Overview

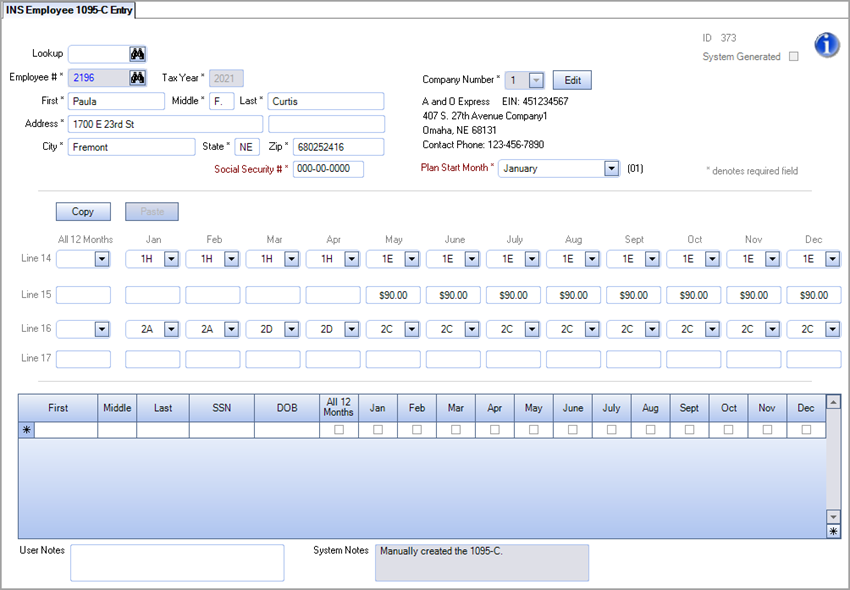

You open the Employee 1095-C Entry window from the WinTeam Insurance Benefits menu, under the ACA/1095-C Tools section. You use this window to create IRS-compliant forms for employees whose benefits were not tracked with the Insurance Benefits module. You can also edit existing forms in this window, both those that were created manually and generated from data maintained in WinTeam's Insurance Benefits module.

To look up and/or modify an existing Form 1095-C, you must enter an Employee Number and Tax Year. After making changes on the Employee 1095-C Entry window (including changes made to manually entered 1095-C forms), you can preview the changes in the INS: Employee 1095-C Report. To incorporate the changes, you must regenerate the form on the Employee 1095-C Report window by clicking the Save/PDF button.

Note: If you use a multi-company database, you can enter multiple 1095-C records for the same employee, each for a different company. WinTeam does not perform any checks to verify that the records were entered correctly for the multiple companies. For example, you could enter a code on line 14 for the same month for both two different companies for the same employee , which is not valid. You must review these types of items manually on this window or by running the 1095-C Exceptions report.

Key Functionality

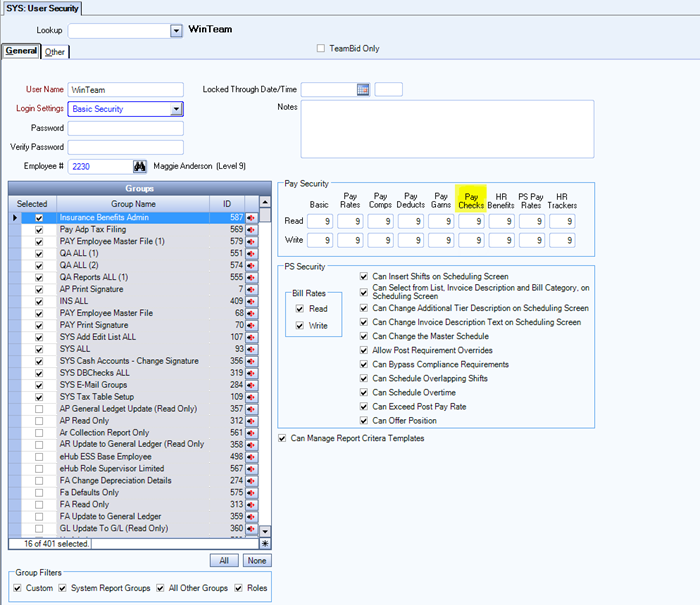

To create a 1095-C Form for an Employee, you must have Pay Checks User Security equal to or greater than the Security Level in his/her Employee Master File.

In order to see the Employee 1095-C Report, you must have one of the following System security groups:

- SYS ALL

- INS ALL

- A custom security group that contains the screen INS Report 1095-C

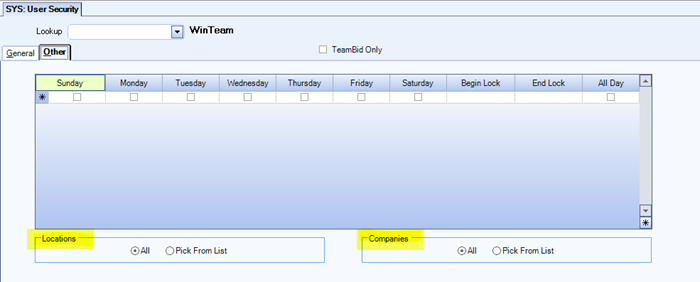

You must also have access to the Employee's Location and Company Number. In this example, the user has access to everything:

You can use WinTeam's standard WinTeam Advanced Filter toolbar feature to select multiple Employee 1095-C forms for editing.

