Use this procedure to make a copy of an existing Deduction Code. Rolling over Deduction Codes is useful if you want to reuse the items from another Deduction Code and make additional changes.

To rollover a Deduction Code

- From the Payroll Menu, click Other Deduction Code.

- Select a Deduction Code, or use the Lookup to locate the Other Deduction Code.

- Click the Rollover button on the toolbar to create a new Other Deduction Code record.

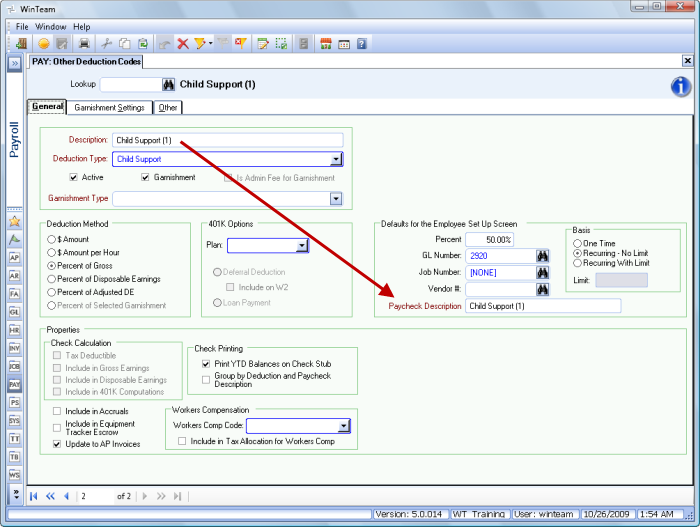

When a record is rolled over, the new Description name takes the original Description and appends (1) to the end. It will increment the count (2) as the same record Description is rolled over so a unique description exists.

If the description is very long and the length has reached its maximum limit based on field width, the incrementing functionality will replace the last few characters with the (x). This will allow users to continue to roll over existing Descriptions due to description name being too long to be rolled over.

During the rollover process, the Paycheck Description will change to match the rollover Description.

For more information on Rollovers, see Rollover Functionality.

When rolling over an existing Deduction Code, the system automatically change the Paycheck Description to equal the rollover Description.