Overview

Tax Filing allows the exporting of tax information related to payroll batches to a Tax Filing Interface (such as ADP) in order to perform all of the necessary tax filing for a company. This program is used to submit a file after each check batch that contains all tax jurisdiction information for the check date range indicated and it is also used to transmit quarterly employee balance information.

The ADP: Tax Filing option produces a report and exports a text file that is uploaded to a ADP website for processing. The Periodic report is a summary by Paycheck Batch ID. The Periodic report includes zero (0) total withholding records, and allows for creation of the file when zero total withholding records are included. The Quarterly report is a detail report by Employee for that date range. You can also use the “Group By” option to group and sort the employees.

An asterisk (*) next to locality records indicate that they are non-resident.

ADP Tax Filing includes any disability description starting with 'NJ UI' as the same as NJ Disability. This affects both Quarterly and Periodic.

The Periodic and Quarterly files have been changed to accommodate some special handling of VI (Virgin Islands) employees. An employee is considered a Virgin Islands employee if his/her paycheck included any Virgin Islands Earnings amount.nnnnnnn

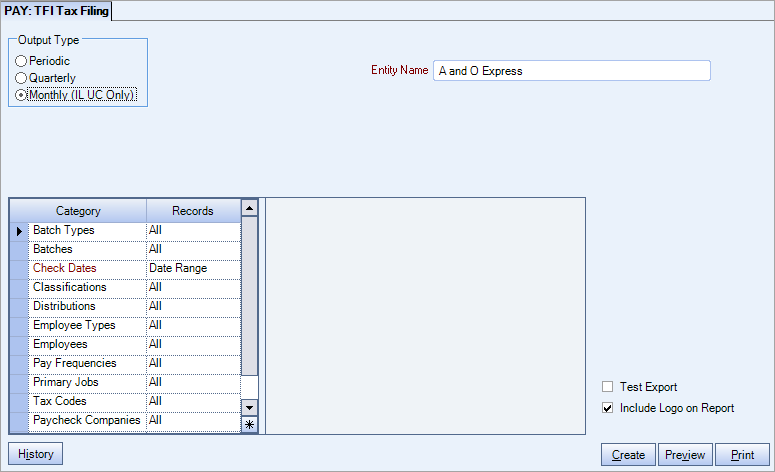

Output Type

Used after each payroll run to file the taxes on a timely basis. As each paycheck “batch” is processed, it is marked as processed or filed in WinTeam

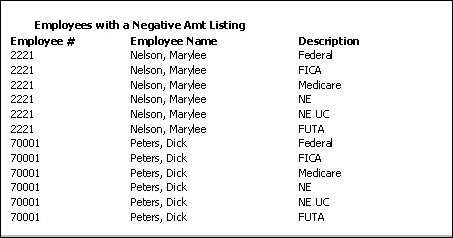

Used after each quarter ends to send in any adjustments and reconciling previous filings. Used to indicate those records with negative wages and withholdings. A summary displays at the end of the ADP Quarterly tax report if there are employees with negative earnings and withholdings, and which tax jurisdictions are negative.

The report will Group by batch (automatically), Show Tax Filing Date in header (if applicable), print a FICA/Medicare Total (Employer and Employee) for each Batch, and at the Grand Total level, print an Impound Amount for each Batch and at the Grand Total level.

The Employer’s portion of FICA includes only the difference between what was withheld from the employee and the total FICA tax burden (both employee withheld and employer costs).

Any activity on a check record that is tied to a Deduction or Compensation Code that has a special tax code indicated, is included on the Quarterly ADP Tax Report and file.

Created monthly for employees who have Illinois unemployment compensation (IL UC) selected. There is no need for additional criteria filtering. The file created only pulls employees with IL UC (filtering by location is not necessary). This file should be created monthly for processing. This file does not include employees from other states.

