If an employee is already subject to one or more withholding orders, decisions must be made establishing the priority of the order and how the available disposable earnings are allocated. You, as the employer, must decide (based on the legal documents and state laws) which withholding order should be deducted first (priorities). These priorities determine deduction amounts when several garnishment orders have been received against an employee’s wages. In general, withholding orders must be satisfied according to the following list.

Warning: Again, we caution you to contact your company's legal counsel to review the order and answer any questions regarding validity, disposable earnings determinations, complying with out-of-state orders, priorities and allocation, etc.

- Child support

- Bankruptcy order

- Federal Administrative Garnishment *

- Federal Tax Levy *

- Student Loan

- State Tax Levy

- Local Tax Levy

- Creditor Garnishment

- Employer deductions

* All deductions in place when the federal tax levy or federal administrative garnishment is received have priority over the order.

In WinTeam, priorities are set up in the Employee Other Compensations and Deductions (Deductions tab).

The Priority field is used to enter a number (whole numbers 1 - 255) to determine the order that garnishments are paid.

Priorities rank in numeric order. Priority 1 (s) are processed first by first determining the garnishment limit (Set up in the Employee Master File Garnishment Limits section). The deduction amount for Priority 1 cannot exceed its garnishment limit. Next the system moves to Priority 2, then 3 etc. The Garnishment Limits in the Employee Master File that are established with each individual garnishment are adhered to. (For example: When processing Priority 2(s) the amounts already withheld Priority 1(s) are subtracted from the limits to see what is left that can possibly be withheld of Priority 2 garnishment(s)).

- If the Priority is blank, these garnishments will be handled last in the order they were entered in WinTeam

- If the Priority number is not-unique (meaning two or more garnishments are assigned the same Priority), then you will need to assign a Priority Allocation

- Admin Fees will display directly below the parent garnishment record

- Admin Fees display with a green background

Allocation can either be prorated or distributed evenly between garnishments that have the same priority number. This is generally based on your court order/state laws.

If you change the allocation method on a record, all other records with the same Priority Level will also change.

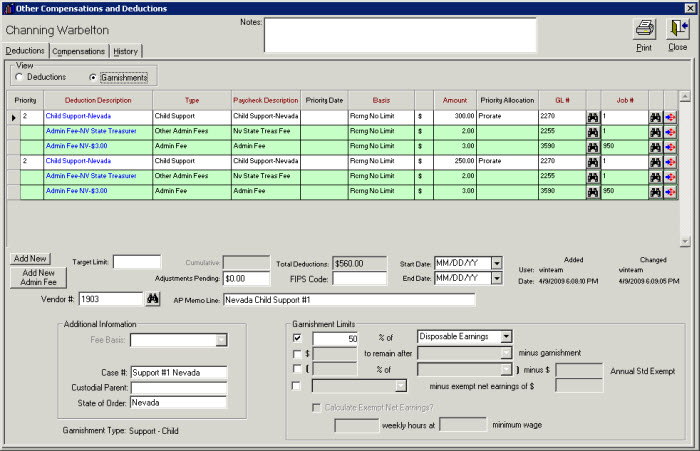

Example: EXAMPLE OF PRORATED PRIORITY ALLOCATION

The Prorated Allocation distributes the garnishments proportionally for all orders in the same priority group.

1st order divided by total orders = $300.00 / $550.00 = 54.545%

2nd order divided by total orders =$250.00 / $550.00 = 45.454%

Percentage multiplied by available funds = resulting amount to be deducted

54.55% x $209.94 x = $114.51

45.45% x $209.94 x = $95.43

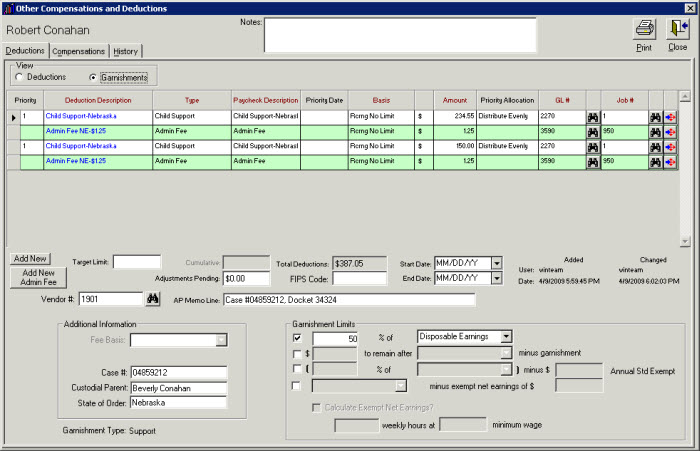

Example: EXAMPLE OF DISTRIBUTE EVENLY PRIORITY ALLOCATION

The Distribute Evenly Allocation distributes the garnishments equally for all orders in the same priority group.

Calculation

- Divide available funds (which is $330.78) by number of (remaining) orders (which is 2) in the same priority group to result in an "average" of $165.39. If the average is less than the minimum order, WinTeam pays the average to all orders.

- Apply average to 1st order. Since the average ($165.39) is less than the minimum order ($234.55), it is initially paid $165.39.

- Apply average to 2nd order. Since the average (165.39) is more than minimum order ($150.00), it is paid the minimum order of $150.00. There is $15.39 remaining.

- Total all remaining amounts ($15.39) and divide by # of remaining orders. In this case it is easy since we only have one remaining amount and 1 remaining order. $15.39 / 1 remaining order = $15.39 that needs applied to each remaining order.

- Apply average remaining order amount to each remaining order(s). 1st order receives $165.39 plus remainder of $15.39. = $180.78 2nd order receives the minimum order of $150.00.

- Continue calculating any remainders, if applicable.