Overview

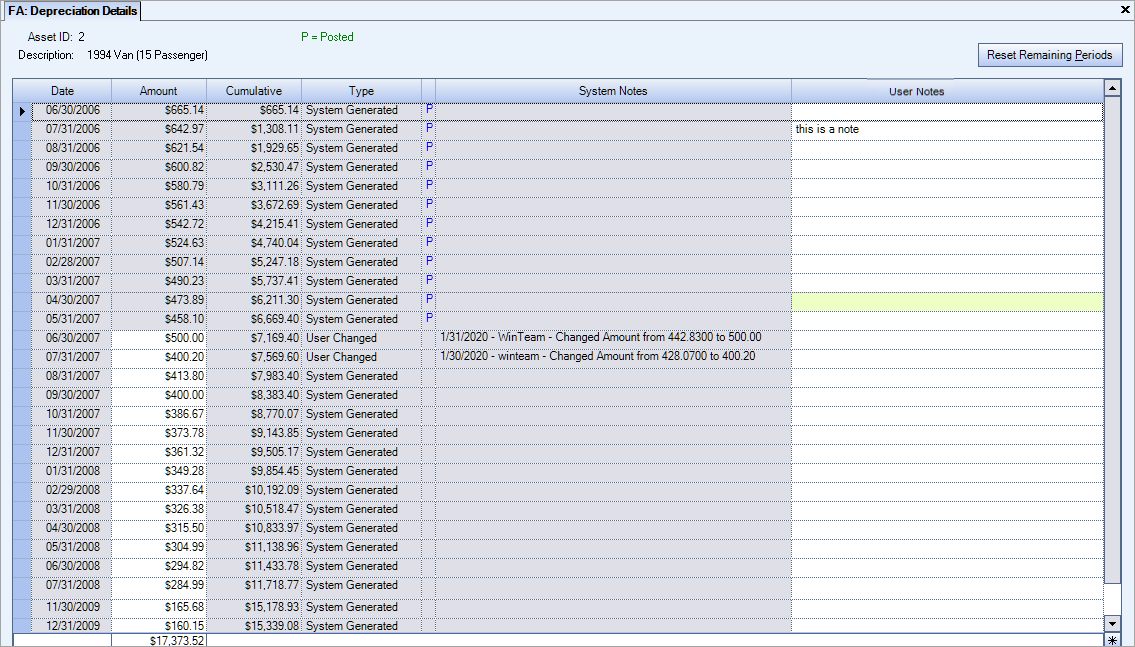

The Depreciation Details window is accessed from the FA: Master File window by clicking the Depreciation Details button. The Depreciation Details window contains the history (past, present, future) of accumulated depreciation for the selected Fixed Asset. This history may include a beginning balance (for a Fixed Asset converted from a previously used Fixed Assets system), the depreciation per period over the Fixed Assets Expected Life, and a Disposal amount, if applicable. The Depreciation Details screen includes : Date, Amount, Cumulative, Type, System Notes, and User Notes. You may change only the Amount (if it is not updated to the General Ledger, or if it is a Beginning Balance record AND you have the proper security) and the User Notes fields in this screen. The system automatically creates/updates the FA: Depreciation Details screen based on the information you enter in the FA: Master File screen.

Note: To be able to edit information in this window, you must have the Can Change Depreciation Details security feature under the FA Depreciation Details screen. See SYS: Security Groups for more information.

The Reset Remaining Periods button is also available on the Depreciation Details screen. If you change the Amount fields, and the system has not been updated to the General Ledger, you may click the Reset Remaining Periods button to recalculate and redisplay the Depreciation Details records based on the depreciation Method selected for this Fixed Asset. If a record has a status of "Posted" you may double-click on the line record to display the GL Log # it was posted with.

When closing the Depreciation Details window, the system compares the total amount with the Asset Master File record. A warning message box displays if they are not in balance. They will not be in balance if you made any manual changes. To retain your manual changes, you must select No in this message box. If you select Yes, the system will put back the original amounts from the Asset Master File.

Key Functionality

Asset ID

Displays the Asset ID of the currently selected asset record.