The upper-right of the screen indicates if a form you are viewing was User or System Generated.

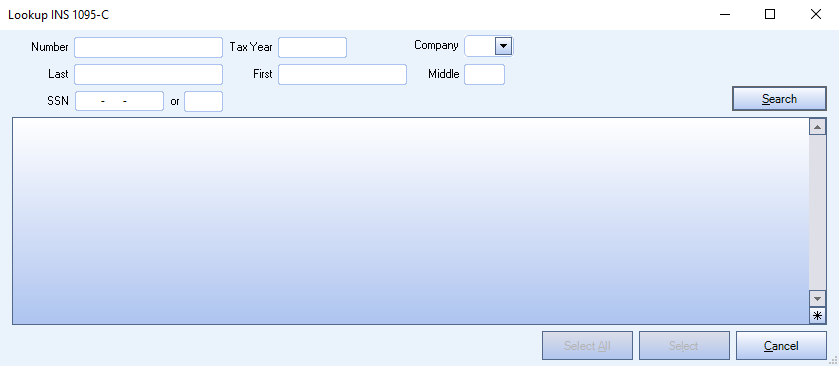

Click the binocular icon to open the Lookup INS 1095-C window where you locate and select existing records.

The number that is used to identify the employee is automatically populated from the Employee Master File. You cannot change the employee number from this window. If you need to change the employee number, you do that in the Employee Master File.

The prior tax year is populated by default if today's date is between January 1 and June 30; the current year is populated by default if today's date is between July 1 and December 31. You cannot change the tax year.

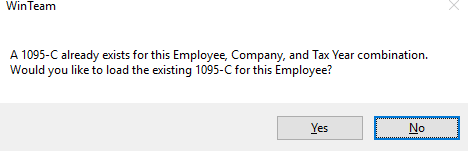

The Company Number is automatically populated from the Employee Master File and cannot be edited if you use a single company database. If you use a multi-company database, you can select the companies that you have permissions to see from the drop down list. If you use a multi-company and a record already exists for the default company, a message box displays that prompts you to load the existing the 1095-C form for the employee. When this message box displays, you can click the Yes button to load the existing record or you can click the No button to create a new record for the employee under a different company.

The employee’s name, address, and social security number are automatically populated from information in the Employee Master File.

Select the calendar month during which the plan year begins of the health plan in which the employee is offered coverage (or would be offered coverage if the employee were eligible to participate in the plan). If more than one plan year could apply (for instance, if the employer changes the plan year during the year), enter the earliest applicable month. If there is no health plan under which coverage is offered to the employee, select Coverage Not Offered. The appropriate two-digit code will be shown to the right of the box as a label.

This feature enables you to copy all Line 14, Line 15, and Line 16 values of the currently loaded Employee Form 1095-C, and paste those values stored on the clipboard into another Employee Form 1095-C. This feature will be useful to benefits administrators manually creating or editing a group of forms.

When you load a form, the Copy button will be enabled. The Paste button will be disabled until Copy is clicked. The Paste button remains active until the values on the clipboard have been pasted into another record. Click the Esc button on your keyboard to remove the pasted information.

The values from the 1095-C that was last saved to the database will remain on the clipboard during your current session.

You should consult your tax professional to understand which codes to use. The following IRS rules apply to the codes in WinTeam:

- If you use the 1G code in line 14, it must used for all 12 months.

- If you use the 1G code in line 14, then you cannot use the 2C code on line 16.

This field reflects the most recent edits to the current form, including old and new values of changed fields, User Name and Date of each change. This includes creation, resetting or modification of the 1095-C report.

For example, when you modify a record in the 1095-C Entry screen, System Notes reflect changes made to the individual fields. If you then re-run the 1095-C report to incorporate the changes made in the 1095-C Entry screen, System Notes will then reflect that a User Corrected form was created.

If you make an edit using the 1095-C Entry screen, and then select the Reset 1095-C Data option when running the 1095-C Report, the System Notes will reflect that the Form was re-created.

In general, an offer of COBRA to an employee is not reported on the 1095-C unless: 1) a former employee enrolled in COBRA, or 2) an employee and/or dependent enrolls in COBRA of a self-insured plan.

1) A former employee enrolled in COBRA

- On Form 1095-C Line 14

- The Code entered is representative of elected coverage

- Code is 1E for family

- Code is 1B for employee only

- The Code entered is representative of elected coverage

- On Form 1095-C Line 15

- Enter COBRA premium for the lowest-cost self-only coverage

- On Form 1095-C Line 16

- Enter Code 2C (denotes that employee enrolled)

2) An employee and/or dependent enrolled in COBRA self-insured plan

- Select months that individuals were covered.

For more information, see IRS FAQs on COBRA reporting.

- In the Insurance Benefits module, in ACA/1095-C Tools > Employee 1095-C Entry, search for the employee(s) in question using the Lookup field.

- Click the red Delete icon in the toolbar at the top of the window to delete the 1095-C PDF(s) for the employee(s) in question. A message will appear to Save/PDF forms but exclude the employees that had forms deleted.

- In ACA/1095-C Tools > Employee 1095-C Report, run the report but exclude the employees that had forms deleted.

- Click Save/PDF. This removes their PDF history from the Employee Master File and from eHub.