Address Validation FAQ

General

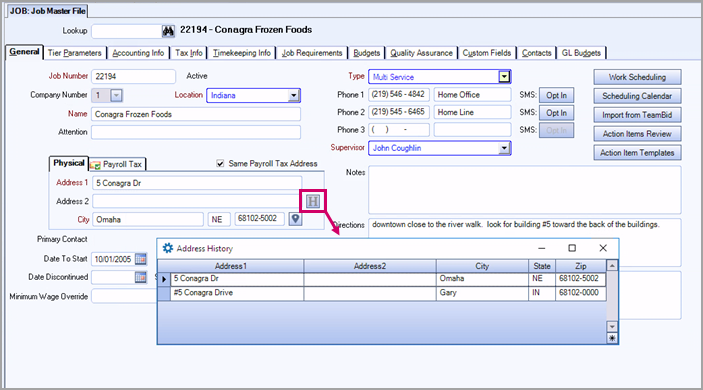

All Physical and Payroll Tax addresses, from the Employee Master File and Job Master File respectively, will need to be validated for active employees and jobs before using the updated payroll tax engine.

If your employee has a FT/PT status of Subcontractor (Pay Info tab on the Employee Master File) you do not need to validate their address.

They provide insight into why an address was not validated. The following link has the best information about each result code: Melissa Data Result Codes.

If an error codes is returned, it means the address does not conform to USPS standards and the address either needs to be edited or latitude/longitude overridden.

Addresses

In order to process payroll using the tax automation feature all addresses need to be validated. We recommend trying to find an address close by with the same city, state, and zip code to be used for the tax addresses (Employee Master File physical address and Job Master File payroll tax address).

In small towns, we've seen instances where all or most residents only have a PO Box for their mail. In this type of situation (or similar), often the actual post office address could be used for the employee's physical address.

For the remaining unverified addresses, use the button which uses the latitude and longitude to verify the address. Use this link for additional information on job address override, and this link for employee address override information.

PO Boxes cannot be used for Payroll Taxes. A physical address is needed for any address used. These are currently the Physical address in the Employee Master File and the Payroll Tax Address in the Job Master File.

In order to process payroll using the tax automation feature all addresses need to be validated. If the address will not validate we recommend for you to try and find an address close by with the same city, state, and zip code to be used for the tax addresses (Employee Master File: physical address and Job Master File: payroll tax address).

At times, other industries will use a community center or post office in the reservation for the physical and payroll tax address.

For the remaining unverified addresses, use the button which uses the latitude and longitude to verify the address. Use this link for additional information on job address override, and this link for employee address override information.

We will address payroll tax automation for Canadian customers and those outside the U.S. in a separate phase and rollout of the project.

Bulk Update

If the address service does not find any addresses to update, then an email will not be sent. This can also happen if there weren't any new addresses entered and all existing addresses have already been processed by the address service. If you want to receive an automated address verification email every day, regardless of errors, select the Guaranteed Daily Email check box on the Payroll Tax Settings tab in System Defaults. See this link for additional information on bulk address validation.

The email will indicate if you have invalid addresses on either the Job and/or Employee Master Files.

Use the Validated Address History tab in the Address Validation window. See this link for employee information on this feature, and this link for job information.

You may also use the Advanced Filters in the Employee and Job Master Files that have fields that allow you to search which addresses have changed based on a date.

- In the Employee Master File use the 'PhysicalAddressLastUpdated' field

- In the Job Master File use the 'TaxAddressLastUpdated' field

In addition, use the H button in the Employee and Job Master files to display the history of address changes for any specific record.