Description

Displays the Description of the currently selected asset record.

Reset Remaining Periods button

Click the Reset Remaining Periods button to restore the amount field to its original state. The record must not have been updated to the General Ledger.

You must belong to the Security Group called "FA Change Depreciation Details" to use this feature.

Date

The Date column displays the month-end date for each fiscal period (or month) of the Fixed Asset’s Expected Life. Provided you have set up enough future Fiscal Years in the Fiscal Year Set Up screen, you will see actual month-end dates (such as 12/31/11). If you have not set up enough future Fiscal years, the dates will appear as periods (such as 2012-1, 2012-2, etc.).

Amount

The Amount field displays the amount of the depreciation expense calculated for the corresponding Date. You may change the amount in the Amount field provided the system has not posted it to the General Ledger, and you have the proper security. See the Security section above for the proper permissions. When the system posts this amount to the General Ledger, it flags the Type field with the letter "P" for Posted.

Cumulative

Displays the Cumulative balance of the Accumulated Depreciation for each fiscal period (or month).

Type

The Type field displays a system-created description of the Amount field. The system displays four Types of descriptions:

Beginning Balance

Identifies the beginning accumulated depreciation balance for assets converted from a previously used Fixed Assets system.

System Generated

Identifies depreciation amounts computed by the system.

User Changed

Identifies depreciation amounts changed by the user.

Disposal

Identifies the amount of accumulated deprecation to reverse on the disposal of a Fixed Asset.

Within the Type field is space for a status flag. After updating Fixed Assets activity for a fiscal period (or month) to the General Ledger, (through the Fixed Assets General Ledger Update process), the system updates the Depreciation Details Type field to a posted status of "P". The Beginning Balance Type always includes the "P" flag because this Type is an amount (for a Fixed Asset converted from a previously used Fixed Assets system) that is already included in the Accumulated Depreciation account in the General Ledger.

Status

After updating Fixed Assets activity for a fiscal period (or month) to the General Ledger, (through the FA: General Ledger Update process), the system updates the Depreciation Details Type field to a posted status of P. The Beginning Balance Type always includes the P flag because this Type is an amount (for a Fixed Asset converted from a previously used Fixed Assets system) that is already included in the Accumulated Depreciation account in the General Ledger.

To view the GL Log# with which the transaction was posted and/or speed the process of un-posting and/or reprinting GL entries, the GL: Journal Update Log screen may be accessed by double-clicking a record's blue Posted status.

Total

The Total field displays at the bottom of the Depreciation Details screen showing the total amount of the depreciation expense to occur over the Expected Life of the selected Fixed Asset.

When closing the Depreciation Details screen, WinTeam will compare the Total amount on the Depreciation Details screen with the Asset Master File record. A warning message displays if they are not in balance and the details can then be recalculated.

System Notes

WinTeam automatically creates System Notes with different types and amounts of accumulated depreciation. WinTeam displays various messages in the System Notes field as indicated below:

"Depreciation from ‘ / / ‘ thru ’ / / ‘"

The system displays this message for a Beginning Balance Type.

"Asset Disposed"

The system displays this message for a Disposal Type.

"Date – User Name – Changed amount from _____ to _____."

The system displays this message for a User Changed Type. If more than one change occurs for the same period, the system lists these changes in reverse chronological order.

"First Period Adjustment of $___.__ automatically entered by the system," or; "System computed an evenly distributed adjustment of $___.__," or; "System computed a last period adjustment of $___.__."

The system displays one of these messages for a System Generated Type amount if it makes an adjustment for Accumulated Depreciation due to rounding or changes made on the Asset Master File screen. The note the system writes depends on the Threshold Amount and the Threshold Type settings in the Fixed Assets Defaults screen.

"Date – User Name – Lump Sum entry made, combining X Fiscal Periods."

The system displays this message for a System Generated Type amount, if an asset was entered in the Asset Master File during the current year and was behind on its accumulated depreciation.

User Notes

Use the User Notes field to enter any helpful notes or information regarding the depreciation of the Fixed Asset.