there are two tax codes (one employer paid and the other employee paid) with the same tax type(in the updated tax engine), both of these need to be assigned to the same original WinTeam shared tax. You can continue to use the existing WinTeam tax, and no additional setup is required.

Example: WA L&I (SDI), OR WC, PR and SDI are examples of when an original WinTeam shared tax can be mapped to two tax codes (updated tax engine).

Different tax types

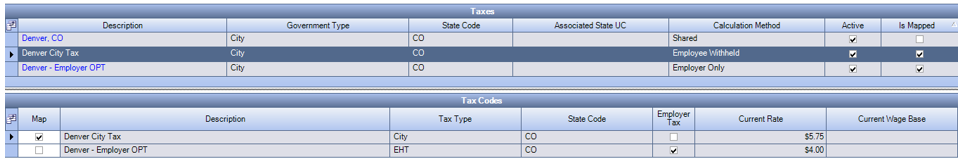

If there are two tax codes (one employer paid and the other employee paid) with different tax types (in the updated tax engine), both of these need to be setup in the Payroll Taxes window. The original WinTeam tax should not be used. Instead, add two new WinTeam taxes (one setup as employer paid and the other setup as employee paid).

You can map a single tax code from the updated tax engine to multiple WinTeam taxes. This allows you to create multiple taxes with varying rates. This only applies to SDI and FLI tax types—all states that have these types of taxes can use this feature. Previously this logic was only available for Washington L&I tax.

Important: You must set up tax codes that have both an employer (ER) and employee (EE) portion as a Shared tax in WinTeam, even if the tax is only to be paid either by the employer or employee.

Example: CO City Taxes (CITY/EHT), NM Workers Compensation (WC/EHT), and NJ Disability (SDI/SUI/FLI/WF) are examples of when the tax codes have different tax types and you need to setup new WinTeam taxes.

Note: For NJ Disability (SDI/SUI/FLI/WF) four separate WinTeam taxes need to be created (even if using a private plan and SDI is not calculated).

Note: When the taxes have different tax types, a Tax Migration batch might be required to move the employee and employer taxes from the original WinTeam tax to the updated taxes. For additional details, contact TEAM Client Services by phone at 800-500-4499 or by email at supportstaff@teamsoftware.com.

