Overview

The Tax Filing Interface was originally created to allow the exporting of tax information related to payroll batches to third party tax filing companies in order to perform all of the necessary tax filing for a company. This program is also used to submit a file after each check batch that contains all tax jurisdiction information for the check date range indicated and it will also be used to transmit their quarterly employee balance information.

Select the Check Voucher Indicator check box in order to include the direct deposit details with the check record. Once selected, and if you are using your Tax Filing Company’s check print services, the export file will include the direct deposit information set up for the employee at the time the file was exported.

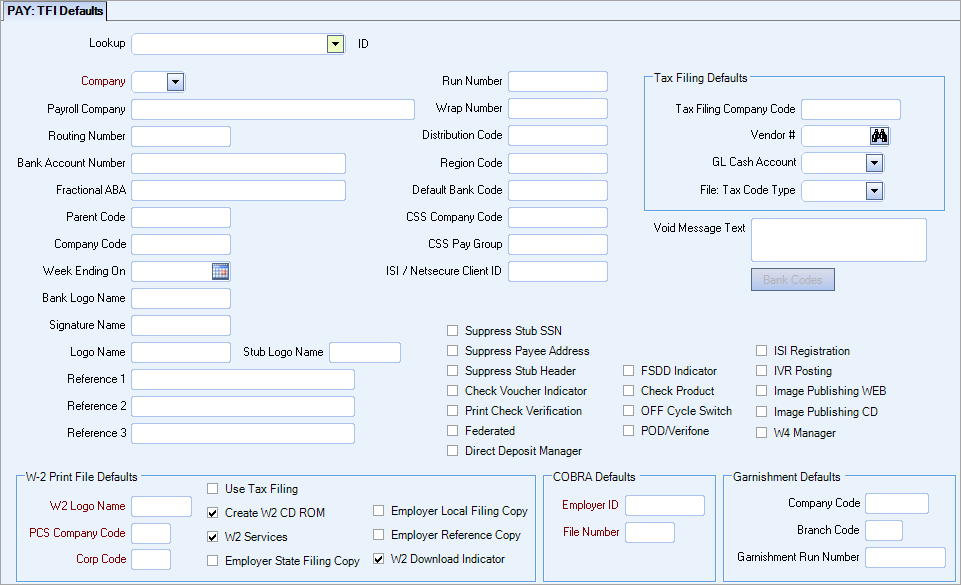

PAY: TFI Defaults

Key Functionality

If you use WinTeam to manage more than one company, select the company for which you wish to set up TFI defaults.

Payroll Company is the third party processor or tax filing interface, such as ADP.

Identifies the bank from which payroll checks are drawn if not drawn from the third party processor's account.

Identifies the bank account number from which payroll checks are drawn. Spaces preceding the bank account number will be preserved.

See routing #.

Same as the company code unless you are a child company & in which case this is the parent company ADP Client ID #.

This company code field is used when creating the periodic and quarterly tax files for ADP. The ADP Client ID will default to the Tax Filing Company Code field if one is set up in the ADP Defaults screen. If it is not set up, then the ADP Company Code that is in ADP Defaults is used.

Note that all three ADP Services issue their own company code that is used for their related services. Services consist of Check Printing, Tax Reporting, and W-2 Printing services.

Unique Client ID # that is assigned by and used by ADP's Check Print Services. This company code will also be used for Tax Filing purpose if the Tax Filing Company Code field is left blank.

Not used at this time, reserved for future development.

This is a 8 character field that represents a bank logo that can print on a check (see ADP for help on this) once its digitized.

This is a 8 character field that represents a image name given to a client by ADP once your signature is digitized.

This is a 8 character field that represents a image name given to a client by ADP once your logo has been digitized.

This is a 8 character field that represents a image name given to a client by ADP once your logo that prints on the stub only has been digitized.

The three reference fields are info fields that ADP can print on the check for a client. Must have ADP authorization for this. Each field can hold 35 characters. An example would be something you want to print in the last line of an address.

This is the max # of files that can be processed in a week. Up to 9.

This is used to help with sorting of the PR checks. This could be changed to sort other than by check #.

This is hard coded list (AB = Airborne, ZZ = Domestic mail, UP = UPS, FX = Fedex) which tells ADP how to send out the checks.

This number represents the sequential run number of the periodic file. Each time a periodic file is created, the system will increase this number by 1. See PAY: TFI Tax Filing for more information about periodic files.

Refer to ADP’s bank account table in their client instruction guide for this.

Client Site Service code assigned by ADP.

Client site services group number assigned by ADP.

