In order to include Payroll Taxes and Insurance into your financial statements when using the Tax Allocation Program, you will need to add some additional lines to your format.

Since you are using the Tax Allocation Program, manual journal entries no longer need to be made in order to record actual company costs associated with Group B Accounts (Workers Comp, General Liability, Umbrella insurance, and up to 2 Other items that are based on a percentage of labor).

If your financial statement format includes the line items for Non Allocated Taxes Insurance, you must leave these lines in your format; otherwise, previously issued period financial statements will not reconcile with the new format. The Non Allocated Taxes and Insurance continues to be used for Year to Date when running a financial statement.

Since the Non Allocated amount is not stored in the General Ledger, but is more a memo entry that shows on financial statements, you will need to keep these fields, for the Non Allocated method, in your financial statement formats.

To set up new financial statement formats

- Rollover your existing financial statement format and add the new GL numbers used in the Tax Allocation program.

- Insert the expense GL number in the appropriate section of the financial. For example:

- Sales Expense GL number in the Sales section of the format

- Administration expense GL numbers in the Administration section of the format

- Operation expense GL numbers in the Operation section of the format.

- Insert the control GL numbers in the Applied Cost section of the format.

Note: In order for the year to date amount to be accurate both the Allocated Taxes and the Non Allocated Tax must be in the format. At the start of a new fiscal year the Non Allocated lines on the P & L can be deleted, except if you run a Comparative Financial Statement. The Comparative Financial Statement compares the current year to last year, therefore the Non Allocated tax needs to print on the P & L.

These examples are provided in order to assist with formatting financial reports when using the Tax Allocation Program.

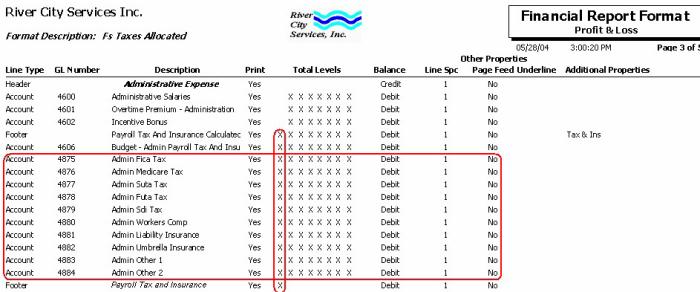

This is an example of a typical report format that includes Admin payroll expenses for the non-allocated method of Taxes and Insurance before using the Tax Allocation Program.

Use this example as a guide to set up the report format for Admin payroll expenses when using the Tax Allocation Program.

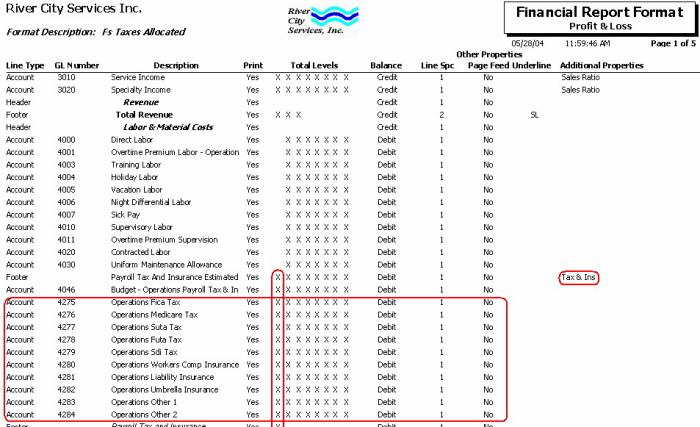

This is an example of a typical report format that includes Direct (Operations) payroll expenses for the non-allocated method of Taxes and Insurance before using the Tax Allocation Program.

Use this example as a guide to set up the report format for Direct (Operations) payroll expenses when using the Tax Allocation Program.

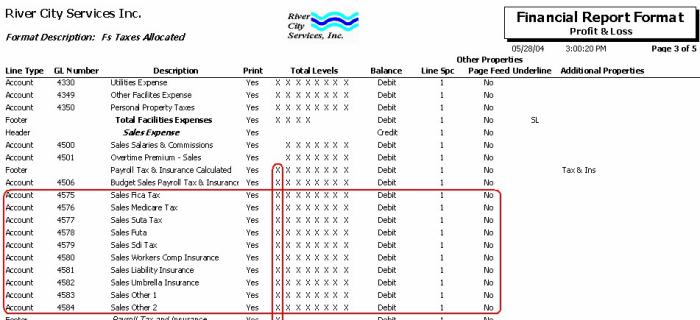

This is an example of a typical report format that includes Sales payroll expenses for the non-allocated method of Taxes and Insurance before using the Tax Allocation Program.

Use this example as a guide to set up the report format for Sales payroll expenses when using the Tax Allocation Program.

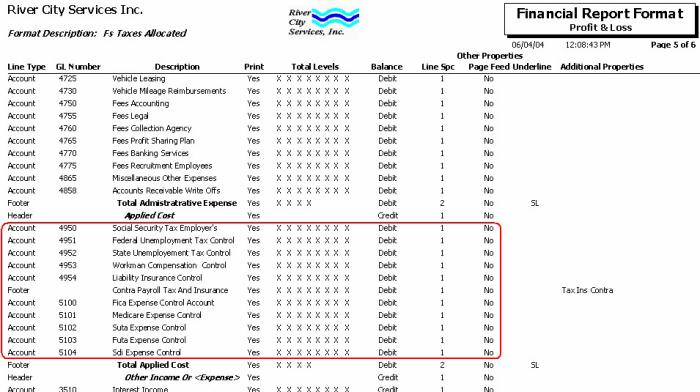

This is an example of a typical report format that includes Applied Costs for the non-allocated method of Taxes and Insurance before using the Tax Allocation Program.

Use this example as a guide to set up the report format for Applied Costs when using the Tax Allocation Program.