Overview

You can access the Use Tax Codes screen from:

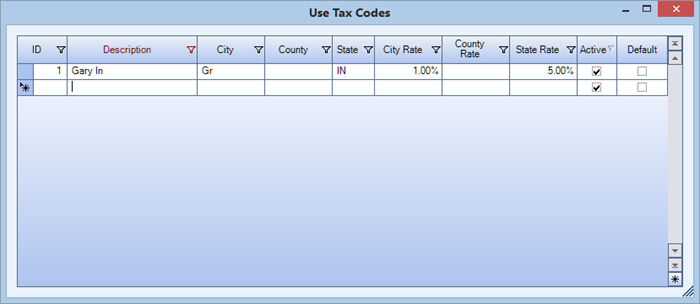

If the Vendor you are purchasing from does not charge sales tax on the items you purchase from them, you will normally have to pay Use Tax on those items at appropriate times during the year. If you selected the Pay Use Tax check box on the Vendor Master File, the check box defaults to selected on the Payments screen. From the Payments screen you will select the Use Tax Code to apply to the payment.

Key Functionality

WinTeam automatically assigns an ID to each new record, and uses the ID field to identify each record. You may change system-assigned ID Numbers.

Use this field to enter a unique name for the record. After a new record is created, WinTeam displays this Description with the corresponding ID number in the Add/Edit list.

Enter the City to which the Use Tax Code applies.

Enter the County to which the Use Tax Code applies.

Enter a two-digit abbreviation of the State to which the Use Tax Code applies.

Enter a percentage for the system to use to calculate the City Use Tax.

Enter a percentage for the system to use to calculate the County Use Tax.

Enter a percentage for the system to use to calculate the State Use Tax.

Select this check box to make the selected record active. Clear the check box to make the record inactive.

Select this check box to make the selected record the default value for this Add/Edit list. WinTeam uses this record to automatically fill in the corresponding field on a new record in the related screen.

Related Information

Adding an entry to an Add/Edit list