Key Functionality

This field displays the Company name that is set up with Company #1. It defaults from the Company Setup screen. ADP's File Layout describes this field as "Corporate Name."

| Category | Records |

|---|---|

| Batch Types |

Use the Batch Types category to select the batch types to include in the file. Select All to include all Batch Types. Select Pick From List to define specific batch types for the file. When you select Pick From List, the Batch Types list displays. Select the check box next to each Batch Type to include in the file. Note: Void and Handwritten batch types will not be transmitted to ADP unless they are updated to the General Ledger. |

| Batches |

Use the Batches category to select the batch types to include in the file. The Batch list will sort in ascending batch ID order, but you can resort in descending order by clicking on the column header. Select All to include all Batch Types. Select Pick From List to define specific batches for the file. When you select Pick From List, the Batches list displays. Select the check box next to each Batch to include in the file. Select Range to define a range of Batch ID's to be submitted. |

| Check Dates |

Use the Check Dates category to enter the dates of the check records you want included in the ADP Tax File being created. For Periodic batches the From and To Date should normally be the same since you are reporting a check run to ADP. However, there are times where a batch will include more than one date as in the case of Tax Adjustments and Handwritten Check batches. For Quarterly batches your check date range would need to be the same as the quarter you are reporting (i.e. For 2nd qtr 04/01/06 - 06/30/06). Type the beginning Check Date in the From field and the ending Check Date in the To field. |

| Classifications |

Use the Classifications category to select the Classifications to include in the file. Select All to include all Classifications. Select Pick From List to define specific Classifications for the file. When you select Pick From List, the Classifications list displays. Select the check box next to each Classification to include in the file. |

| Distributions |

Use the Distributions category to select the Distribution types to include in the file. Select All to include all Distribution types. Select Pick From List to define specific Distribution types for the file. When you select Pick From List, the Distribution type list displays. Select the check box next to each Distribution type to include in the file. |

| Employee Types |

Use the Employee Types category to select the Employee Types to include in the file. Select All to include all Employee Types. Select Pick From List to define specific Employee Types for the file. When you select Pick From List, the Employee Types list displays. Select the check box next to each Employee Type to include in the file. |

| Employees |

Use the Employees category to select the Employees to include on the report. Select All to include all Employees on the report. Select Range to define a range of Employees for the report. Type the beginning Employee Number in the From field and the ending Employee Number in the To field. Select Create to define your own list of Employees. When you select Create, a small grid displays to the right. Enter the Employee Numbers you want to include in the list, or use the Lookup to locate the Employee Numbers. Select Exclude to identify records that should not be included. When you select Exclude, a small grid displays to the right. Enter the Employee Numbers you want to exclude in the list, or use the Lookup to locate the Employee Numbers. |

| Pay Frequencies |

Use the Pay Frequencies category to select the Pay Frequencies to include in the file. Select All to include all Pay Frequencies. Select Pick to define specific Pay Frequencies for the file. When you select Pick From List, the Pay Frequencies list displays. Select the check box next to each Pay Frequency to include in the file. |

| Primary Jobs |

Use the Primary Jobs category to select the Primary Jobs to include/exclude. Select All to include all Jobs. Select Range to define a range of Jobs. Select Create to define a new job. Select Exclude to exclude jobs. |

| Tax Codes |

Tax Codes are defined within Payroll Tax Tables. Select All to include all Tax Codes. Select Pick to define specific Tax Codes for the file. |

| Paycheck Companies |

This category is available to users who have more than one company. Use the Paycheck Companies category to select the Paycheck Companies to include. Select All to include all Paycheck Companies. Select Pick to define specific Paycheck Companies. When you select Pick, the Paycheck Companies list displays. Select the check box next to each Paycheck company to include. |

| Locations |

This category is available to users who have more than one location. Use the Locations category to select the locations to include in the file. Select All to include all locations in the file. Select Pick From List to define specific location's for the file. When you select Pick From List, the Location list displays. Select the check box next to each Location to include in the file. |

This report will break by Company and display the proper totals for each Company. A sub total displays after each Company’s batches on the Periodic report, showing each tax jurisdiction’s totals and then the FICA/Medicare total and Impound amount before breaking to the next Company. The reports will also give grand totals of all Companies combined. The system knows which paycheck record belongs to which Company by the Company # that is used with each paycheck record.

This option is applicable for 4th quarter reporting. Based on the selection on this screen, ADP will know how to handle the mailing of W-2's. This flag sets all employees Mail indicator to what is indicated on this screen.

Use the Sort By option to sort report data by Employee Name or Employee Number. The default selection is Employee Name.

This option is applicable for 4th quarter reporting. Based on the selection on this screen, ADP will know how to handle the mailing of W-2's. This flag sets all employees Mail indicator to what is indicated on this screen. The default is Mail to employee.

