Overview

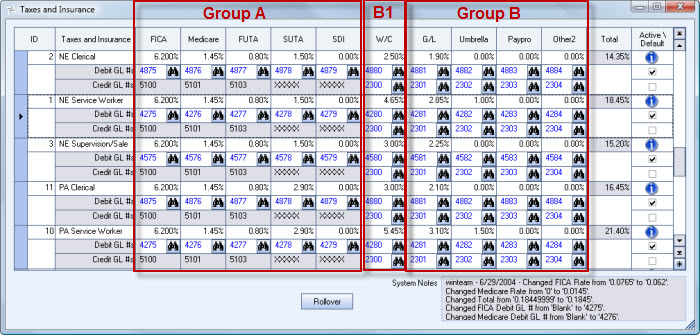

Use the Taxes and Insurance screen to view/edit tax and insurance codes and their applicable percentages. Tax and Insurance Codes are required when setting up a new Job.

The main purpose of the Taxes and Insurance Type screen is to include the employer's portion of payroll taxes and insurance when updating payroll to the General Ledger.

The information DOES effect the General Ledger. Debit and Credit accounts are assigned to each record and are used when posting the Tax Allocation Journal down to the Job level. These figures are no longer used solely for estimating and budgeting in Job Costing.

Note: The system continues to store the estimated tax and insurance when posting labor to the General Ledger. This total percentage stored here is used when calculating Daily Job Budgets.

The Payroll Taxes and Insurance Types screen can be accessed from the Job Master File (Accounting Info tab) screen. Double-clicking in the Taxes and Insurance Type field displays the Taxes and Insurance screen.

Note: If you are NOT using the Tax Allocation Program, the Taxes and Insurance screen has different functionality. For details on Taxes and Insurance without using the Tax Allocation Program, see Taxes and Insurance.

Key Functionality

The system uses the ID field to identify each Tax and Insurance Type. The system automatically assigns an ID to each new record; however, you may change the system-assigned ID number.

Use this description when selecting a Tax and Insurance Type on the Job Master File (Accounting Info) screen. The Description should be specific to the Worker Compensation Class and State (i.e. NE Service Worker). For more information, see Setting Up Payroll Taxes and Insurance.

FICA

This is the applicable tax percentage for the Employers portion of FICA.

Since the tax is already figured by payroll processing, the percentage entered here is used for Budget purposes only.

Medicare

This is the applicable tax percentage for the Employers portion of Medicare.

Since the tax is already figured by payroll processing, the percentage entered here is used for Budget purposes only.

FUTA

This is the applicable percentage for Federal Unemployment Tax.

Since the tax is already figured by payroll processing, the percentage entered here is used for Budget purposes only.

SUTA

This is the applicable percentage for State Unemployment Tax.

Since the tax is already figured by payroll processing, the percentage entered here is used for Budget purposes only.

Disability

This is the applicable percentage for Disability Insurance.

Since the tax is already figured by payroll processing, the percentage entered here is used for Budget purposes only.

W/C

This is the applicable percentage for Worker's Compensation.

Since the expense for these accounts have not been figured yet, the percentages here will be used for figuring both the Budget and Actual employer expense.

G/L

This is the applicable percentage for General Liability.

Since the expense for these accounts have not been figured yet, the percentages here will be used for figuring both the Budget and Actual employer expense.

Umbr.

This is the applicable percentage for Umbrella.

Since the expense for these accounts have not been figured yet, the percentages here will be used for figuring both the Budget and Actual employer expense.

Other1

This is the applicable percentage for any Other Taxes and Insurance items, which are not included in any other column. You may change the label for this column in PAY: Defaults.

Since the expense for these accounts have not been figured yet, the percentages here will be used for figuring both the Budget and Actual employer expense.

Other2

This is the applicable percentage for any Other Taxes and Insurance items, which are not included in any other column. You may change the label for this column in PAY: Defaults.

Since the expense for these accounts have not been figured yet, the percentages here will be used for figuring both the Budget and Actual employer expense.

This is the total Taxes and Insurance Percentage, based on the percentages displayed for the selected line of information. If you change a percentage, the system automatically updates this field.

Hover over the Change Information icon to see User Added, Date Added, User Changed and Date Changed information. WinTeam records the logon name of the user entering or changing this record. The Date Added is the original date this record was entered into the system. The Date Changed is the date the record was last changed. Right-click on the Change Info icon to filter for records added or changed by a specific user or date.

When you hover over the User Changed or Date Changed filters, you can:

- Filter By Selection - Filters for all records that match your current records field value.

- Filter by Exclusion - Excludes from your filter all records that match your current records field value.

- Filter For - Filters based on the text/value you enter.

- Sort Ascending - If you already have a filter applied, the Sort Ascending command is available. Also used to include all records in the filter and sort in ascending order based on the current records field value.

- Sort Descending - If you already have a filter applied, the Sort Descending command is available. Also used to include all records in the filter and sort in descending order based on the current records field value.

Use the Debit GL # field to enter a General Ledger # to post the Debit side of the applicable tax code.

Use the Credit GL # field to enter a General Ledger # to post the Credit side of the applicable tax code.

Click the Rollover button to make a copy of the selected record. This saves time by not having to retype like information. Make sure to give the new record a different description.

WinTeam creates system notes when information is changed on this screen.

Security

You must have the JOB Taxes and Insurance Security Group set up with your User Name or you must belong to SYS ALL in order to access this screen.