Overview

To guide businesses toward Affordable Care Act (ACA) compliance, the Internal Revenue Service has established methods for determining variable-hour or seasonal employees who will be considered full-time and calculating shared responsibility for health coverage. One method states an employer will not be subject to an assessable payment for an employee if the minimum essential coverage offered to that employee was affordable, based on a percentage (e.g., 9.5%) of Form W-2 wages reported in Box 1. This is often referred to as the affordability safe harbor.

WinTeam enables you to manage affordability compliance, seamlessly integrating Insurance Benefits and Payroll. You can set up a percentage-based cost method to automatically calculate affordable, wage-based deductions for health coverage. The deduction amount will vary based on the percentage you designate and an employee's wages each pay period, but you can systematically track how these deductions -- and your expenses -- are adding up as the year progresses.

WinTeam tools help ensure that at year end, total payroll deductions for minimum essential coverage do not exceed the percentage of "W-2 Box 1" wages deemed affordable. As your company plans for ACA compliance, you can set up the following combination of Payroll Deduction and Benefit Plan Option to help meet the IRS affordability safe harbor guidelines.*

So that this Insurance Benefit will be calculated as a percentage of an employee's "Wages, tips, other compensation," when setting up the benefit on the PAY: Other Deduction Codes screen, select the Deduction Method Percent of Form W-2 “Box 1”. At the end of the year, the W-2 Box 1 shows the total taxable wages, tips, and other compensation (before any payroll deductions) that you paid the employee during the year. (This does not include elective deferrals, such as employee contributions to certain retirement plans. See see IRS General Instructions for Forms W-2 and W-3 for more information.)

WinTeam will calculate what amounts to a variable deduction each pay period (depending on hours worked, wage, other compensations/deductions each period), based on information contained in the Employee Master File Other Comps/Deducts screen.

Note: Because WinTeam cannot predict how long an employee will work, nor how much s/he will earn, The PAY: Payroll Wizard calculates this deduction each pay period. The amount deducted for the entire year will be variable, but each pay period during the year, you will have a "snapshot" of an employee's benefit deductions.

Will this deduction be taken pre- or post-tax? Select the Tax Deductible option if this deduction is to be tax deductible. In this instance, typically you would also select Include in Gross Earnings. WinTeam will actually figure Federal earnings after the deduction is taken.

For more information, see Understanding How Percentage-Based Deductions are Calculated.

The Min Amount per Check and Max Amount per Check are used as defaults when manually entering an Employee Only deduction for insurance benefits on the Employee Master File, with a second deduction for dependents, with amounts monthly and annualized.

You can use the Min Amount per Check to ensure an employee has a co-funding responsibility for insurance in cases where minimal or no hours during the pay period were worked and a Percentage Based Cost Method has been used. Similarly, the Max Amount per Check would ensure a highly paid employee isn’t charged more than the actual premium when using a Percentage Based Cost Method.

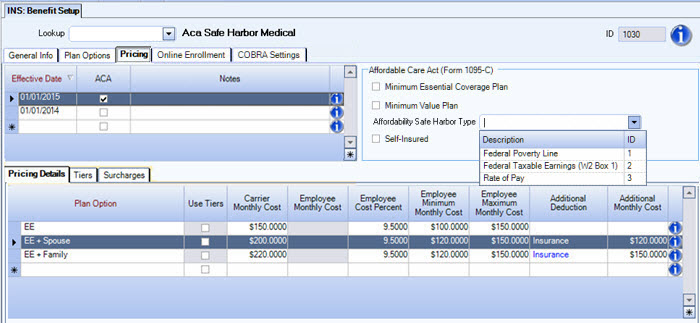

Create the benefit with Plan Options that use the Percentage Based Cost Method.

The Employee Cost Percent is the percentage that you want WinTeam to use when calculating the percentage of W-2 Box 1 for the deduction.

If the amount calculated is less than the Employee Minimum Monthly Cost, then WinTeam will use the Employee Minimum Monthly Cost as the deduction instead of the calculated percentage.

If the amount calculated is more than the Employee Maximum Monthly Cost, then WinTeam will use the Employee Maximum Monthly Cost as the deduction instead of the calculated percentage.

If no Minimum or Maximum are entered, then WinTeam will use the calculated percentage amount as the deduction.

For an Employee Only Plan Option, neither Additional Deduction nor Additional Monthly Cost should be entered.

For an Employee plus other dependent option, the Additional Deduction and Additional Monthly Cost can be entered.