This field is not visible for Clients who are using the Multi-Company feature. For Clients who are using the Multi-Company feature, the system looks at the Paycheck Company to determine the Client ID and Company Name as set up in the ADP Defaults screen. ADP's File Layout describes this as "client defined company name" which the data in this file applies.

This field is not visible for Clients who have more than one company. The ADP Company Code will default to the Tax Filing Company Code if one is set up in the ADP Defaults screen. If it is not set up, then it will continue to use the ADP Company Code that is in ADP Defaults. For Clients who are using the Multi-Company feature, the system looks at the Paycheck Company to determine the Client ID and Company Name. You cannot directly enter information into this field.

This option displays if you have set up this Custom Setting:

| Section | Item | Value |

|---|---|---|

| ADPTaxFiling | ShowFilingDate | Yes |

This setting is used to create one check date for the periodic file being transmitted. This will be the date that will be used for all tax information being transmitted. This will group all checks under one main date. This will create one check header record and one totals record for the max check date that the tax filing is being ran for. This field will fill in automatically with the date of the most current check date based on the check date range and Batch Types you are including.

If this check box is selected, the file name created will have the word TEST at the end of the name. Otherwise, the formats are exactly the same.

Select the Include Logo on Report check box to print the company logo on the report. This check box is selected or cleared by default, based on the option selected in SYS:Defaults. However, you can modify the setting on each report.

Click to open the TFI Tax Filing History window that contains a record of the tax files that have been created and allows for reprinting and creation of AP Payment records for Periodic tax files.

Click to show a “preview” of the report. Once previewed, the user is prompted to “commit” or update the “Batch”. WinTeam creates a text file in the ADP format. User can then choose where to save the file. If the was file was not properly saved or the export was aborted, WinTeam will display "File was not created successfully."

Note: The file is no longer saved in a predetermined location and is not prompted if they want to save the file again.

Each time a user selects the “Create” button and chooses to “commit”, a copy of the resulting text file and related report are archived. WinTeam also stores who, when and how the program was run.

Periodic

WinTeam will first check for batches that were not previously marked as transmitted to ADP. The ADP tax filing program will not send a batch that is marked with the ADP Tax Transmitted flag.

You will see a preview of the report. You can print this report. Once the report is closed, the file is created.

For the Periodic file, the file name created will use the following format:

Per-Date-Time.dat (i.e. Per-071905-092805.dat)

You will receive a message similar to this:

The following payroll batches will be marked as transmitted to ADP: Batch 1, Batch 2, Batch 3. Are you sure you want to commit this update? Press Yes to proceed with the creation of the file or No to cancel this process.

If you select OK, the system sets an ADP Tax Transmitted flag in the batch header.

If you were to view the Supplemental Info for this batch, you would see the Transmitted to ADP Tax Filing check box selected.

If there are no batches to commit based on your selection criteria, you will receive this message:

No Payroll batch that need to be transmitted exists for the criteria specified. It could be that the batch(s) was already marked as being transmitted. Click OK to continue.

Quarterly

The file name created will use the following format:

Qtr-Date-Time.dat (i.e. Qtr-071905-093656.dat)

The Quarterly Output Type can be resent more than once to ADP. You will NOT receive a message with using this Output Type.

Note: If the employee name includes any ASCII characters (including dashes), they will be removed from the Quarterly tax files.

Click the Preview button to view the report before printing.

Click the Print button (or press ALT + P) to send the report to your default printer.

Quarterly Amendment

An amended quarterly can be created if corrections are required after a quarterly file has already been sent to the third party (such as ADP). Typically an amended files is created after any tax adjustments were created to fix the issue for the employee.

Select the Amendment checkbox. The Ascertained Date and Reason Code fields display and are required.

The federal government requires the following information on all amended federal filings.

- Ascertain Date: The IRS considers the ascertain date to be the date you discovered the error and you had “enough information to be able to correct it.” For more information, see the official IRS website.

- Amendment Reason Codes: Provide information to explain why the original tax filing return must be changed, how refunds to employees were handled, and how corrections for additional Medicare Wage/Tax (surtax) were determined.

ADP must collect this data for every amendment you transmit to us, regardless of the jurisdiction(s) impacted by the amendment.

As an Employment Tax client, you will need to provide the appropriate Ascertain Date and Reason Codes to your Account Manager every time you transmit an amendment file to ADP. Processing your amendment cannot start until your Account Manager receives this data, so please do not delay providing the Ascertain Date and the Reason Code(s).

