Overview

You can use Personal Property Jurisdictions to group related assets into a single category by the name of the taxing authority (such as city name, county name, state name, etc.) collecting the personal property tax.

Example: The state of Nebraska requires businesses to file a Nebraska Personal Property Return, but collects taxes separately by county. In this example, a valid Jurisdiction could be "NE - Douglas County" or simply "Douglas County".

To access the Personal Property Jurisdiction add/edit list, the Personal Property Tax check box must be selected on the FA: Master File screen.

Key Functionality

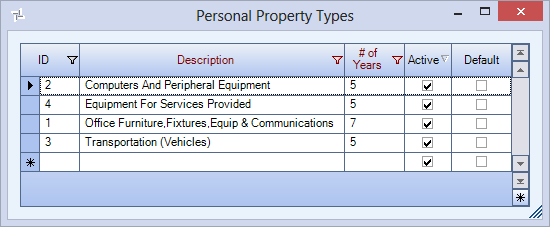

Use this field to enter a unique name for the record. After a new record is created, WinTeam displays this Description with the corresponding ID number in the Add/Edit list.

Select this check box to make the selected record active. Clear the check box to make the record inactive.

Select this check box to make the selected record the default value for this Add/Edit list. WinTeam uses this record to automatically fill in the corresponding field on a new record in the related screen.