Overview

The Sales Tax Report is used to track taxable and non-taxable purchases for a specific date range. Use this report when filing sales tax forms for the state, county, and city.

You can group by Customer & Invoice or Government Type & Description.

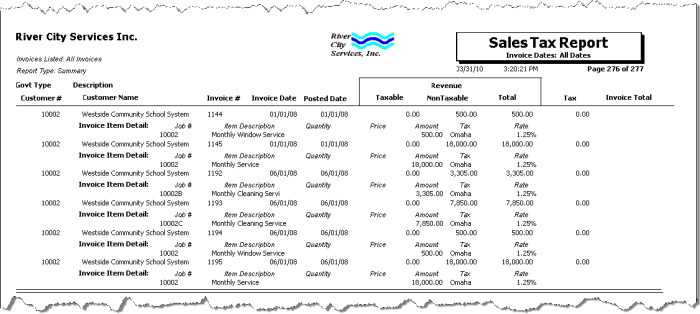

If you Group by Customer & Invoice, you can sort by Customer Name or Number.

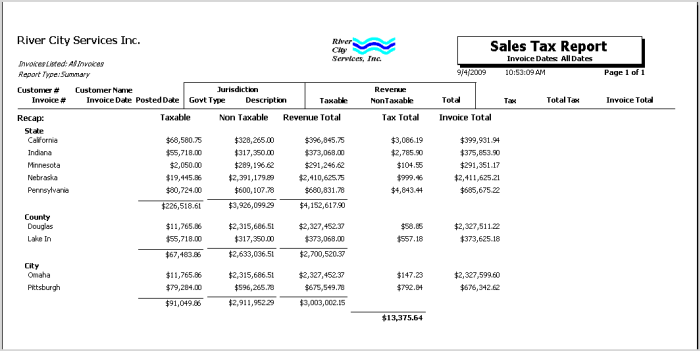

If you Group by Government Type & Description, you can sort by Government Type or Government Hierarchy. When you sort by Government Type, the report lists all State information first, then County, City, and Local tax information.

When you sort by Government Hierarchy, this looks at jurisdictions based on parent and groups them together for reporting purposes. For the State of Nebraska (who is the "parent" of other jurisdictions, under Govt Type of State: Nebraska, all counties, then Cities, and Locals that have Nebraska as the Parent, are grouped together; followed by the next Jurisdiction and grouping.

Jurisdictions that have no "Parent" are listed first.

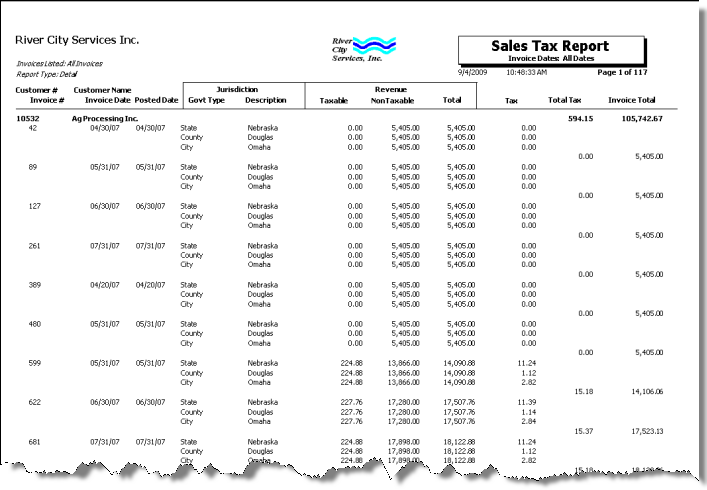

The details report contains all sales tax information down to the invoice level. Invoices that were entered through Customer Balances display in the Non Taxable column.