Amendment Reason Codes

Note: There is a list of codes to review and select from in the ADP knowledge base.

There are three parts to identifying the Employment Tax Amendment Reason Codes:

Part 1: Root Causes

Explain why the original tax filing return must be changed.

Part 2: Refund

Explains how refunds to employees were handled.

Part 3: Surtax Corrections

Explain how corrections for additional Medicare Wage/Tax (surtax) were determined.

Special Notes

The only time Medicare surtax will be shown on the ADP Tax Filing reports and exports is if the tax adjustment to Medicare withholding meets the following criteria:

- The employee’s Medicare earnings have to be over $200,000.00 (either YTD is already over before the tax adjustment or the tax adjustment is going to push them over $200,000.00).

- Then only if the Employee’s Medicare tax withholding is greater than 2 cents difference from the amount they entered for the Employer Portion of Medicare withholding. Otherwise, we will never have a tax adjustment affect Medicare surtax.

If both of these conditions exist, then WinTeam uses the Employer Medicare tax amount as the Employee Medicare tax amount and the excess (what is left in the Employee Medicare tax withholding that was entered) will go to Medicare Surtax.

For databases that have multiple companies, if your Tax Filing includes batches that cross over to other companies, there is a sub total section after each company that will show sub totals for all of the tax jurisdictions for that company. Also included is the FICA/Med Total and the Impound Amounts at this level.

If you have tax codes that you do not want them included in the Periodic or Quarterly ADP Tax Filing files, you can select the check box to “Exclude From Tax Filing”. BE CAREFUL! You never want to exclude something unless you are SURE that ADP does not need this information for periodic, quarterly or year end processing. Please be careful as you could accidentally mark something to be Excluded and then will not be reporting your Taxes properly.

As a precaution, at the end of the ADP Periodic and the Quarterly Tax File reports, a recap will print of the codes being excluded. This indicates what codes have details for the time period being transmitted but that have the Exclude From Tax Filing check box selected. If there are no tax codes that are being excluded, the message will not print. This example shows three codes that have details for the time period and that are currently marked to be excluded:

A summary displays at the end of the ADP Quarterly tax report if there are employees with negative earnings and withholdings, and which tax jurisdictions are negative.

An Unposted Batch summary displays on the last page of the ADP Quarterly tax report indicating batches that have not been transmitted.

- The Resident PSD code is now being passed through in the ADP Quarterly tax file.

- PSD tax lines, in addition to containing the Resident PSD code will also now all be flagged as “non-resident”.

- WA L & I tax codes can now be reported through ADP. To accommodate for this, since Washington needs a Workers Comp code associated with each different WA L & I code, we are using the Formula reference code to know which tax codes coming through are WA L & I codes. If the formula reference code starts with W.

- Washington L & I is calculated per hour. For employee types (salary and other compensation), WinTeam will convert to hours using the Washington standard calculation. More information can be found on the states website. If a salary employee is being paid other compensation on the regular paycheck or on a one time basis, the Washington L&I will not be calculated. The tax is considered taken on the salary hours only.

- The state of New York is requiring the reporting of the benefits of Same Sex Domestic Partners (SSDP) on the NYS-45 and the NY Metro Form MTA-305.

TEAM created new W2 Special Descriptions called SSDP Spouse Worker Benefit & SSDP Spouse Retired Benefit for this purpose. Using these codes, any Employer Contribution to Health Benefits for an employee will be recorded in the withholding field of the Tax Adjustment screen. This will be done on a quarterly basis so that the employer gets credit for their New York Metro tax (Form MTA-305), that they pay in. - New York also recognizes governmental employee benefits via IRC 125 which must be reported on the NYS-45. TEAM will not be doing any programming for this item since the customers we service are not Government employees so we will fill the fields in with 0.

- Puerto Rico UC requires an indicator on the employer wage reporting file to identify part-time employees that have an arranged schedule of less than 40 hours. The report will show a P flag for any employee who has Puerto Rico UC earnings and is Part Time as indicated in the Pay Info grid in the FT/PT field.

- Vermont requires an indicator on the employer wage reporting file to identify part-time employees that have an arranged schedule of less than 35 hours. The report will show a P flag for any employee designated as Part Time in the Employee Master File.