This 10-character alpha-numeric field populates positions 87-96 in the H00000 Record. You must work with ADP to determine if this field needs to be populated and the required value.

This is a standard message that prints on all checks indicating the date the check becomes void if not cashed.

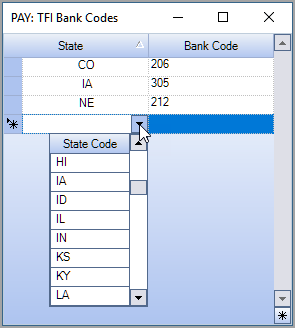

This Bank Codes button is available when the Check Product check box is selected. The Bank Codes button is used with the ADP check printing product.

When you click this button the PAY: TFI Bank Codes window displays. This window contains a drop-down list of the standard two-character state abbreviations and their corresponding bank codes. You must get the list of valid three-digit bank codes from your ADP representative. There can only be one code per state, duplicate records are not allowed.

This value is set in the P03000 record in positions 7-9 and is set based on the employee's address. The Default Bank Code is used If there is no record set up for the employee's state.

If the employee's physical address is NE, then the associated value of 212 is populated in the file.

If the employee's physical address is SD, then the Default Bank Code value (###) is populated in the file.

This company code field is used when creating the periodic and quarterly tax files for ADP. The ADP Client ID will default to the Tax Filing Company Code field if one is set up in the ADP Defaults screen. If it is not set up, then the ADP Company Code that is in ADP Defaults is used.

Note that all three ADP Services issue their own company code that is used for their related services. Services consist of Check Printing, Tax Reporting, and W-2 Printing services.

This number is unique to the customer and is generated by WinTeam.

Used when creating a payment record based on the tax filing report information.

Determines whether WinTeam's descriptions or ADP's descriptions are sent in the export file. The first 15 characters of the Description must be unique. If selecting ADP, the customer needs to set these up from the Taxes screen.

Select this check box to suppress the SSN on the check stub.

Select this check box to suppress the payee address on the check stub. This is normally not selected.

Select this check box to suppress headings that print on the stub.

Select the Check Voucher Indicator check box to print a direct deposit check and include direct deposit information with the check record when creating the export file to send to ADP. Normally, this is selected unless ADP does not print out any direct deposit information for you.

Once selected, and if using ADP's check print services, the export file will include the direct deposit information set up for the employee at the time the file was exported.

This check box is not selected by default.

The ADP Check Verification is a voice response verification process that ADP added in 2004 as a fraud deterrent. If you use this option on ADP Check, a message will print on check that states "Assistance with verification available at 877-423-7243". This functions similarly to the positive pay feature that banks utilize to make certain that the check number, payee and dollar amount on the check matches with the recon file supplied by the account holder.

ADP Check Verification allows a bank, merchant or institution that cashes the check the ability to verify that the check information matches what is in our system before they honor the check. If a call is made, the bank, merchant or institution will supply some basic information from the check. The system will search the data to see if it matches what we have on file. If it does match, a transaction number will be assigned and the merchant can write this on the check for future reference. If there is not a match, the caller will be told, the inquiry will be terminated and they should not honor the check.

Required by ADP.

Required by ADP.

This is currently not used. This is for Federally Secured Direct Deposit clients like a bank.

Select the Check Product check box if you use the ADP check printing product. When you select this check box, the Bank Codes button becomes available. See the Back Codes drop-down- above for details.

This is for Clients who have a CSS code assigned by ADP and will have ADP print off cycle PRs.

Required by ADP.

Required by ADP.

This information will be used in preparation of the W-2 Print File for ADP.

Maximum of six characters.

Maximum of four characters.

Maximum of four characters.

This information comes from ADP if needed for your company.

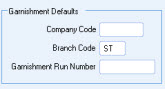

This information is used in the Garnishment Export file for ADP. For more information see Tax Filing Garnishments.

Maximum of 4 numeric, alpha, and/or special characters allowed.

Maximum of 2 numeric, alpha, and/or special characters allowed.

Maximum of 9 numeric characters allowed.

Related Information

The Tax Filing Interface Defaults screen is secured by obtaining a Financial Accounting License Feature.

You will need to setup a Custom Security Group, and add ADP Defaults, ADP Labels, and PAY ADP Tax Filing to the screens tab.

Then the PAY ADP Tax Security Group must be added to the User.

Tip: For more information see Security Groups Overview and Security Groups By Module.

| Section | Item | Value | Purpose |

|---|---|---|---|

| Payroll | ADPTaxFiling | Yes | This setting must be in place for the ADP Defaults, ADP Labels, and ADP Tax Filing options to display under the Payroll, ADP Menu. |