You, the employer, may have received a letter stating that you must deduct an additional tax amount from an employee's paycheck, due to outstanding amounts due to tax agencies. If an employee owes past taxes, a "levy" is placed on the employee for the back taxes due. The levy will inform you of the amount of the levy and requires the employer to deduct the amount owed (plus penalties and interest) from the employee's wages and remit it to the proper government agency. The money is levied to the extent that it is not exempt. The employer must determine:

- The amount of the employee's wages that is subject to the levy; and

- Whether there are other claims on the employee's wages that take priority over the levy.

The levy remains in effect until you receive a release of levy.

To figure the amount exempt from the levy:

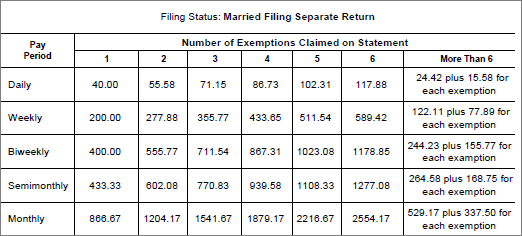

- Determine Filing Status and number of Exemptions. The amount of the employee’s standard deduction and personal exemptions is determined for the year the levy is received. If the employee does not submit a verified, written statement regarding the employee’s tax filing status and personal exemptions (Statement of Exemptions and Filing Status form), the employer must figure the exempt amount as if the employee’s filing status is married filing separately with one personal exemption. Employers cannot rely on the employee’s Form W-4 to determine the filing status and number of exemptions. The IRS issues tables for figuring the exempt amount each year as IRS Publication 1494. Publication 1494 is enclosed with each notice of levy.

- When you need to determine the employee's income that is exempt from a levy based on the applicable filing status, number of exemptions, and pay period use the current IRS Publication 1494. You can access it from http://www.irs.gov/. As an example, a section of Publication 1494, shown below, provides tables that show the amount of an individual's income that is exempt from a notice of levy used to collect delinquent tax in 2017. (Amounts are for each pay period.)

- Determine the exempt amount the taxpayer needs to pay support, established by a court or an administrative order that was ordered before the date of this levy. Tax levies must be satisfied before all other garnishment or attachment orders, except for child support withholding orders in effect before the date of the levy. For more information see Understanding Garnishment Priorities and Allocation.

- Subtract the exempt amount from "take home pay". The amount of an employee's wages that is subject to the federal tax levy is the amount remaining after the exempt amount has been subtracted from the employee's "take home pay". In WinTeam, we will use adjusted disposable earnings to calculate >"take home pay". Consult your tax advisor for the items that may be subtracted from an employee's gross pay for tax levies.

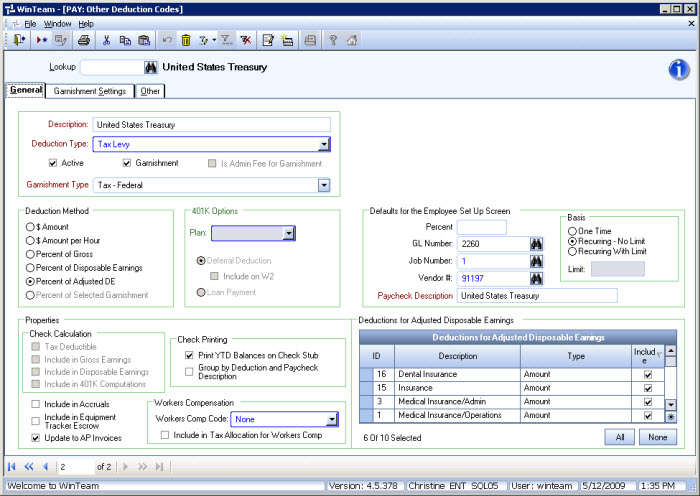

Tax Levies are set up in WinTeam as Garnishment Deduction Codes

In our example we will use Percent of Adjusted DE (Disposable Earnings) as the Deduction Method since we need to select the items that may be exempt from an employee's gross pay for tax levies. Select the check box next to each Deduction we want to exempt from the employee's pay in the Deductions for Adjusted Disposable Earnings grid.

We selected to Update to AP Invoices and entered Vendor #91197.

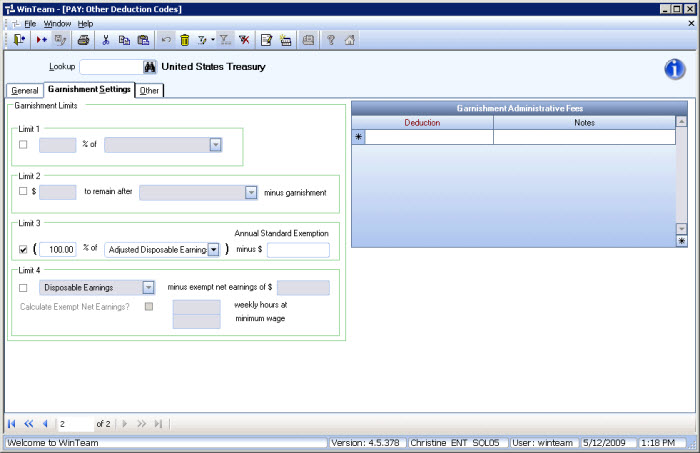

The levy limit is subject to 100% of Adjusted Disposable Earnings minus the annual standard exemption. Since the annual standard exemption is different for each employee, we will leave it blank, and include the standard exemption amount when we add the garnishment (levy) to Employee Deductions. All remaining details of the levy will be entered when the garnishment (levy) is added to Employee Deductions.

The tax levy is now ready to add to Employee Deductions.

For more information see Adding Federal Tax Levies to Employee Deductions.