- New Mexico is requiring the reporting of Unit Numbers and Owner/Corporate Officer Indicator on the NM SUI electronic filing. Added NM to the list of UC states that need the worksite code identified by employee. This is done by using a Custom Field and Custom Setting: UCWORKSITECODE, USECUSTOMFIELD, 1-26. (IA, MN, MI, MA, NM are the 5 states that require this)

If either IA UC, MN UC, MI UC, MA UC, or NM UC is being transmitted in the tax file, we will go look at the custom field that is indicated in the custom setting to see what work site code to bring through.

- WHEN CREATING THE 4TH QUARTER ADP TAX FILE, NEW BOX 14 LINES WILL COME THROUGH FOR THIS -- We will have to send through the new SSDP codes in Box 14 with the following Code letters: This is only applicable for ADP. These codes will not be used in Year End processing through WinTeam.

- A = SSDP Spouse Worker Benefit

- B = SSDP Spouse Retired Benefit

Changes made per request from ADP. NJ Disability earnings will no longer be sent through when there is a Private Plan. The NJ Disability line will still come through, but it will be all zeroes.

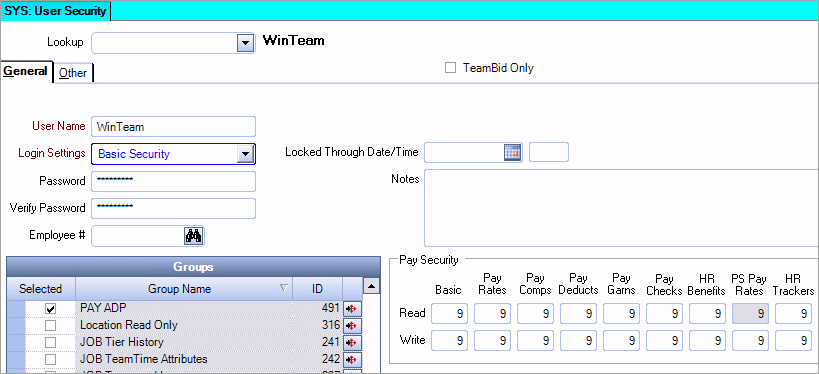

Security and Custom Settings

The TFI Tax Filing screen is secured by obtaining a Financial Accounting License Feature. Each company will need to set up a Custom Security Group, and add TFI Defaults, TFI Labels, and PAY TFI Tax Filing to the screens tab. Then the PAY ADP Tax Security Group must be added to the User.

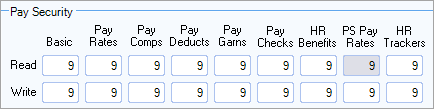

When creating the periodic or quarterly tax files, it is the user’s Paycheck Write security level that determines the Employee check records contained in those files.

Once a user has access to the History button, in order for the Create button and PDF functionality to be enabled, the user must also have AP Payments screen access and Pay Security Read/Write Pay Checks level to see all employees in that batch.

For example, if employees in a batch have Pay Security level 9, then the user attempting to review the PDF must also have Pay Security level 9. For more information, see User Security.

| Section | Item | Value | Module and Purpose |

|---|---|---|---|

| ADPTaxFiling | CreateSpecialDescription | Yes | This setting changes the Tax Filing format to use the Tax ID, Expense GL and the Description as the ADP Tax Code Description instead of pulling the Tax Code description from the normal spot (Team Tax Code field in Tax Set Up screen). ADP limits the description to be 15 characters and the client was concerned that the 15 would not be clear enough as to which tax code it really was. By using this method, then they can ensure that their tax code descriptions coming through in the file are unique. |

| ADPTaxFiling | ShowFilingDate | Yes | When this setting is in place a new field is displayed on the ADP Tax Filing screen called “Tax Filing Date” when selecting Output Type: Periodic. With this Custom Setting, there will only be one Tax Filing Date used for all batches that are being transmitted instead of a separate filing date for each separate check date being transmitted. The system will automatically fill in this field once the criteria has been selected and you click or tab into this field. It is a required field. The date that is defaulted will be the most current date among the batch criteria that you have selected. |

| Payroll | ADPTaxFiling | Yes | This setting must be in place for the ADP Defaults, ADP Labels, and ADP Tax Filing options to display under the Payroll > ADP Menu. |