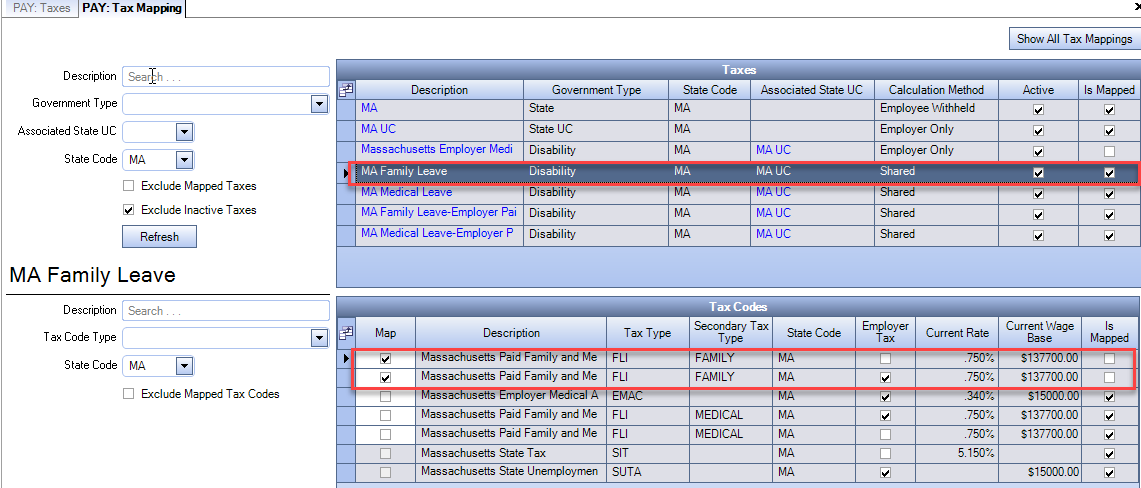

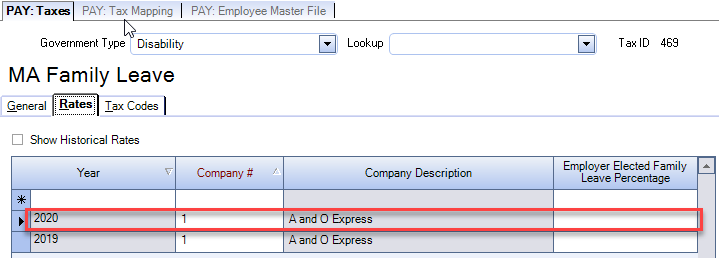

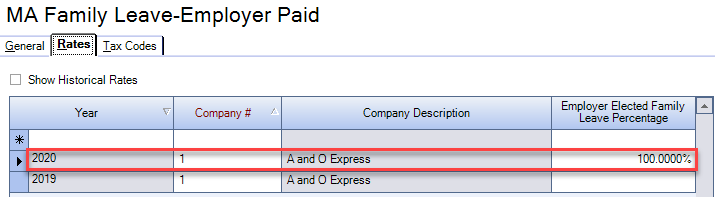

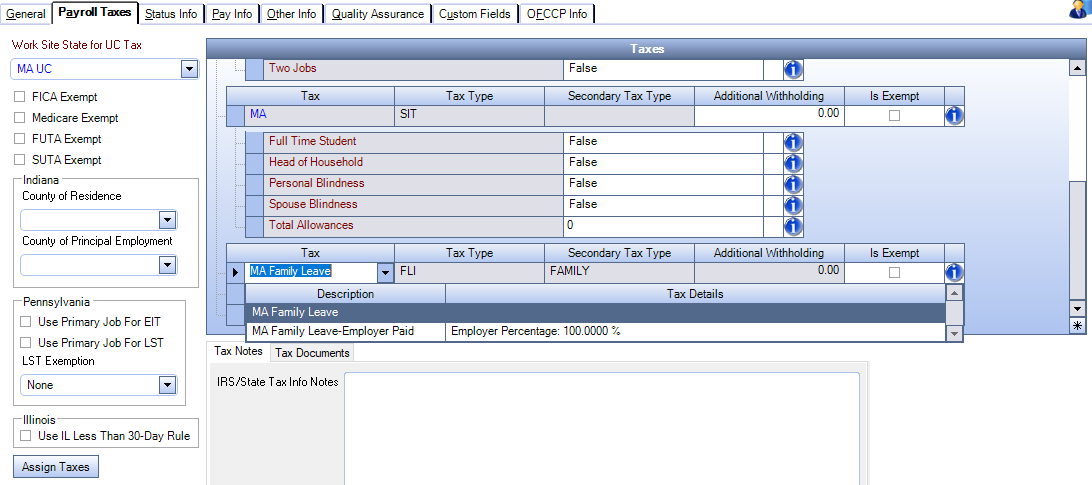

The MA Family Leave tax is assigned to both of the tax codes (employee and employer)

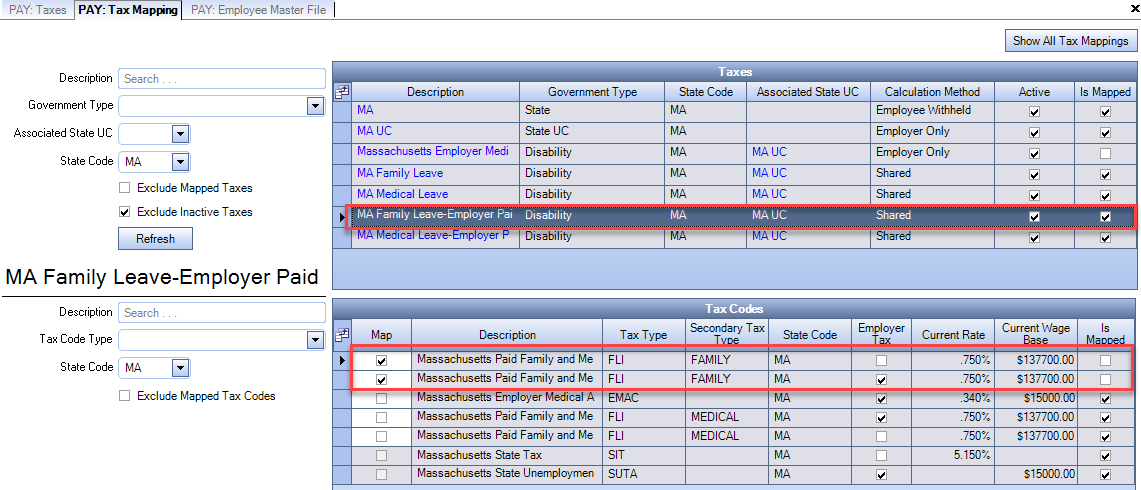

The MA Family Leave-Employer Paid is also assigned to the same tax codes (employee and employer)

The only difference between the two taxes is setup on the PAY Taxes tab

Select the appropriate tax from the drop down list.

Note: On the Tax Validation and Assignment window, if there are multiple taxes assigned to the same tax code, the employee may show under the Complete Match or Partial Match tab depending on whether or not the employee is currently assigned the same tax on the Tax Info tab as what is defaulted on the Payroll Taxes tab. If the defaulted tax is not the correct one, the employee cannot have taxes assigned though this window, and you must do that manually through the Employee Master File.