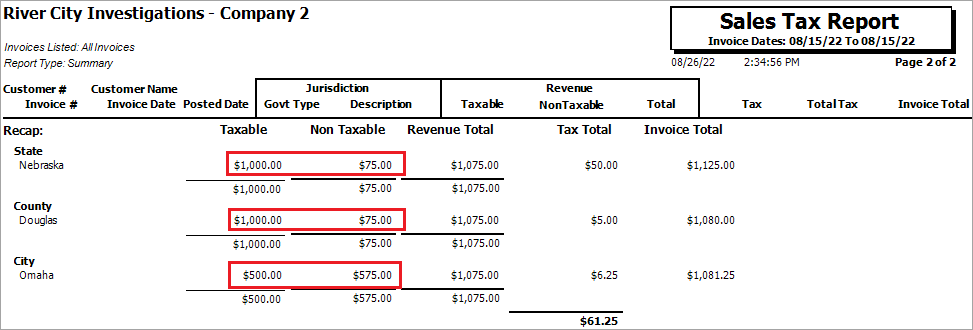

The recaps only report contains taxable, non-taxable, revenue total, tax total and invoice total by tax jurisdictions.

You can filter, group, and print by Tiers, allowing for total customization of the report. To make filtering easier, for any Tier, you can include All, Pick/Create or Exclude parameters. Using Tier Templates to set up and save report templates makes it easy to generate a specific report each time you need it, without having to recreate the criteria. See Using Tier Templates for more information.

Key Functionality

Select a report template from the list, or type a description and Save your settings to create a report template for later reuse. You may also select and Delete report templates from the list.

Type a description to name the report. This description prints above the Report Title.

The Default Company Name for Report is populated from the Company Setup screen. The list contains all companies for which you have security permissions to view. If you have permission for only one company, that will be the only one displayed in the list. If you have permissions to multiple companies, the list will display those companies PLUS the default reporting company.

When discernible, WinTeam will print the appropriate company name and logo on each page; otherwise the Default Company Name will print. That is, if a Company level is included in the tiered section and is displayed in the tiered information at the bottom of the page, then that company's Report Name and Logo (if selected) prints on that page.

If there is not a Company identified in the tier area of the page, then the Default Company Name for Reports is used. The default Company Name and Logo is also used for the Total Enterprise report. For more information see Learning about WinTeam Reports.

Use the Report Format option to choose the level of detail for the report.

Detail

The Detail report contains all sales tax information down to the invoice level.

Summary

The Summary report contains taxable, non-taxable, revenue total, tax total and invoice total by tax jurisdictions.

