Overview

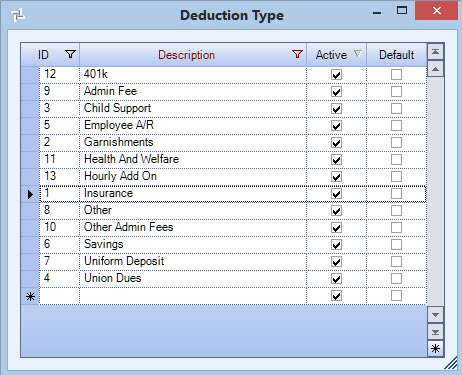

Deduction Types are used to group related deductions.

Example: Deduction Types could be based on the underlying reasons for the deductions (i.e., Insurance, Garnishments, Savings, Union Dues, Child Support, etc.). When creating a batch of checks in the Check Processing Wizard, you may select the Deduction Types to include in the batch (i.e., calculate paychecks using just the Other Deductions grouped under the Deduction Type of Insurance).

When adding a new Other Deduction Code, the system displays the default Deduction Type selected here (if one was selected).

You can access the Deduction Types add/edit list from the PAY: Other Deduction Codes and the PAY: Employee Master File Other Comps / Deducts screen.

Key Functionality

WinTeam automatically assigns an ID to each new record, and uses the ID field to identify each record. You may change system-assigned ID Numbers.

Use this field to enter a unique name for the record. After a new record is created, WinTeam displays this Description with the corresponding ID number in the Add/Edit list.

Select this check box to make the selected record active. Clear the check box to make the record inactive.

Select this check box to make the selected record the default value for this Add/Edit list. WinTeam uses this record to automatically fill in the corresponding field on a new record in the related screen.

Security

This add/edit list is part of the SYS Add Edit List ALL Security Group.

Security Features include the ability to:

- Deny Set Active\Inactive

- Deny Set Default

Tip: For more information see Security Groups Overview and Security Groups By Module.