Overview

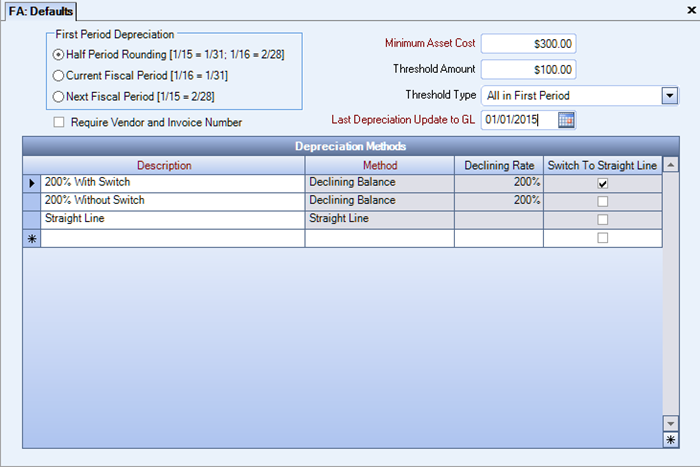

Use Fixed Asset Defaults to set up the default settings to use throughout the Fixed Asset module.

The FA:Defaults screen can be accessed from the Fixed Assets menu.

Key Functionality

Use the First Period Depreciation option group to designate the first fiscal period (or month) you want to begin depreciating fixed assets. As you add new records using the Fixed Asset Master File screen, WinTeam populates the Date Effective field based on the date that you enter in the Date Acquired field and on the First Period Depreciation option selected on the Fixed Assets Defaults screen.

Note: On the FA: Master File screen, WinTeam applies this First Period Depreciation option to each fixed asset record you enter that has a Date Acquired during the fiscal years set up in the Set Fiscal Years screen.

There are three First Period Depreciation options available: Half Period Rounding, Current Fiscal Period, or Next Fiscal Period.

- Half Period Rounding - If you select this option, as you enter a fixed asset’s Date

Acquired on the FA: Master File screen:

- If it is on or before the 15th day of the fiscal period (or month), by default, the system fills the Date Effective field with the last day of the SAME fiscal period.

- If it is after the 15th day of the fiscal period (or month), by default, the system fills the Date Effective field with the last day of the NEXT fiscal period.

- Current Fiscal Period - If you select the Current Fiscal Period option, as you enter a fixed asset’s Date Acquired on the FA: Master File screen, by default, the system fills the Date Effective field with the last day of the SAME fiscal period.

- Next Fiscal Period - If you select the Next Fiscal Period option, as you enter a fixed asset’s Date Acquired on the FA: Master File screen, by default, the system fills the Date Effective field with the last day of the NEXT fiscal period.

Select this check box to require a Vendor Number and Invoice Number in the Fixed Assets Master File when adding new records.

This is not selected by default.

Use the Minimum Asset Cost field to enter the minimum amount an item must cost in order for it to be set up as a depreciable fixed asset and depreciated in the system. Your company’s fixed assets policies and procedures dictate the amount that you should enter in this field.

Example: Your company may have a policy that requires you to capitalize and depreciate any items that cost more than $400, and to expense any items that cost less than $400. When you add a new record on the FA: Master File screen, the system compares the amount you enter in the Cost field to this Minimum Asset Cost amount. If the Cost you enter is less than the Minimum Asset Cost amount, you will receive a warning message.

This does not apply to non-depreciable assets.

Use the Threshold Amount field to enter the amount to use in handling differences (or adjustments) in accumulated depreciation. Differences in accumulated depreciation records converted from a previously used system or change an existing record’s Cost, Salvage, Life, or Method fields. In either case, if the amount in the Accumulated field differs from the system-calculated accumulated depreciation, the system corrects this difference at some point during the fixed asset’s remaining life. If this difference is less than the Threshold Amount, the system corrects the accumulated depreciation in the last fiscal period (or month) for the fixed asset. If this difference is equal to or greater than the Threshold Amount, the system corrects the accumulated depreciation based on the Threshold Type selected.

Use the Threshold Type field to designate the method to use in correcting differences (or adjustments) in accumulated depreciation.

Select one of the following options:

- All in First Period – If you select this option, the system corrects differences in accumulated depreciation during the first fiscal period (or month) that the fixed asset is depreciated on the system.