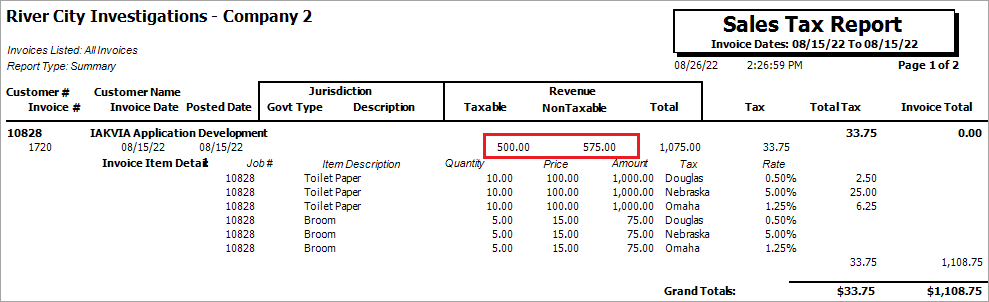

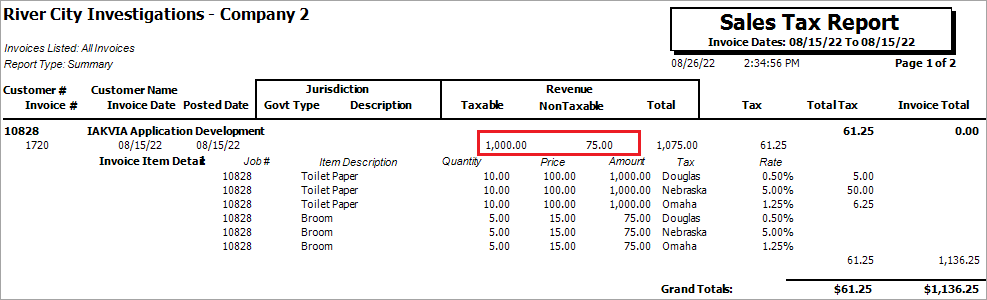

Show Invoice Item Detail

The Show Invoice Item Detail lists all sales tax information by item (this is only available when Group By Customer & Invoice is selected). The item amount is only included once when the item is taxed in multiple jurisdictions to correctly display the taxable and non-taxable amounts. The taxable and non-taxable amounts on the main report and the recap match if the item has the same taxable and non-taxable amounts for each of the jurisdictions.

When applied to multiple jurisdictions, only $500.00 of the toilet paper item ($1,000.00) was set as taxable in all jurisdictions.

When applied to a single jurisdiction, the entire $1000.00 displays as taxable in the main report and the actual distribution for each jurisdiction displays in the recap.

Use the Group By option group to select how the report will print.

Select to group report results by Customer & Invoice or Government Type & Description.

If you Group by Customer & Invoice, you can sort by Customer Name or Number.

If you Group by Government Type & Description, you can sort by Government Type or Government Hierarchy. When you sort by Government Type, the report lists all State information first, then County, City, and Local tax information.

City Tax Codes

Use the City Tax Codes category to select the invoices that are taxed at a City level.

The list that displays comes from the Government Type add/edit list.

County Tax Codes

Use the County Tax Codes category to select the invoices that are taxed at a County level.

The list that displays comes from the Government Type add/edit list.

Customer Types

Select the Customer Types to include on the report.

Select All to include all Customer Types on the report.

Select Pick to define specific Customer Types for the report. When you select Pick, the Customer Types list displays. Select the check box next to each Customer Type to include on the report.

Customers

Select the Customers to include on the report.

Select All to include all Customers on the report.

Select Range to define a range of Customer Numbers for the report. When you select Range, the Customer Number range fields display. Type the beginning Customer Number in the From field and the ending Customer Number in the To field.

Select Pick to define specific Customers for the report. When you select Pick, the Customer list displays. Select the check box next to each Customer to include on the report.

Select Create to define your own list of Customers. When you select Create, a small grid displays to the right. Enter the Customer Numbers you want to include in the list, or use the Lookup to locate the Customer Numbers.

Select Exclude to identify records that should not be included. When you select Exclude, a small grid displays to the right. Enter the Customer Numbers you want to exclude in the list, or use the Lookup to locate the Customer Numbers.

Invoice Dates

Use the Invoice Dates category to filter the report criteria by invoice dates.

Select All to include all invoices regardless of the invoice date.

Select Date Range to define a range of dates for the report. When you select Date Range, the date range fields display. Type the beginning date in the From field and the ending date in the To field, or use the Date Control to select a date.

The following priority is used to determine which dates (Payment, Invoice, or Posting) display under the report title when more than one of them is selected.

- Payment Dates: MM/DD/YY To MM/DD/YY

- Invoice Dates: MM/DD/YY To MM/DD/YY

- Posting Dates: MM/DD/YY To MM/DD/YY

Example: If all three dates are selected, payment dates display. If invoice dates and posting dates are selected, invoice dates display.

If only one of them is selected, that is the date that displays. If none of them are selected, Invoice Dates: All displays.

Invoices

Use the Invoices category to select the invoices to include on the report.

Select All to include all invoices.

Select Range to define a range of invoice numbers for the report. When you select Range, the invoice range fields display. Type the beginning invoice number in the From field and the ending invoice number in the To field.

Payment Dates

Use the Payment Dates category to filter the report criteria by Payment dates.

You should only use this option if you want to report sales tax on Paid Invoices.

For companies that base their sales tax on invoice/posting dates, you will not want to use this option.

