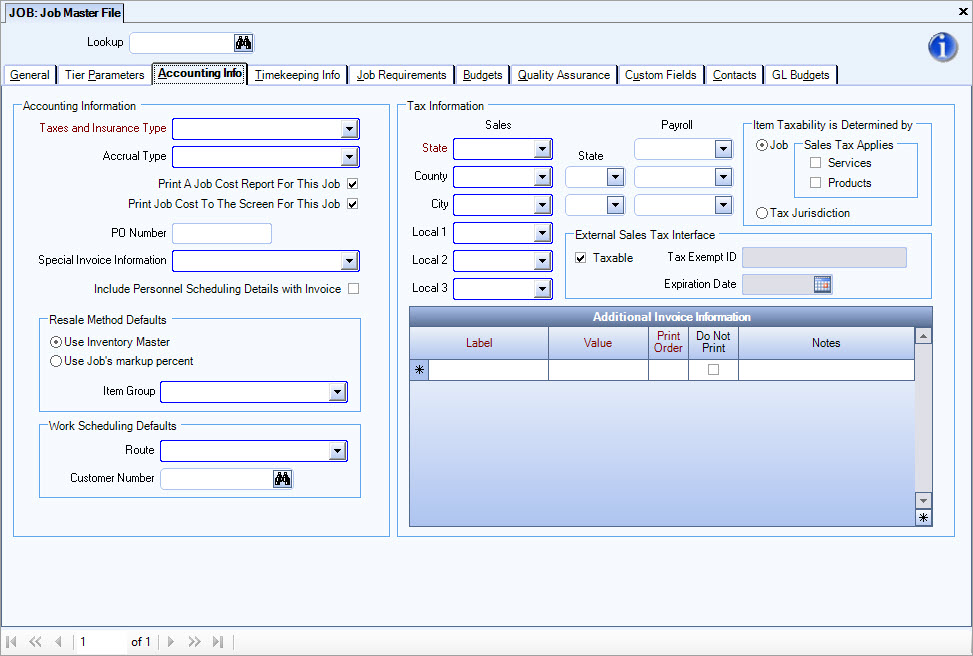

The Payroll Taxes and Insurance Types screen may be accessed from the Job Master File (Accounting Info)) screen. Double-clicking in the Taxes and Insurance Type field displays the Taxes and Insurance screen.

The information contained in the Taxes and Insurance screen is used to update the General Ledger and for budgeting purposes (Daily Job Budgets). The total percentage is also used to determine the estimated actual Taxes and Insurance which is not applicable to those companies using the Tax Allocation Program.

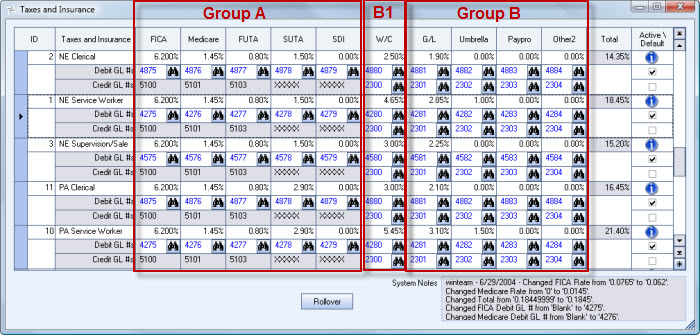

Group A

Since you are using the Tax Allocation Program, Group A rates (the first five columns - FICA, Medicare, FUTA, SUTA, and SDI) are based on the rates stored in the Payroll Taxes screen and will match the Taxes calculated when processing Payroll. Group A is always used for budgeting, as well as computing the "Estimated Actuals" in the Labor Distribution Details.

Group B

Group B includes Workers Comp, General Liability, Umbrella insurance, and up to 2 Other items that are based on a percentage of labor (set up in PAY: Defaults).

Group B is further separated into B1–B1 is Workers Compensation. The system will subtract out the OT and Double time premium dollars.

Actuals for Group B and B1 are based on the rates in the Taxes and Insurance screen.

GL has a custom setting that allows you to exclude OT and Double time premium dollars

| Section | Item | Value |

|---|---|---|

| PayrollTAJ | GenLiabExcludePremDollars | Yes |

Umbrella Insurance will exclude OT and Double time premium dollars if the Employer Insurance by Job check box is selected in PAY: Defaults.

In our example, the item Paypro in Group B identifies a payroll processing fee. We defined the Label for Other 1 in Payroll Defaults.

Group B is always used for budgeting, as well as computing the "Estimated Actuals" in the Labor Distribution Details.

Group B uses the rates from Taxes and Insurance to get their "actuals".

The Debit GL #'s and Credit GL #'s are used when posting the Tax Allocation Journal (TAJ).

For more information, see Calculating Allocations for Taxes and Insurance.

Due to the various Workers Compensation and State Unemployment rates, you will need to add a description for each Workers Compensation classification and each state you are doing business in.

You should record, in this area, any employer percentage that is calculated based on a percentage of payroll. FICA, FUTA, SUTA, Workers Compensation Insurance, General Liability Insurance, Umbrella Insurance, and Disability Insurance are all usually based on a percentage of payroll dollars, therefore this screen has predefined columns. The last two columns are available for any Other percentage that is employer paid based on a percentage of payroll. The Total column sums the percentages from each column.

If there are different classifications of labor at the same job site, you may want to set up a Parent and Sub job.

Example: A Job has both Service Worker labor and Supervision labor. Since the Service Worker and Supervision Tax and Insurance codes contain different rates, the Parent job should be set up using a Taxes and Insurance Type of Service Worker and the Sub job should be set up with a Taxes and Insurance Type of Supervision. When the Job Cost report is run, a selection on the report option screen allows for Grouping by Parent Job. Both jobs would be added together, therefore showing only one job on the Job Cost Report.

To add or verify rates

- From the Job Costing Menu, click Jobs.

- Click the Accounting Info tab.

- Double-click in the Taxes and Insurance Type field to display the Taxes and Insurance screen.

- For each Taxes and Insurance Type record, adjust the FICA and Medicare rates. Since we have a Medicare column, separate the Medicare portion from FICA. This is normally 6.2% for FICA, and 1.45% for Medicare. This is important since the Employer portion is already being computed separately during Payroll processing.

- For each Taxes and Insurance Type record, add/verify the rates.

Group A accounts (FICA, Medicare, FUTA, SUTA, and SDI) should only have the Employer portion. - For each Taxes and Insurance Type record, enter the applicable Debit GL#. Use the GL Expense Accounts applicable to the Tax Code.

- For each Taxes and Insurance Type record, enter the applicable Credit GL#. For Group A accounts (FICA, Medicare, FUTA, SUTA, and SDI) the Credit GL # is carried over from the Payroll Taxes screen. For Group B accounts (W/C, G/L, Umbrella, Other 1, and Other 2) use the GL Insurance Liability Account applicable to the Tax Code.

If you make changes to your Tax and Insurance Rates AND you want to include the updated rates in previously calculated budgets, you will need to recalculate the job daily budgets. For more information, see Recalculating Payroll Taxes and Insurance.

If you want to include Payroll Taxes and Insurance in your Financial Statements, see Formatting Financial Statements to Include Taxes and Insurance (using the Tax Allocation Program).