- Evenly over Remaining Periods – If you select this option, the system corrects differences in accumulated depreciation by allocating an even amount over the remaining fiscal periods that the fixed asset is depreciated on the system. Last Depreciation Update to GL

Use the Last Depreciation Update to GL field to enter the last day of the fiscal period (or month) that fixed asset activity (from a previously used system) was recorded in the General Ledger.

For example, suppose you last depreciated fixed assets on a previously used system in February 2001. If you plan to convert fixed asset information to the WinTeam system in March 2001, then you should enter 02/28/01 in the Last Depreciation Update to GL field. The Last Depreciation Update to GL field is initially blank, so you must enter a date in this field before the system allows you to add fixed assets records on FA: Master File screen. The system automatically updates the Last Depreciation Update to GL field each time you update fixed assets activity to the General Ledger on the FA: Update to GL screen. The system copies the Enter Thru date from the FA: Update to GL screen to the Last Depreciation Update to GL field. In turn, the system automatically updates the Last Update field on the FA: Update to GL screen using the date from the Last Depreciation Update to GL field. When you add a new record on the FA: Master File screen, the system refers to the Last Depreciation update to GL field to determine if a lump sum entry is needed. If you add a fixed asset record with an Effective Date from a previously updated fiscal period (or month), the system creates a lump sum entry to catch up missed depreciation from previous fiscal periods. This lump sum entry eliminates the need for you to update each fiscal period separately or reprint previous fiscal period-end reports.

Select the deprecation calculation methods your company will be using to depreciate fixed assets.

Description

Use the Description field to enter the name for each of the Depreciation Methods set up in the system. When you add new records on the Asset Master File screen, this description appears in the list of the Method field.

Method

Use the Method field to select the depreciation calculation method to use for each of the Depreciation Methods set up in the system. Select Straight Line, Declining Balance or Canadian Cost Allowance (Canada businesses only) Method.

Declining Rate

The Declining Rate field is available only if you select the Declining Balance Method. The system uses the Declining Rate, multiplied by the Straight Line Rate, in the Declining Balance Method of depreciation calculation. The Straight Line Rate is equal to (100% / Expected Life [in fiscal periods]). A common Declining Rate to use is 200%, which is the rate used in the Double Declining Balance method. The Declining Rate field has a valid range from 100% to 500%, which means that the system can depreciate a fixed asset at a rate up to 5 times higher than the Straight Line Method.

Switch to Straight Line

The Switch to Straight Line option is available only if you select the Declining Balance Method. To ensure that fixed assets become fully depreciated using the Declining Balance Method, you may choose to have the system switch to the Straight Line method in the later fiscal periods. If you select the Switch to Straight Line option, for a fixed asset depreciated using the Declining Balance Method, the system switches to the Straight Line depreciation method when appropriate. The switch to the Straight Line Method occurs if, at any point, the straight line depreciation amount for the remainder of the fixed asset’s life is greater than the Declining Balance depreciation amount. The system calculates the straight line depreciation amount for the remainder of the fixed asset’s life as follows:

(Cost – Salvage – Accumulated Depreciation) / Remaining Fiscal Periods)

If you clear the Switch to Straight Line option, for a fixed asset depreciated using the Declining Balance Method, the system uses the Declining Balance Method over the fixed asset’s entire life. In this case, it is quite possible that the system will not fully depreciate the fixed asset.

Canadian Cost Allowance (CCA)

This is similar to the Declining Balance Method and is for use by Canadian businesses only. This method reduces the value of the asset by a constant factor every year. Canadian tax law applies it to asset classes 3, 4, 7, 8 and 10. Specifically, the book value of the asset in any given year is:

BVn= P(1 – depreciation rate)

And the depreciation cost in that year is:

DCn – BVn-1 (depreciation rate)

Note that this method may not lead to a book value of zero, so it may overstate the value of an asset towards the end of its life.

It is important to note that if the Switch to Straight Line option is not checked, the system will continue to use the CCA method over the entire life of the asset, and the asset may or may not become fully depreciated. However, if the Switch to Straight Line option is checked, the system will switch to the Straight Line depreciation method if, at any point the Straight Line depreciation amount for the remainder of the asset’s life is greater than the CCA depreciation amount. Switching to the straight line method will ensure that an asset becomes fully depreciated under the CCA method.