The invoice must be fully paid to be included on the report. If an invoice has multiple payments applied to it,the invoice will only show up on the report range that includes the last payment date.

Select All to include all invoices regardless of the Payment Date.

Select Date Range to define a range of Payment Dates for the report. When you select Date Range, the date range fields display. Type the beginning date in the From field and the ending date in the To field, or use the Date Control to select a date.

Example: If you have an invoice whose payment dates were 08/11/15 and 09/03/15, the invoice will only show up on the Sales Tax report that includes the payment date of 09/03/15.

The following priority is used to determine which dates (Payment, Invoice, or Posting) display under the report title when more than one of them is selected.

- Payment Dates: MM/DD/YY To MM/DD/YY

- Invoice Dates: MM/DD/YY To MM/DD/YY

- Posting Dates: MM/DD/YY To MM/DD/YY

Example: If all three dates are selected, payment dates display. If invoice dates and posting dates are selected, invoice dates display.

If only one of them is selected, that is the date that displays. If none of them are selected, Invoice Dates: All displays.

Posting Dates

Use the Posting Dates category to filter the report criteria by posting dates.

Select All to include all invoices regardless of the posting dates.

Select Date Range to define a range of dates for the report. When you select Date Range, the date range fields display. Type the beginning date in the From field and the ending date in the To field, or use the Date Control to select a date.

The following priority is used to determine which dates (Payment, Invoice, or Posting) display under the report title when more than one of them is selected.

- Payment Dates: MM/DD/YY To MM/DD/YY

- Invoice Dates: MM/DD/YY To MM/DD/YY

- Posting Dates: MM/DD/YY To MM/DD/YY

Example: If all three dates are selected, payment dates display. If invoice dates and posting dates are selected, invoice dates display.

If only one of them is selected, that is the date that displays. If none of them are selected, Invoice Dates: All displays.

State Tax Codes

Use the State Tax Codes category to select the invoices that are taxed at a State level. Only the detail lines of the invoice that contain at least one the tax codes selected are included in the report.

The list that displays comes from the Government Type add/edit list.

User Names

Use the User Names category to select the records to print based on who created the invoices. This allows users to process their own work without processing the work of others.

Select All to include all invoices.

Select Pick to define specific invoices by the user who created them.

Use the Tier Template to define and save customized settings for a report. To use an existing template, select the template from the list and click Load.

To create a new template, you can load an existing template, make the necessary modifications, click Save, and define a new template name in the Save As dialog box. Alternatively, you can start with a blank template by clicking the Clear button.

To modify an existing template, load the template, make the necessary modifications, and then click Save. The name of the existing template display in the Save As dialog box. Click OK.

For more information see Using Tier Templates and Using Tier Parameters.

The Print Enterprise Totals check box is available to users who have more than one company, and may be selected to print enterprise totals on the report. This check box is selected by default.

If this is not selected, the report prints only the tiered reports that are marked for printing.

The Print Company Totals check box is available to users who have only one company, and may be selected to print company totals on the report.

Select this check box to print the company logo on the report. It is selected or cleared by default based on the option selected in SYS:Defaults. However, you can modify the setting on each report.

Select this check box to include a list of the report options selected for the report. The Report Criteria page includes any ranges specified and each Category/Record selection made for the report. This check box is cleared selected by default.

Preview

Click the Preview button (or use the shortcut key, ALT + V) to view the report before printing.

Click the Print button (or press ALT + P) to send the report to your default printer.

Export

Click the Export button (or press ALT + X) to export the report to a specified format. Reports may be exported to Adobe Acrobat (PDF), Excel, Comma-Separated Values (CSV), Grid View and E-mail (available for premise-based clients only).

Invoices entered through Customer Balances display in the Non Taxable column on the report.

Security

The AR Report Sales Tax screen has its own Security Group, AR Report Sales Tax.

The AR Report Sales Tax screen is part of the AR Reports ALL Security Group.

Tip: For more information see Security Groups Overview and Security Groups By Module.