Although not a typical accounting procedure, WinTeam does allow you to make changes to the Cost, Salvage Value, Expected Life, and Method of Depreciation fields for a Fixed Asset.

You may want to review the following topics before changing an Assets' cost, salvage value, expected life or depreciation method:

The following rules apply when changing the Expected Life field:

- The value entered in the Expected Life field must fall within the Lifetime Min and Max Range set up in the FA: Asset Categories screen.

- You cannot change the Expected Life field to a value that is less than the value in the Periods Completed field.

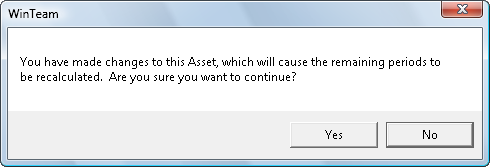

After you make the desired changes and attempt to save the record, the system displays the following message:

Click No to return to the FA: Master File screen. This DOES NOT reverse the changes made to any fields. You must press the Esc key to reverse the changes made.

Click Yes to accept the change.

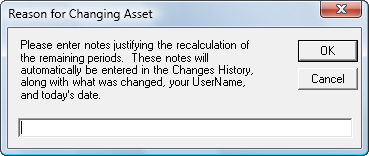

A message displays providing you with an opportunity to enter a reason for the changes being made.

Click the OK button. The system writes these notes to the Asset Change History screen, found by clicking on the Change History button on the FA: Master File screen. If you enter notes and then click the Cancel button, the system does not write these notes to the Asset Change History screen.

Once you click the OK or Cancel button, the system saves the changes made to the FA: Master file record, then recalculates the Depreciation Details for the remaining fiscal periods in the Fixed Asset’s life to reflect the changes. The system does not change the fiscal periods posted to the General Ledger. If the system makes an adjustment, the Depreciation Details reflect this. You may view the FA: Depreciation Details screen by clicking the Depreciation Details button on the FA: Master File screen.